25-YR FIXED RATE

6.37%

20-YR FIXED RATE

6.39%

10-YR FIXED RATE

6.17%

REFINANCE RATE

+0.025%

empowering economic growth

504 loan program

Borrower Benefits

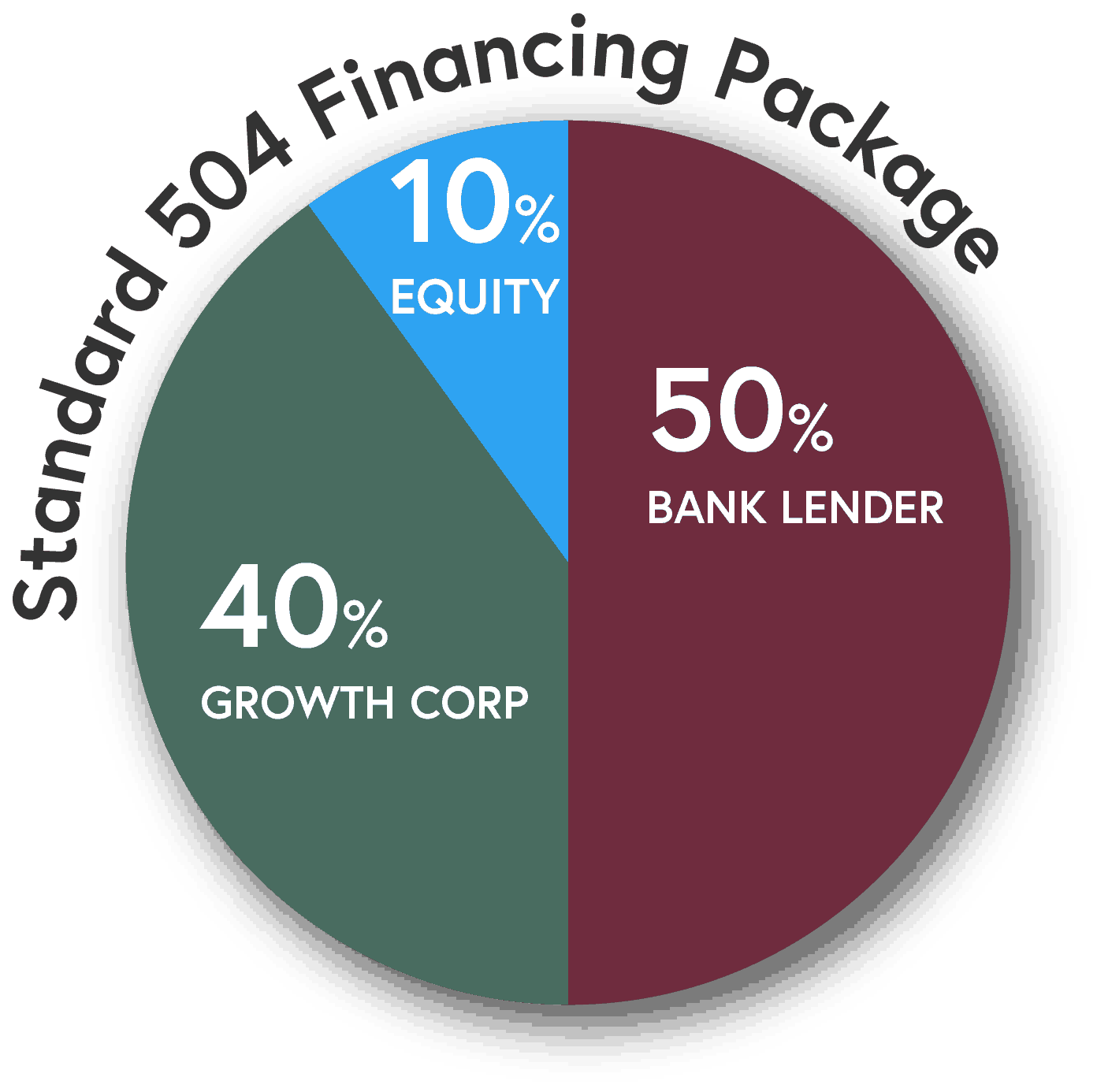

- Low down payment (10% in most cases)

- Low, fixed interest rate on 504

- Long loan term

- Includes soft costs such as furniture, fixtures and fees

- Payment stability

- Preserves working capital

- Protection from balloon payments

- Can include leasehold improvements

- Up to $5 million for SBA portion of loan, no limit on overall project size

- Keep your lender or allow us to match you with one of our lending partners

- The 504 Loan Program can be used multiple times

Quick Links

Interest Rate History

Loan Calculator

504 vs 7a

Quick Qualifiers

Forms

Project-Specific Solutions

EXPANSIONS

Equipment Purchases

Building Acquisitions

Land Purchases

New Construction

Leasehold Improvements

HOW THE 504 HELPS

Long-term fixed rates

Predictable payments

No future balloons

Low down payments

REFINANCING

Real Estate Loans

Lines of Credit

Consolidate Multiple Loans

Obtain Working Capital

Cash-Out Available

HOW THE 504 HELPS

Eliminates balloon payments

Fully amortized

Existing equity = down payment

Can provide a cash out option

GREEN ENERGY

New Builds w/ Sustainable Energy

Energy Efficient Upgrades

Energy Generating Equipment

Reduction of energy consumption by 10%

Increased use of sustainable design

HOW THE 504 HELPS

Removes $ limit on 504 portion

Borrowers can take multiple loans

Slashes the bank’s risk to 50%

Up to $5.5 million per project

fAQ’S

How much can I finance?

The 504 portion cannot exceed $5 million or $5.5 million, depending on whether your business meets an approved public policy goal or is classified as a small manufacturer (NAICS codes beginning with 31, 32 or 33). Remember, this limit is for the SBA portion only. There is no overall maximum project size.

Can 504 Loans include soft costs?

Yes. Soft costs (e.g. appraisals, environmental, construction interest, closing costs, etc.) can be financed into the 504 loan, which allows small businesses to preserve working capital.

What are the equity requirements?

Generally, 10% is the standard equity requirement for the 504 Loan Program. That amount increases to 15% if you have owned the business less than two years (a start-up) or if the real estate is considered special-use (for example: hotel, bowling alley, car wash, etc.). A 20% down payment is required in situations involving BOTH a start-up business and a special-use property.

How are the 504 rates determined?

The interest rate on 504 loans is determined at the time the 504 debenture pool is sold to the private market and is based on current market conditions, which fluctuate. This typically happens approximately six weeks after your project is fully complete. All SBA 504 loans are funded using the same market sale process, so interest rates in any given month are the same nationwide…regardless of CDC.

Who is eligible for 504 loans?

Most small businesses qualify for the 504 Loan Program. The business must:

- Be operating a for-profit business

- Be organized as a corporation, sole proprietorship, partnership, LLC, etc.

- Be located in the U.S.

- Have a tangible net worth of less than $20 million and profit after taxes of less than $6.5 million (including affiliates)

- Have a successful track record and growth potential

- Occupy majority of project property (or owner-occupied property)

Projects that qualify must, according to SBA guidelines, promote economic development, which generally means the creation or retention of jobs.

Who is the typical 504 borrower?

- Industrial companies that may have capacity or efficiency limitations or need to install new equipment at their current facility. May include industries such as commercial printers, machine shops, freights & transport, wholesalers, food distributors, and manufacturers.

- Office buildings and condos that may need a substantial build-out and/or furnishings such as doctors, dentists, chiropractors, physical therapists, accountants, lawyers, architects, graphic designers, etc.

- Retail companies such as motels, restaurants, car washes, farmer’s markets, boutiques, auto repair shops, gas stations, and convenience stores.

Why SBA 504 loans are so popular:

Low, Fixed Interest Rates

With the 504, borrowers take advantage of a low interest rate, which is fixed for either 10-, 20- or 25-years.

10% Down Payment

In most cases, borrowers receive a 90% advance, which preserves working capital for day-to-day business expenses.

Includes Soft Costs

The 504 finances total project costs, including not just the costs for land, existing building, hard construction and equipment, but also soft costs like furniture, fixtures, closing costs and professional fees.

No Future Balloon Payments

With the 504, borrowers do not have to concern themselves with saving the large amount of cash necessary for a balloon payment. This eliminates the need for refinancing, additional appraisals and deterioration in property values.

Predictable Monthly Payments

Borrowers lock in a low fixed interest rate, which gives them predictable payments and allows them to easily forecast for future years. So there’s no inflationary pressures and interest rate increases to worry about.

Keep Your Current Lender

The 504 Loan Program requires a partnership between Growth Corp and a lending institution, so there’s no need to give up that lending relationship you’ve grown comfortable with.

If you need a small business loan...

You’ve come to the right place.

The 504 Loan Program is one of the best financing solutions on the market. It provides small business owners with financing for the purchase, construction and renovation of commercial real estate and/or the purchase of long-term machinery and equipment. The best part? Borrowers typically receive financing for up to 90% of the project cost at a low fixed interest rate, which is then locked in for twenty years (10 for equipment). Plus, with the re-launch of the Refinance Program, small business owners can use the long-term, fixed rate 504 Loan Program to refinance existing commercial mortgages.

A Sampling of Our 504 Projects

Growth Corp is the top CDC in Illinois, the largest 504 Lender in Chicago and a top ten 504 Lender Nationwide, but we're still just a small, focused team working together every day to make the 504 process the best it can be.

We know that when it comes to 504 loans, it's about much more than just getting an approval. It's the ease-of-mind that comes from knowing Growth Corp's team has their finger on the pulse of the process from application to funding and even beyond into long-term servicing. It's knowing you will be informed every step of the way by the point-person responsible for overseeing the closing of your loan. It's knowing that, given Growth Corp's extremely low turn-over, you'll have the same experienced team members continuing to serve you year-after-year.

SBA recognized Growth Corp as an Accredited Lender after a thorough review of its policies, procedures and prior performance. The prestigious ALP status grants Growth Corp increased authority to process and close 504 loans, which results in an expedited process for both borrowers and lending partners. In addition, under the ALP Express Program, Growth Corp has been granted the authority to approve, authorize, close and service SBA 504 loans of $500,000 or less.

Quality, accuracy and quick turn-around times are just some of the reasons why Growth Corp is the top CDC in Illinois, the largest 504 Lender in Chicago and a top ten 504 Lender nationwide. But, remember, we're just a small team working together every day to make the 504 Loan process the best it can be.

SBA 504 LOANS

How Will You Grow Your Business?

877-BEST 504

www.GrowthCorp.com