For more than 50 years, the U.S. Small Business Administration (SBA) has celebrated National Small Business Week, which recognizes the critical contributions of America’s small business owners. This year, National Small Business Week takes place April 28 – May 4, 2024. Scheduled events for the week include award ceremonies, spotlights on available resources, educational sessions, and virtual summits.

One of the most critical components for small businesses to remain productive is access to capital. As many businesses struggle to find affordable growth financing in this higher-rate environment, Growth Corp, a non-profit, mission-driven Certified Development Company (CDC), is proud to continue its 35-year commitment to connecting small businesses with access to quality capital via the SBA 504 Loan Program, a lending program designed to help business owners invest in their business and expand in an affordable way. This unique program allows business owners to secure fixed-rate financing that is often at a lower interest rate than most traditional loan programs. Combined with longer repayment terms of up to 25 years and lower down payments, it’s hard to find a better option anywhere. More and more business owners are utilizing the 504 as an opportunity to lock in predictable, long-term, fixed-rate financing.

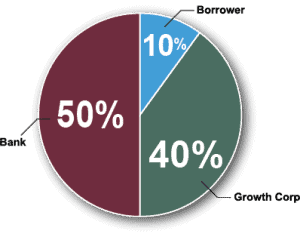

Created in 1958, the SBA 504 Loan Program is a premier economic development tool. 504 loans put expansion dreams within reach for growing businesses by offering affordable, long-term financing with low, fixed interest rates for purchasing major fixed assets, such as equipment or real estate. Business owners find the structure of 504 loans attractive as well. Because there are three parties involved (a local bank or credit union; a Certified Development Company (CDC), such as Growth Corp; and the small business owner), as much as 90% of the expansion project is financed from sources outside of the business owner’s pocket. In addition, participation in the 504 Loan Program requires either job creation or the fulfillment of public policy goals, which simultaneously encourages local economic growth.

National Small Business Week

Growth Corp is a strong advocate for economic development and the advancement of small business. As part of National Small Business Week, Growth Corp is honoring the irreplaceable role they play in our economies and pledges to continue equipping them with the tools and resources they need to succeed.

Small businesses deserve some special recognition for helping our communities thrive. Not only are they run by courageous entrepreneurs working tirelessly, but they are also the sponsors of little league teams, the community fundraising donors and the employers of our friends and family. Small businesses are the local coffee shops that greet you by name each morning, the jewelers who help make engagements and anniversaries extra special and the restaurants where the crowd goes after a football game.

So How Is The Lending Industry Helping Small Businesses Succeed?

Small business owners need financial support in order to invest in their business and expand in an affordable way. Whether you’re a seasoned company or just someone that hopes to start a business someday, there are lending programs designed specifically for you.

For instance, the SBA 504 Loan Program (504) was created by the U.S. Small Business Administration (SBA) to provide small businesses with long-term, fixed-rate financing to expand or buy their own facility. With a 504 loan, a small business owner can expect:

- 90% financing

- Fixed interest rates, currently below Prime

- No balloon payments

The SBA provides these loans via community-based nonprofit lenders, called Certified Development Companies (CDC’s). These CDC’s are regulated by SBA and work in partnership with participating lenders to provide financing to small businesses.

SBA 504 Loans typically covers 90% of the total project costs, as opposed to 80% with most conventional loans. The usual breakdown of funds with the 504 is: 50%

The 504 Loan Program is the best option for borrowers who need to make capital improvements, expand an existing facility, or purchase a new piece of equipment.

Borrowers reduce their equity injection to as little as 10% at the outset, which slashes the bank portion to only 50% of the project costs. As a result, the 504 is a win-win for both lenders and borrowers. Most noteworthy, thousands of small business owners across the country are using the 504 to realize their dreams of growth and expansion.

A Stalled Business Expansion Got Back on Track…

For instance, a wholesale bakery, nearing the end of its lease, received news their business property was being sold and needed vacated. Facing an inevitable move, the business owner decided to make the most of the situation and began to seek a property that would not only house the business, but would also allow for expanded production.

Nearby land was purchased and construction of a larger building began. However, due to cost overruns, conventional financing could no longer allow for the completion of the construction as the borrower required a higher advance rate than the bank could offer. Exploring alternative options in hopes of getting the expansion back on track, the lender introduced the borrower to the 504 Loan Program and they found it to be the perfect solution.

The participation of the 504 Loan Program allowed the bank to offer a 90% advance, which gave the business the financing they needed to pay contractors and finish the project. The new location offers ample space to produce, distribute and sell an expanded line of bakery items.

The Impact on Small Business Success

Growth Corp focuses exclusively on 504 Loans because we see the impact they have on small business success. Furthermore, because the 504 promotes economic development while simultaneously providing numerous benefits to banks and business owners, it is a program perfectly designed to fuel the small business sector.

About Growth Corp

Small Business Growth Corporation (Growth Corp) is a nonprofit, mission-based lender dedicated exclusively to connecting small businesses with quality expansion capital through administration of the SBA 504 Loan Program. With a commitment to economic development, job creation and the small business sector, Growth Corp is ranked a Top 10 National CDC for SBA 504 loan volume and is Illinois’ largest 504 loan provider. In fact, Growth Corp’s substantial portfolio ($900+ million) is particularly impressive because every dollar was utilized by Midwest entrepreneurs to open and expand their small businesses. Contact any member of our lending team today!