25-YR FIXED RATE

6.37%

20-YR FIXED RATE

6.39%

10-YR FIXED RATE

6.17%

REFINANCE RATE

+0.025%

empowering economic growth

504 loan program

504 Case Study Example

A widget manufacturer wants to open a second location and needs to purchase both the new building and new manufacturing equipment at the same time.

[su_table]

| Purchase Land | $500,000 |

| Purchase Building | $1,500,000 |

| Purchase Equipment | $500,000 |

| Soft Costs* | $0 |

| Total | $2,500,000 |

[/su_table] *Soft costs can include interim interest and fees, professional fees, a construction contingency, appraisal and environmental costs, etc.

If a bank was willing to finance the project conventionally, it would typically lend up to 80% of the project costs at a floating interest rate with a 15 year amortization and a balloon after three to five years. However, utilizing the 504 Loan Program, up to 90% of the project costs can be financed. The bank lends up to 50%, thereby reducing its risk and corresponding interest rate. Growth Corp lends up to 40% at a fixed rate for 20 years, with a down payment of only 10% from the borrower.

[su_table]

| Conventional | With 504 | |

| Bank | $2,000,000 | $1,250,000 |

| Growth Corp | $0 | $1,000,000 |

| Borrower | $500,000 | $250,000 |

| Total | $2,500,000 | $2,500,000 |

[/su_table] As shown, the borrower’s equity injection can be reduced by $250,000, thereby conserving cash and providing the necessary working capital to support continued growth. Additionally, cash flow is improved as a result of the longer maturity and potentially lower interest rates.

Typical 504 Financing Structure

%

Local Bank

A bank provides a first mortgage for

50% of the total project costs

%

SBA 504 Loan

Growth Corp provides an SBA 504 Loan (as a second mortgage) for 40% of the total project

%

Borrower

The borrower provides a down payment of typically just 10% of the total project costs

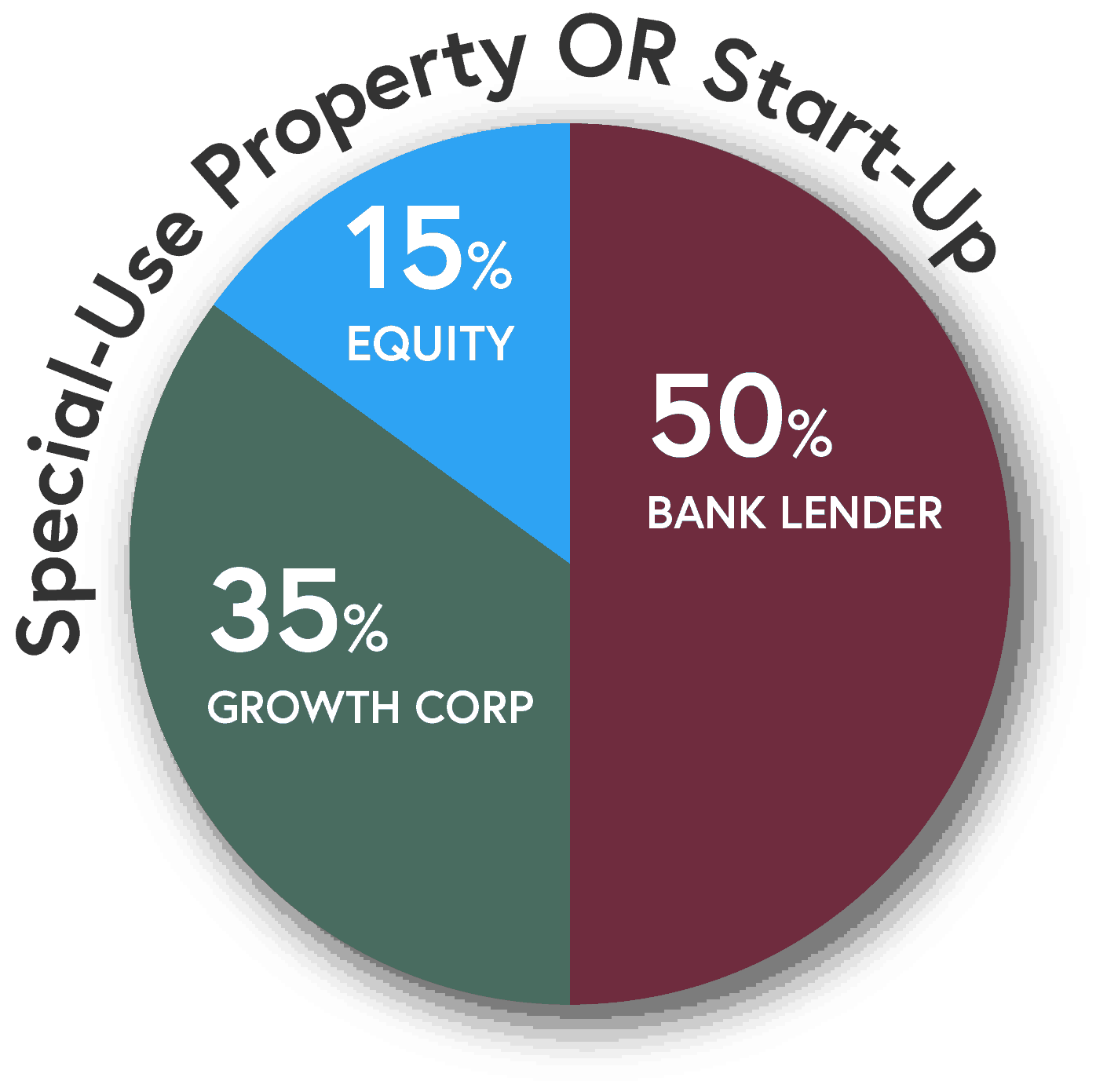

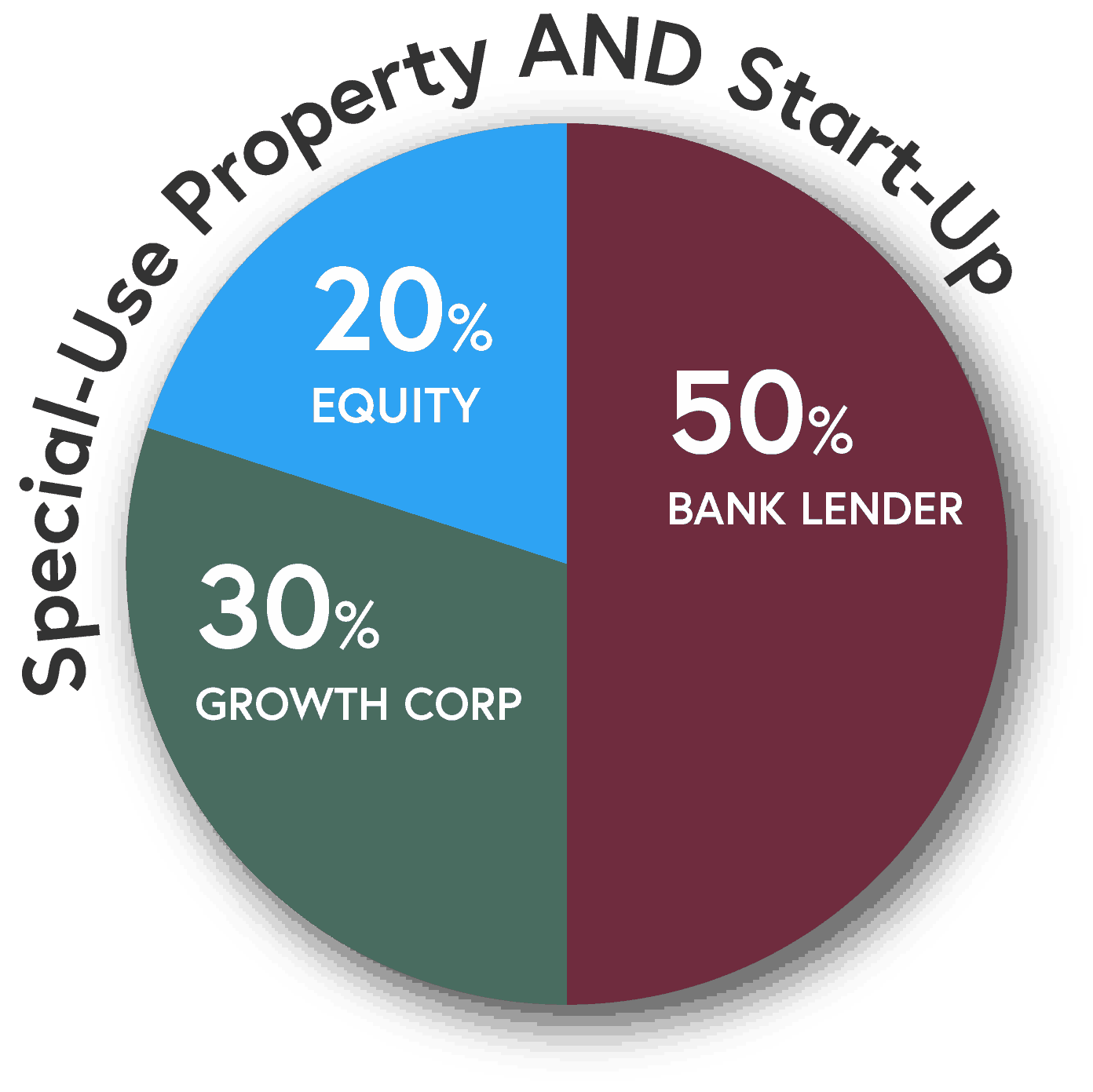

Higher equity requirements exist for start-ups or special purpose properties…the equity required will increase by 5% if one condition exists or by 10% if both.

A Sampling of Our 504 Projects

Why SBA 504 loans are so popular:

Low, Fixed Interest Rates

With the 504, borrowers take advantage of a low interest rate, which is fixed for either 10-, 20- or 25-years.

10% Down Payment

In most cases, borrowers receive a 90% advance, which preserves working capital for day-to-day business expenses.

Includes Soft Costs

The 504 finances total project costs, including not just the costs for land, existing building, hard construction and equipment, but also soft costs like furniture, fixtures, closing costs and professional fees.

No Future Balloon Payments

With the 504, borrowers do not have to concern themselves with saving the large amount of cash necessary for a balloon payment. This eliminates the need for refinancing, additional appraisals and deterioration in property values.

Predictable Monthly Payments

Borrowers lock in a low fixed interest rate, which gives them predictable payments and allows them to easily forecast for future years. So there’s no inflationary pressures and interest rate increases to worry about.

Keep Your Current Lender

The 504 Loan Program requires a partnership between Growth Corp and a lending institution, so there’s no need to give up that lending relationship you’ve grown comfortable with.

Our mission is to advocate for small businesses.

We love our communities and believe small business is the foundation of their economic prosperity. We will do all we can to support you and your business goals. Start-ups to seasoned businesses and everything in between can benefit from working with Growth Corp. Here’s why:

We Are An Industry Leader

We’re the #1 SBA 504 Lender in Chicago and Illinois. Growth Corp also consistently ranks as one of the top ten SBA 504 Lenders nationwide.

In Business 30+ Years

We’ve assisted thousands of businesses spanning various industries. In fact, our portfolio is currently in excess of $817 million.

Trusted by the U.S. SBA

SBA recognized Growth Corp as an Accredited Lender after a thorough review of its policies, procedures and prior performance.

SBA 504 LOANS

How Will You Grow Your Business?

877-BEST 504

www.GrowthCorp.com