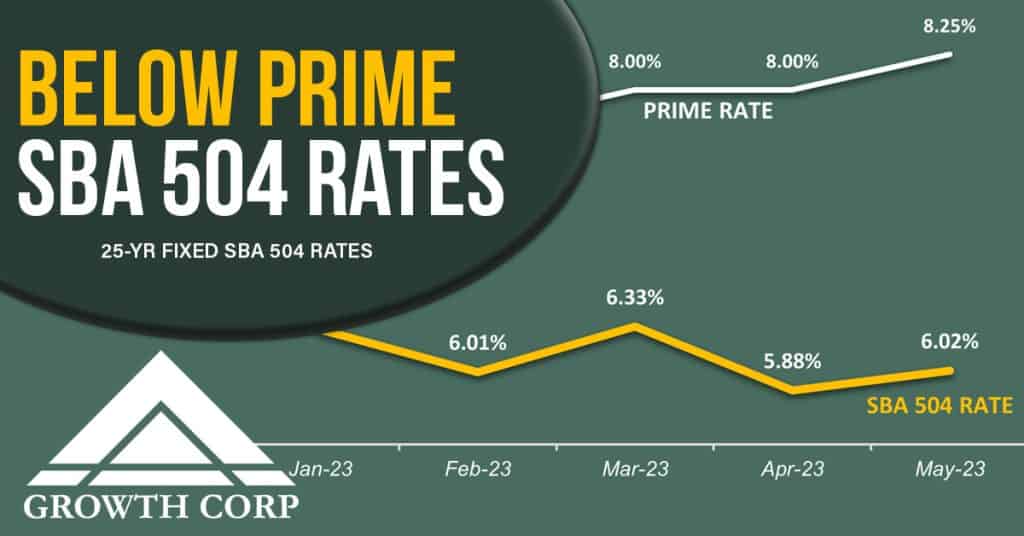

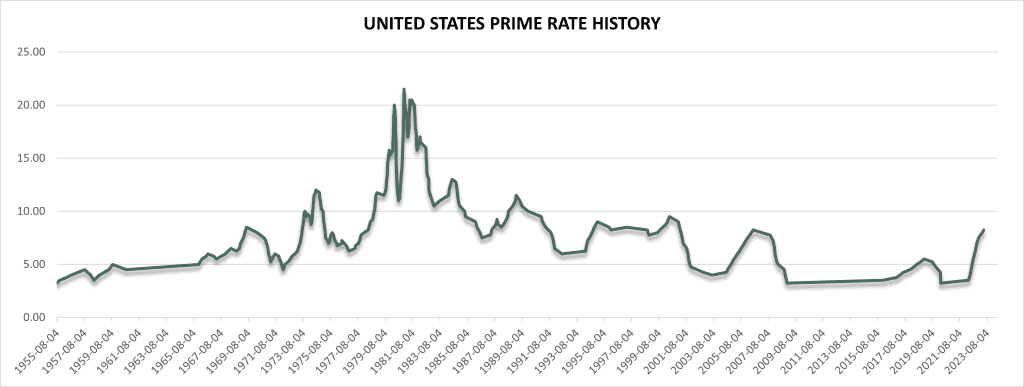

SBA 504 Interest Rates are often below the Prime Interest Rate. The average Prime Rate (August 1955 – Present) is 9.80%. Today’s Prime Rate is 8.25%. Conversely, today’s 25-Year Fixed SBA 504 Interest Rate is 6.02%. While this is higher than the record low rates we’ve seen the past few years, it still falls historically well-below average.

You’ve seen the headlines: interest rates are rising on everything from home mortgages to credit cards. Anyone in the market for business financing right now likely has serious concerns. However, the SBA 504 Loan Program is a smart way for businesses to move forward with their growth plans while hedging against inflation and rising interest rates.

SBA 504 loans, guaranteed by the U.S. Small Business Administration, offer long-term, fixed-rate financing of up to $5 million to buy, build, or renovate commercial/industrial facilities; to finance machinery and equipment; and/or to refinance existing real estate debt(s) into a long-term, fixed-rate loan.

Demand for 504 loans has skyrocketed the past few years. Here are just some of the reasons why, as interest rates rise, small business owners are turning to the SBA 504.

.

SBA 504 loans, guaranteed by the U.S. Small Business Administration, provide long-term financing for the purchase of real estate, equipment, and other fixed assets. There are three parties to an SBA 504 loan—the borrower, the bank, and the SBA-approved certified development company (CDC) (Growth Corp). SBA 504 loans feature 10- to 25-year terms, low interest rates, and down payments as low as 10%.

1. Below-Prime Interest Rates and Loan Terms

SBA 504 loans allow business owners to secure fixed interest rates that are extremely competitive, often at or below prime. Combined with longer repayment terms of up to 25 years and lower down payment requirements, it’s hard to find a better option anywhere. The SBA 504 allows business owners to get off the roller-coaster of variable rate loans and into predictable, long-term, fixed-rate financing.

In fact, the 504 Interest Rates are often below the Prime Interest Rate. The average Prime Rate (August 1955 – Present) is 9.80%. Today’s Prime Rate is 8.25%. Conversely, today’s 25-Year Fixed SBA 504 Interest Rate is 6.02%. While this is higher than the record low rates we’ve seen the past few years, it still falls historically well-below average.

Check out the current and historical interest rates for 504 loans

It’s no secret that when interest rates rise, banks charge more for business loans. Therefore, small businesses will likely flood to the SBA 504 loan program to either refinance their variable rate loans or to lock in today’s low, long-term fixed rate as a smart way to finance their expansion plans. The 504 offers a great opportunity for fixing occupancy costs well into the future.

2. Down Payment Requirements

For businesses looking to protect their cash flow, or facing tighter cash flow because of higher interest rates, the SBA 504 offers another advantage.

The structure of 504 loans is unique, offering lower down payments than most conventional loans…typically just ten percent. Start-ups and single-purpose facilities require a slightly higher equity contribution. There are three parties involved – your business banker (50%), a Certified Development Company (CDC) such as Growth Corp (40%), and you, the small business owner (10%). With this structure, as much as 90% of the project is financed from sources outside of your own pocket.

Not to mention…there are no future balloons. A balloon loan mortgage, common in commercial real estate, is usually a short mortgage that requires a large one-time payment at the end of the term. This can mean your payments are lower in the years before the balloon payment comes due, but you will either owe a lump sum at the end or be required to refinance the balance. This can lead to another round of building appraisals and credit approvals to endure. However, unlike conventional commercial real estate loans, a 504 Loan has no balloon payments.

The SBA 504 Loan Program has no covenants or call provisions either. Call provisions are similar to balloon payments in that, with a conventional loan, you may be required to maintain a specific debt-service coverage ratio as a way for lenders to lower their risk. If you fail to meet that provision, the bank can “call in” your loan. This means you would either have to pay off the balance, or refinance it. What you get with the SBA 504 Loan Program is a long-term, fixed rate loan offering secure, predictable monthly payments for the life of the loan.

SBA 504 loans, guaranteed by the U.S. Small Business Administration, offer long-term, fixed-rate financing of up to $5 million to buy, build, or renovate commercial/industrial facilities; to finance machinery and equipment; and/or to refinance existing real estate debt(s) into a long-term, fixed-rate loan.

3. A Path to Ownership

The 504 was designed to make building ownership possible for small business owners by pairing it with the best terms on the market. Owning the building housing your business is often more cost-effective than soaring rental costs. Plus, there are long-term investment benefits of owning an asset that increases in value over time, including potential tax benefits. Furthermore…as the building owner, you’re free to customize the facility to fit your needs.

4. Predictable Overhead Costs

By securing a fixed-interest mortgage, your monthly principal and interest payments stay the same over the life of your loan (as opposed to rent payments, which likely increase annually; or variable-rate loans, which can fluctuate with interest-rate increases). Budgeting and long-term planning become easier with predictable, fixed monthly expenses and no future balloon payments to worry about.

5. Most Businesses Qualify

Most for-profit businesses are eligible to receive SBA 504 financing, so long as they average less than $5 million in annual after-tax profits and $15 million in net worth. Additionally, most national, regional, and community banks participate in the program…

Typical 504 borrowers:

| Medical/Professional | Retail/Service | Industrial | Special-Use |

| Doctor’s Office | Restaurants | Recycling Facilities | Bowling Alleys |

| Veterinarian Offices | Retail Stores | Food Manufacturing | Funeral Homes |

| Dentists | Health Clubs | Steel Production | Car Washes |

| Attorneys | Day Care Providers | Packaging Companies | Assisted Living |

| Accountants | Pet Care Services | Commercial Printers | Grain Elevators |

| Chiropractors | Farmers Markets | Machine Shops | Livestock Feedlots |

| Architects | Boutiques | Freight & Transport | Mini-Storage |

| Graphic Designers | Auto Repair Shops | Wholesalers | Sports Arenas |

| Physical Therapists | Convenience Stores | Mass Production | Tennis Clubs |

Funds from a 504 loan can be used for:

- Acquisition of real estate (land and buildings)

- Acquisition of equipment

- Construction and renovation costs

- Soft costs – the ability to include furniture, fixtures, and fees

- Refinancing conventional loans

There is no limit to the total project cost with a 504 Loan. The SBA portion (40 percent of the total project cost) is capped at $5,000,000 or $5,500,000 for manufacturing projects or projects that implement green efficiencies.

Sometimes it takes a big investment of resources to jump start growth for a small business. Maybe there’s special equipment that could increase productivity. Or, a building next door that would make a perfect addition to an existing shop. Or, maybe an existing facility needs a serious face-lift. In each of these cases, an SBA 504 loan could be the perfect business financing solution. These loans are available to for-profit businesses to purchase real estate, equipment, and machinery. They can also be used to refinance existing commercial mortgage debt or to remodel existing facilities. SBA 504 loans are very business-friendly, requiring a down payment of typically just 10% and offering 10- to 25-year terms with low, fixed interest rates.

6. Support from a Local CDC

A CDC is a nonprofit organization that promotes economic development within its community through 504 loans. CDCs, such as Growth Corp, are designed to help strengthen local businesses by connecting them with quality financing for fixed asset investments. This, in turn, supports local economies, revitalizes neighborhoods, and breathes new life into communities. Plus, CDCs work in conjunction with local banks so you can stay with the lender you already use for your business banking.

Want to Learn More?

Keep in mind, we work in conjunction with local banks…not in competition with them.

Why Growth Corp? We know small business. It’s our passion. We are proud to have helped thousands of businesses facilitate expansion. As the largest 504 Lender in Illinois, we have dedicated ourselves to making the 504 Loan Program as efficient and seamless as possible. In addition, we are an authorized Continuing Professional Education sponsor and can provide you with C.P.E. credits for our SBA 504 Loan Program update course.

Let’s join forces! Make Growth Corp your partner in helping businesses discover the very best solution to their expansion or refinancing concerns…the 504 Loan Program. If you want to learn more, we would be happy to meet with you. Just give us a call at (217) 787-7557 or contact any member of our Lending Team.