25-YR FIXED RATE

6.20%

20-YR FIXED RATE

6.27%

10-YR FIXED RATE

6.48%

REFINANCE RATE

+0.025%

empowering economic growth

504 Refinance program

Refinance Into a Low, Long-Term Fixed Rate

The 504 Refinance Program comes with two huge advantages: One, it offers business owners a below-market, fixed interest rate loan. You’ll enjoy a repayment period of up to 25 years with no balloon payment to worry about. Second, a long-term fixed rate mortgage alleviates occupancy expense fluctuations.

Furthermore, when you utilize SBA 504 Refinancing, you have the option of tapping into your equity and obtaining cash for payment of many eligible business expenses. These expenses can include items such as utilities, inventory and lines of credit.

Benefits of SBA 504 Refinancing

- The small business owner’s equity in the collateral often fulfills the down payment requirement

- Low, fixed interest rate on 504

- Long loan term – up to 25 years

- Access cash in the building for salaries, rent, inventory, utilities, payables, etc.

- Payment stability

- Protection from balloon payments

- Up to $5 million for SBA portion of loan, no limit on overall project size

- Keep your lender or allow us to match you with one of our lending partners

What Kind of Rate Can I Expect?

The interest rate is fixed for 20- or 25- years, much like the standard 504 Loan Program. However, the effective rate will be slightly higher than standard 504 loans due to higher servicing fees.

expansion solutions

Purchase a Building

Construct a New Facility

Renovate Your Current Property

Purchase Heavy Machinery or Equipment

Refinance Commercial Mortgage Debt

EXPANSIONS

Equipment Purchases

Building Acquisitions

Land Purchases

New Construction

Leasehold Improvements

– How the 504 Helps –

Long-term fixed rates

Predictable payments

No future balloons

Low down payments

REFINANCING

Real Estate Loans

Lines of Credit

Consolidate Multiple Loans

Obtain Working Capital

Cash-Out Available

– How the 504 Helps –

Eliminates balloon payments

Fully amortized

Existing equity = down payment

Can provide a cash out option

GREEN ENERGY

New Builds w/ Sustainable Energy

Energy Efficient Upgrades

Energy Generating Equipment

Reduction of energy consumption by 10%

Increased use of sustainable design

– How the 504 Helps –

Removes $ limit on 504 portion

Borrowers can take multiple loans

Slashes the bank’s risk to 50%

Up to $5.5 million per project

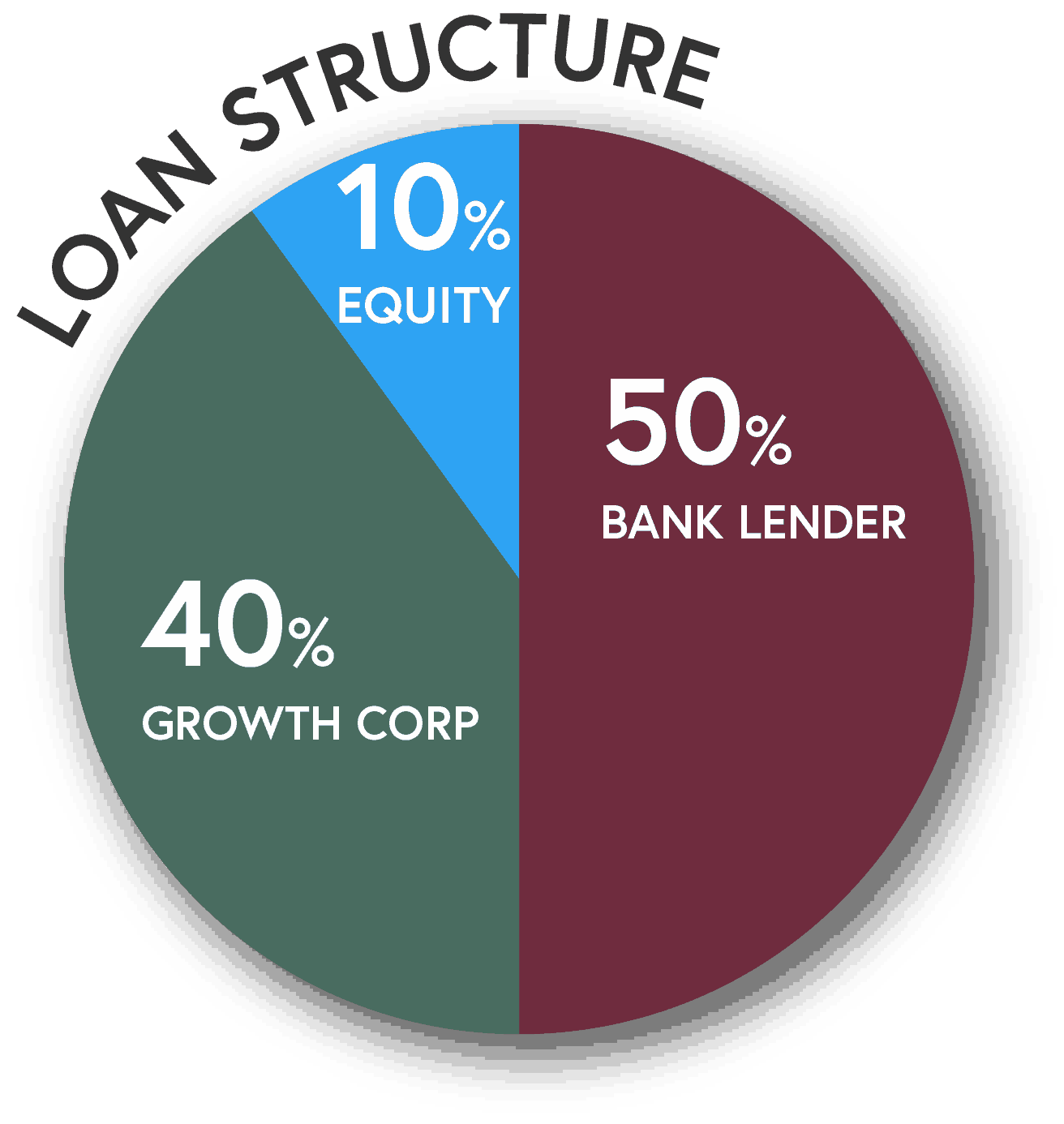

How SBA 504 Refinance Loans are Structured

Case Study: 504 Debt Refinance – No Cash Out

A widget manufacturer is refinancing an existing $1.8 million commercial real estate loan. The property appraises at $2 million.

Loan Structure:

| Portion | Amount | |

| Bank | 50% | $1,000,000 |

| Growth Corp | 40% | $800,000 |

| Borrower | 10% | $200,000 |

| Total | 100% | $2,000,000 |

NOTE: The third-party (bank) loan must be equal to, or greater than, the SBA 504 debenture amount. The SBA piece cannot exceed 40% of the appraised value.

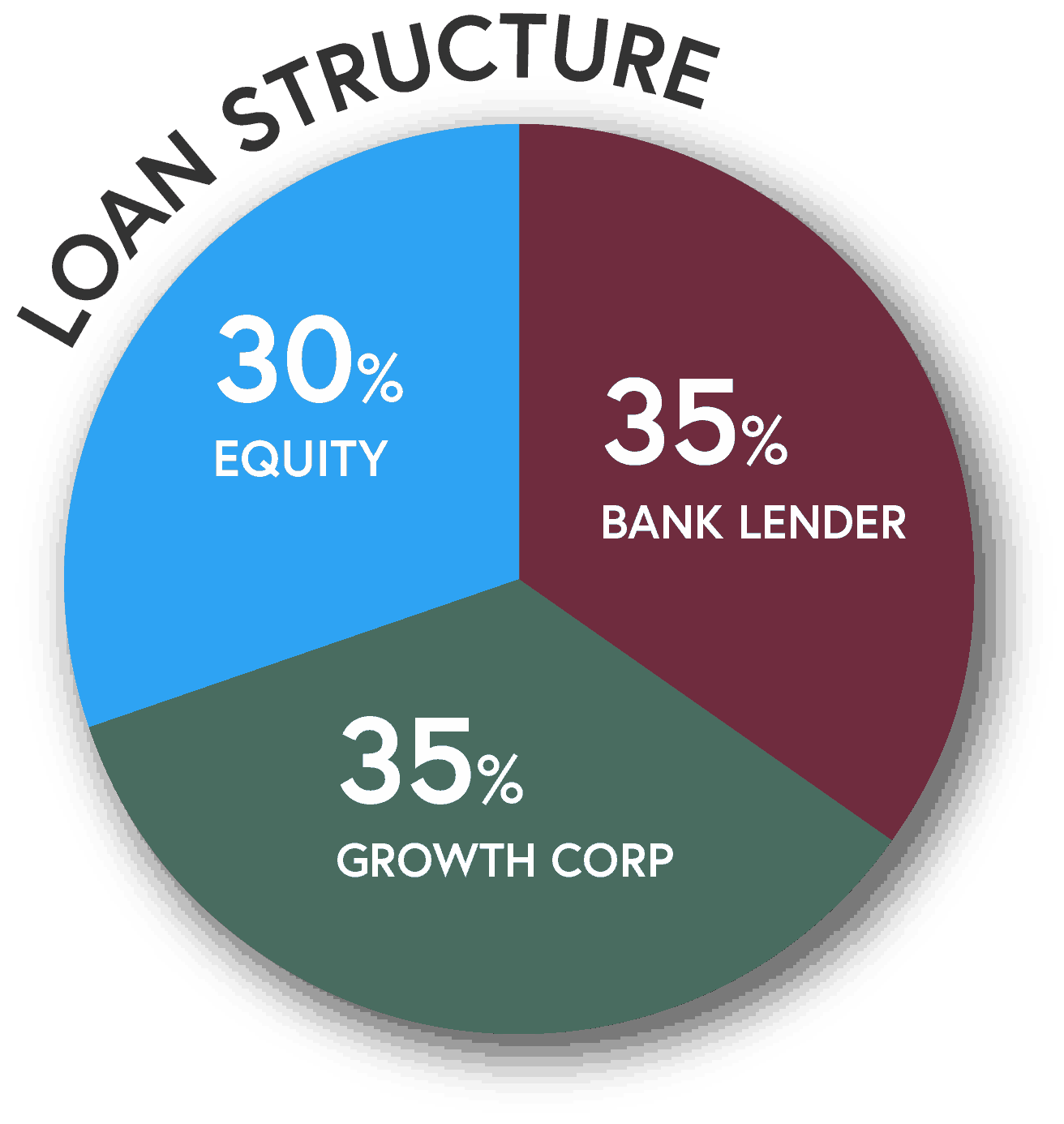

504 Debt Refinance – Cash Out

A widget manufacturer is refinancing an existing $1 million commercial real estate loan and would like to get cash out of the building for eligible business expenses. The property appraises at $2 million.

- Appraised Value: $2,000,000

- Qualified CRE Debt: $1,000,000

- Eligible Business Expenses (Cash Out): $400,000

Loan Structure:

| Portion | Amount | |

| Bank | 35% | $700,000 |

| Growth Corp | 35% | $700,000 |

| Borrower | 30% | $600,000 |

| Total | 100% | $2,000,000 |

NOTE: The loan-to-value does not exceed 85% and the cash out portion does not exceed 20% of the appraised value.

Let’s keep in touch…join our email list…

A Sampling of Our 504 Projects

Our mission is to advocate for small businesses.

We love our communities and believe small business is the foundation of their economic prosperity. We will do all we can to support you and your business goals. Start-ups to seasoned businesses and everything in between can benefit from working with Growth Corp. Here’s why:

We Are An Industry Leader

In Business 30+ Years

We’ve assisted thousands of businesses spanning various industries. In fact, our portfolio is currently in excess of $817 million.

Trusted by the U.S. SBA

SBA 504 LOANS

How Will You Grow Your Business?

877-BEST 504

www.GrowthCorp.com

A Non-Profit Organization Focused Exclusively on Small Businesses

By using this website, you understand that Growth Corp is good, but not perfect (although we do try!). Therefore, it is possible that you may find information on this site that is no longer accurate. Links, images, downloads, pages and blog posts may inadvertently contain information that has been superseded over the years. You also understand that we aren’t giving any legal, tax, or financial advice. So, while we hope our site makes you love 504 Loans as much as we do, the content herein is for informational purposes only.