25-YR FIXED RATE

6.03%

20-YR FIXED RATE

6.10%

10-YR FIXED RATE

5.82%

REFINANCE RATE

+0.025%

empowering economic growth

504 loan program

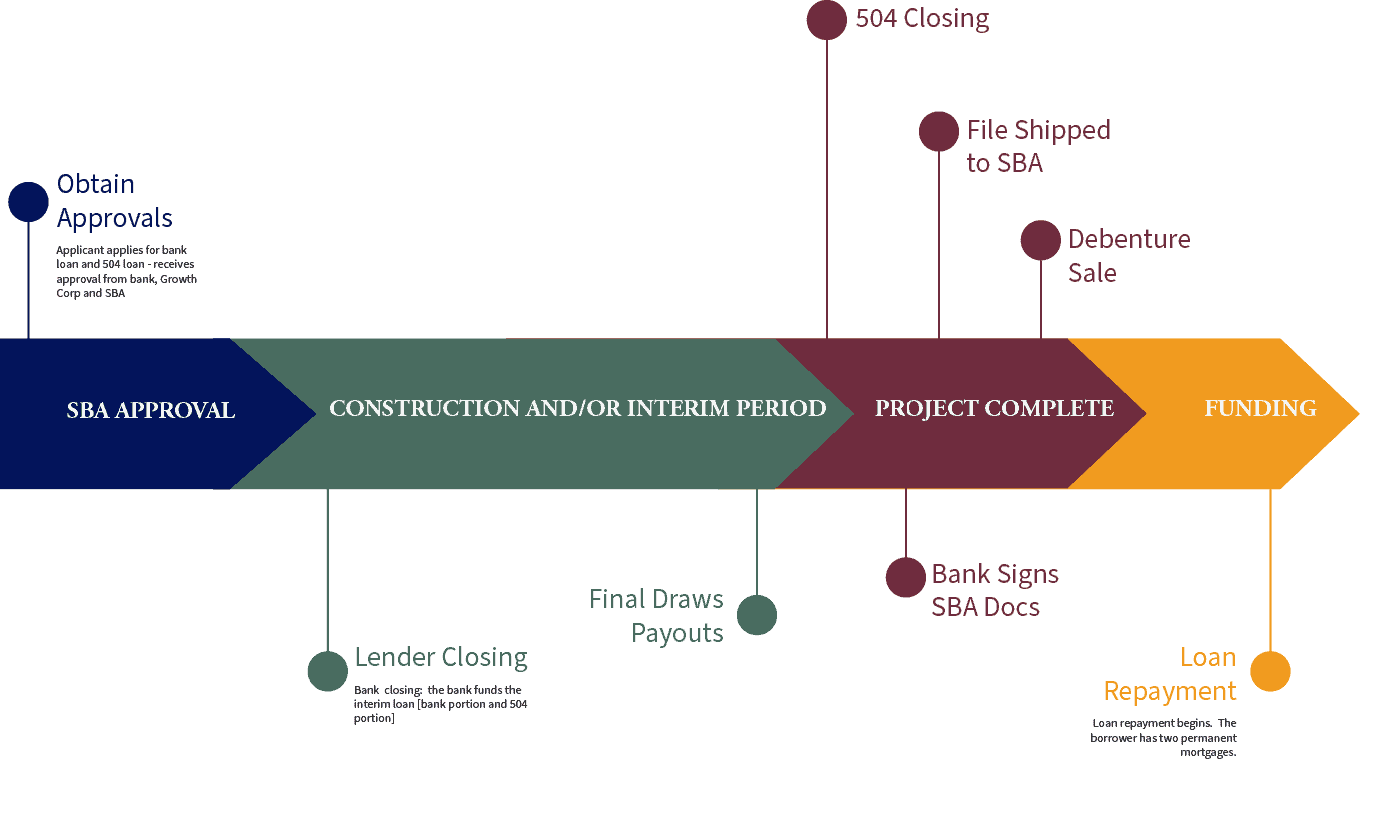

THE 504 CLOSING PROCESS…1, 2, 3

I’m Approved For a 504 Loan…Now What?

1. Read through the entire Loan Authorization document, as it sets forth the terms and conditions under which SBA provides the guaranty on your loan. It also outlines the servicing actions and loan compliance requirements for the term of your loan.

2. Review your Closing Deposit Invoice and remit payment as soon as possible. As stated in Section III of your application agreement, “the closing deposit, together with the application deposit, will be used to pay for the closing costs, including, but not limited to, credit reports, title insurance, recording and search fees, Growth Corp legal fees, and all other out-of-pocket costs. Growth Corp will send a statement detailing the costs paid from these funds together with a refund of the balance, if any, after the loan is funded. (Please note: the loan cannot proceed with closing until these fees are paid in full.)

3. Expect a call from the Closing Officer assigned to your project. They’ll go over timelines and checklists, plus they’ll explain the closing process in detail.

Growth Corp’s Closing Team works diligently to ensure approved projects are funded in a timely manner. As soon as a 504 loan is approved, the Closing Specialist assigned to your project will provide you with a project-specific checklist and prepare the paperwork necessary for the 504 loan closing. You will continue to work with your interim lender throughout two closings: 1) the bank funding of its loan and the 504 interim loan, and 2) the funding of the 504 loan. In the interim, Growth Corp will work with you and your bank to collect items necessary for the 2nd closing. Typically, these items are:

• Appraisal

• Environmental

• Title Work

• The Bank’s Note and Mortgage

• Organizational Docs

• Life Insurance Policies…these can be time consuming, so please plan ahead

Other required documents, specific to your project, will be outlined by your Closing Specialist.

When Do I Lock In My Interest Rate?

The interest rate on 504 loans is determined at the time the 504 debenture pool is sold to the private market and is based on current market conditions, which fluctuate. This typically happens approximately six weeks after your project is fully complete. All SBA 504 loans are funded using the same market sale process, so interest rates in an given month are the same nationwide…regardless of CDC.

Hurdles That Often Delay Closing…

Typically, there are two aspects of closing that can be time-consuming: obtaining life insurance, if required, and appraisals/environmentals. Please address these as early in the process as possible.

expansion solutions

Purchase a Building

Construct a New Facility

Renovate Your Current Property

Purchase Heavy Machinery or Equipment

Refinance Commercial Mortgage Debt

SBA 504 LOANS

How Will You Grow Your Business?

877-BEST 504

www.GrowthCorp.com

A Non-Profit Organization Focused Exclusively on Small Businesses

By using this website, you understand that Growth Corp is good, but not perfect (although we do try!). Therefore, it is possible that you may find information on this site that is no longer accurate. Links, images, downloads, pages and blog posts may inadvertently contain information that has been superseded over the years. You also understand that we aren’t giving any legal, tax, or financial advice. So, while we hope our site makes you love 504 Loans as much as we do, the content herein is for informational purposes only.