25-YR FIXED RATE

6.37%

20-YR FIXED RATE

6.39%

10-YR FIXED RATE

6.20%

REFINANCE RATE

+0.025%

empowering economic growth

504 loan program

Machinery & Equipment Financing

All costs associated with the purchase, transportation, dismantling, or installation of machinery and equipment can be considered part of the project cost. (If the project is only for machinery and equipment, the machinery and equipment has to have a useful life of at least 10 years). The costs of dismantling, moving, and installation of equipment may be included if these costs are part of a more comprehensive 504 project.

Examples include:

- X-Ray or Digital Imaging Machines

- Manufacturing Equipment

- Dry-Cleaning Equipment

- Commercial Printers

- Food Processing Machinery

- Highly Calibrated Machines

- Equipment that generates renewable energy

Benefits

- Low down payment (10% in most cases)

- Low, fixed interest rate on 504

- Long loan term

- Includes moving and installation costs

- Payment stability

- No future balloon payments

- Up to $5 million for SBA portion of loan, no limit on overall project size

- Keep your lender or allow us to match you with one of our lending partners

expansion solutions

Purchase a Building

Construct a New Facility

Renovate Your Current Property

Purchase Heavy Machinery or Equipment

Refinance Commercial Mortgage Debt

EXPANSIONS

Equipment Purchases

Building Acquisitions

Land Purchases

New Construction

Leasehold Improvements

– How the 504 Helps –

Long-term fixed rates

Predictable payments

No future balloons

Low down payments

REFINANCING

Real Estate Loans

Lines of Credit

Consolidate Multiple Loans

Obtain Working Capital

Cash-Out Available

– How the 504 Helps –

Eliminates balloon payments

Fully amortized

Existing equity = down payment

Can provide a cash out option

GREEN ENERGY

New Builds w/ Sustainable Energy

Energy Efficient Upgrades

Energy Generating Equipment

Reduction of energy consumption by 10%

Increased use of sustainable design

– How the 504 Helps –

Removes $ limit on 504 portion

Borrowers can take multiple loans

Slashes the bank’s risk to 50%

Up to $5.5 million per project

How SBA 504 Loans Work

50%

LOCAL BANK

A bank provides a first mortgage for

50% of the total project costs

40%

SBA 504 LOAN

Growth Corp provides an SBA 504 Loan

for 40% of the total project costs

10%

BORROWER EQUITY

The borrower provides a down payment of

typically just 10% of the total project costs

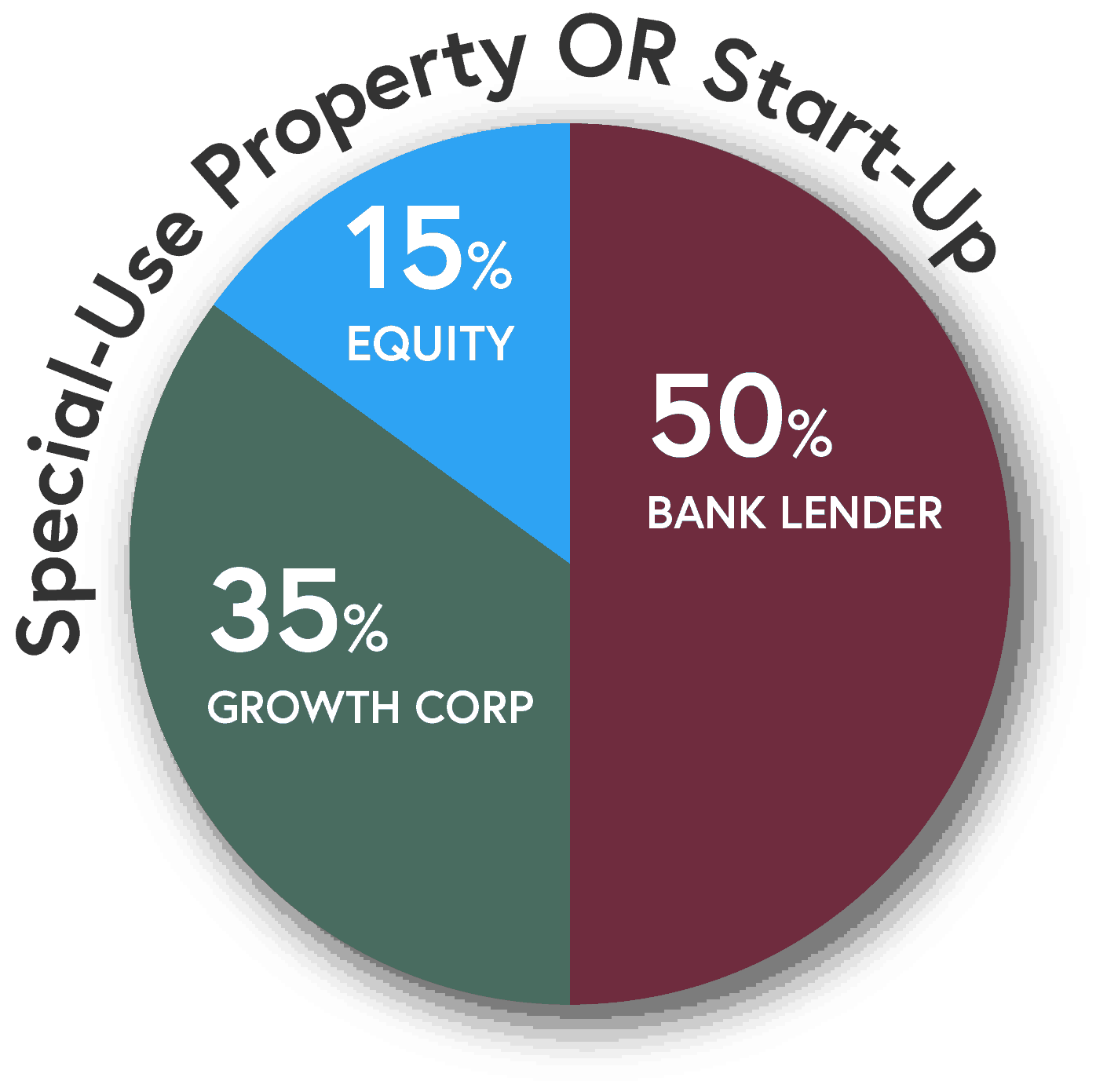

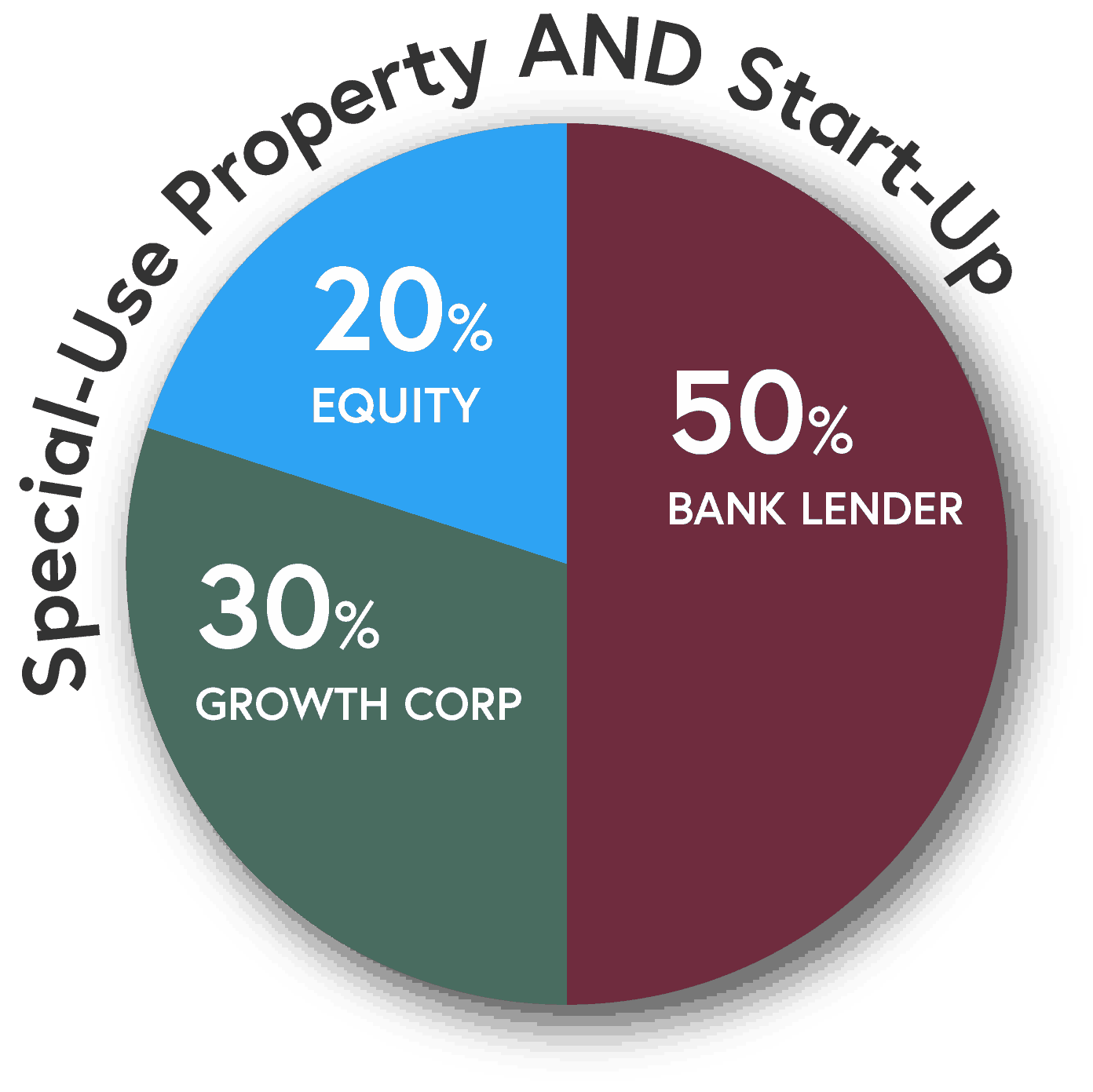

Higher equity requirements exist for start-ups or special purpose properties…the equity required will increase by 5% if one condition exists or by 10% if both.

SBA 504 Loans are made in conjunction with your local bank...so you can keep your lending relationship.

504 Case Study – New Equipment

A widget manufacturer was just awarded a multi-million dollar contract, but needs to purchase a new piece of equipment to keep up with their growing demand.

[su_table]

| Purchase Equipment | $800,000 |

| Real Estate | $0 |

| Purchase Furniture & Fixtures | $0 |

| Soft Costs* | $0 |

| Total | $800,000 |

[/su_table]

Unlike real estate, terms for equipment loans vary greatly. Depending on the nature of the borrower’s lending relationship with the bank and how much equity they have in any existing equipment, the terms could run anywhere from three to ten years, a three to seven year range for the balloon and up to 20% down payment. However, utilizing the 504 Loan Program, up to 90% of the project costs can be financed. The bank lends up to 50%, thereby reducing its risk and corresponding interest rate. Growth Corp lends up to 40% at a fixed rate for 20 years, with a down payment of only 10% from the borrower.

[su_table]

| Conventional | With 504 | |

| Bank | $640,000 | $400,000 |

| Growth Corp | $0 | $320,000 |

| Borrower | $160,000 | $80,000 |

| Total | $800,000 | $800,000 |

[/su_table] As shown, the borrower’s equity injection can be reduced by $80,000, thereby conserving cash and providing the necessary working capital to support continued growth. Additionally, cash flow is improved as a result of the longer maturity and potentially lower interest rates.

Let’s keep in touch…join our email list…

A Sampling of Our 504 Projects

877-BEST 504

www.GrowthCorp.com