Women-Owned Business – Stats

-

Women-Owned Business in the United States

- There are 114% more female entrepreneurs in the US today than 20 years ago.

- There are 12.3 million women-owned businesses in the US.

- 42% of all American small businesses are women-owned and operated

- Businesses owned by women of color employed 2,230,600 people.

- 27% of new female business owners stated they seized a pandemic-related business opportunity.

- Statistics from Small Business Advocacy, “Women-Owned Employer Businesses” and 2022 Small Business Profile.

-

Businesses Owned by Women of Color

- Women and entrepreneurs of color continue to drive new business creation. In 2020, Gusto found that new business owners were much more likely to be Black, Hispanic, Latino, and female than prior years, and that trend continued in 2021.

- Women of color represent half of all female entrepreneurs, according to Earthweb,

- An estimated 6.4 million women of color-owned businesses employ nearly 2.4 million people and generate $422.5 billion in revenue.

-

Trends for Women Owned Business

- The three industry sectors for women-owned businesses are health care and social assistance, accommodation and food services, and professional services

- In 2021, 49% of startups were formed by women (incfile)

SBA Financing for Women-Owned Businesses

The SBA is set up to help all small business owners get financing to start or grow their businesses. Yet, while the SBA doesn’t discriminate, it does have a vested interest in helping more women business owners get SBA loans.

The Small Business Administration (SBA) is a government entity that has a wide array of resources for female entrepreneurs. SBA itself does not make these loans. Banks and other direct lenders actually make the loans, and the SBA subsidizes a portion of the loan if the borrower defaults. These small business loans for women come with a government guarantee, so lenders find them less risky. SBA loans are a great financing option too—with low, fixed interest rates and long loan terms (up to 25 years).

Types of SBA Financing

- The SBA microloan program lends small amounts of money—up to $50,000 in capital—for startups and micro businesses.

- The SBA 7(a) loan program is for general purpose working capital for businesses that are already a few years old.

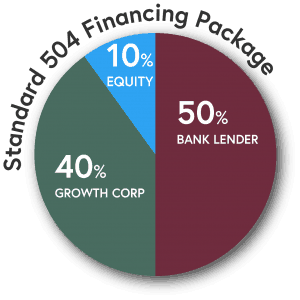

- The SBA 504 loan program is ideal for all business owners if they need assistance with resources to launch their business, expand it, or acquire commercial real estate and equipment. The SBA 504 makes financing more accessible as you have affordable down payments and long-term, fixed interest rates that are lower than the average loan. It also proposes a lower risk to lenders through a shared financing structure! Here’s the breakup of the loan structure:

- Borrower – As the business owner, you only have to pay 10% of the project costs using cash or prepaid project-related expenses. This minimal down payment will help your small business preserve cash. Additionally, the competitive interest rates and friendly maturity terms minimize your monthly payment! Keep in mind, 15-20% equity is required for startup businesses and for single-use properties such as car washes, hotels, and gas stations.

- CDC – CDCs such as Growth Corp make an SBA-guaranteed loan of up to 40% of total project costs including the SBA loan fees. The total loan amount is dependent on business or project type and is secured by a 2nd Deed of Trust.

- Lender – A bank, credit union, or other non-bank lender provides a commercial loan that is secured by the 1st Deed of Trust. It typically amounts to 50% of the total project costs.

SBA loans are perhaps the best types of business loans out there, so it’s worthwhile to see if you qualify.

General Resources for Women in Business

- The Office of Women’s Business Ownership helps women entrepreneurs through programs coordinated by SBA district offices. Programs include business training, counseling, federal contracts, and access to credit and capital.

- The Women-Owned Small Businesses (WOSB) Federal Contracting program helps women-owned small businesses compete for federal contracts.

- The National Women’s Business Council is a non-partisan federal advisory council serving as an independent source of advice and counsel to the President, Congress, and the U.S. Small Business Administration. The Council is the government’s only independent voice for women entrepreneurs, tackling important and relevant economic issues.

- Becoming a Women’s Business Enterprise (WBE) is another tool to add to your marketing kit that helps promote your company to major corporations that are actively seeking to conduct business with a woman/women owned business(es).

More resources for women-owned small business:

- Association of Women’s Business Centers (AWBC)

- National Association of Women in Construction

- National Association of Women in Real Estate Businesses (NAWRB)

- National Association of Women’s Business Owners (NAWBO)

- U.S. Women’s Chamber of Commerce (USWCC)

- Women’s Business Enterprise National Council (WBENC)

- Women Impacting Public Policy (WIPP)

- Women’s Presidents’ Organization (WPO)

Why Growth Corp?

Because we help get deals done. Growth Corp is the largest CDC in Illinois, the top 504 Lender in Chicago and a market leader in quality, consistent service. In addition, Growth Corp has earned an Accredited Lender status with SBA, which grants us the ability to expedite the processing of loan approvals and closings. Contact any member of our Lending Team to discuss your goals and ideas.