More and more small business owners are turning to SBA loans as a quality source of capital. That’s why its important to be aware of what’s new with SBA 504 lending and why volume isn’t expected to slow any time soon.

We have good news…not only did the U.S. Small Business Administration (SBA) create the 504 Loan Program to offer business owners a more affordable and accessible way to grow and expand, but they are continually improving the program to better meet the needs of today’s small business owners.

The SBA 504 Loan Program is designed to help business owners be successful. Let’s dive in to the six most recent improvements to the 504 Loan Program.

.

What’s New with SBA 504:

- Removal of the 504 Loan Program’s cap on lending for clean energy projects

- SBA turn-around times are quicker

- Appraisal shortfalls of up to 10% are allowed

- More businesses qualify

- Improvements to SBA 504 debt refinancing

- No SBA Guaranty Fee for fiscal year 2024

Removal of the 504 Loan Program’s cap on lending for clean energy projects

- Borrowers may now secure as many 504 loans up to $5.5 million for which they qualify.

- Loans made for eligible energy public policy goals do not reduce the $5 million limit for each small business concern for other 504 projects.

- Energy public policy projects include those that reduce energy consumption (e.g. retrofits) and renewable energy projects (e.g. adding solar), etc.

SBA turn-around times are quicker

- Typically, the SBA total turn time is less than one week

Appriasal shortfalls of up to 10% allowed

- SBA allows up to a 10% shortfall in appraised value without requiring additional collateral.

More businesses qualify

- Eligible businesses now include those with a Tangible Net Worth of not more than $20 million and Average Net Income after Federal Income Taxes for the two full fiscal years before the SBA application date of not more than 6.5 million.

Improvements to SBA 504 debt refinancing

- In terms of qualified debt, the “substantially all” threshold has been lowered to 75%. Qualified debt is defined as existing debt for which the original use of proceeds were for an eligible fixed asset, such as land, buildings, machinery/equipment.

No SBA Guaranty Fee for fiscal year 2024

- For SBA 504 loans approved in Fiscal Year 2024, the SBA Guaranty Fee is 0.0%.

New Opportunities to Grow Your Business: Think 504 When…

- You are looking to buy, build or renovate a commercial facility

- You need to finance the purchase of heavy machinery or equipment

- You are looking to add multiple retail locations

- Your business is buying real estate as part of a business acquisition

- An owner wants to sell his/her share of real estate to the other owners

- A balloon payment is coming due on your commercial mortgage and you want to refinance the debt into a long-term, fixed-rate loan

- A 25-year loan could help manage your operating capital

12 benefits that prove SBA 504 Loans were specifically designed to help businesses expand and prosper…

SBA 504 Loans from Growth Corp feature:

- Low down payments (10% in most cases)

- Low, fixed interest rate on the 504 portion

- Long loan terms (10-, 20-, or 25-year terms)

- The ability to include furniture, fixtures and fees

- An option for refinancing commercial debt

- Payment stability

- Preservation of working capital

- Protection from balloon payments

- The ability to include leasehold improvements

- Up to $5 million for SBA portion of the loan, and no limit on the overall project size

- The option of using the 504 Loan Program multiple times to continue expansion

- The ability to keep your current bank/lender

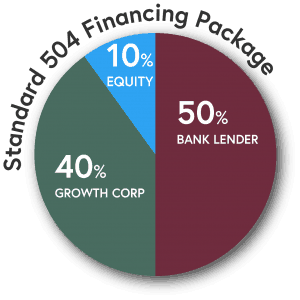

How Does the 504 Loan Program Work?

- 50 percent from a bank or other private lender,

- 40 percent from the SBA, and

- 10 percent from the borrower

Business owners can reduce their initial capital outlays by as much as $1 million in some circumstances by leveraging the 504 Program’s 90 percent loan-to-cost financing.

To qualify for the SBA 504 Loan Program, the business must:

- have fewer than 500 employees

- be located in the United States

- be a for-profit business

- have a tangible net worth of not more than $20 million and average net income after taxes (two years prior to application) of not more than $6.5 million

- be owner-occupied

- if a manufacturing company, meet the definition of a small to mid-sized manufacturer as classified in the North American Industry Classification System, sectors 31-33.

Keep in mind…SBA 504 Loans are offered in conjunction with local banks, not in competition with them!

Why Growth Corp?

We know your success depends on having access to expansion capital. We offer affordable and accessible expansion capital to grow your business. Our experienced staff takes pride in making a difference in the lives of small business owners and their employees. Start-ups to seasoned businesses and everything in between can benefit from working with Growth Corp. Here’s why:

- We’re the #1 SBA 504 Lender in Chicago and Illinois. Growth Corp also consistently ranks as one of the top ten SBA 504 Lenders nationwide.

- SBA recognized Growth Corp as an Accredited Lender after a thorough review of its policies, procedures and prior performance. The prestigious ALP status grants Growth Corp increased authority to process and close 504 loans, which provides expedited processing of loan approvals and closings.

- We simplify the loan approval process. Our team coordinates the entire process from application through closing, funding and servicing, making it seamless for you and your bank lender.

- We are SBA 504 Experts. Our responsive and educated staff focuses almost exclusively on SBA 504 loans. We’ve got the process down to a science!

- We’ve worked with thousands of businesses, spanning various industries. That means, there’s not much we haven’t seen. Your goals, project structure and business type will likely be familiar to us and we’ll understand your unique situation.

- Our mission is to advocate for small business. We love our communities and believe small business is the foundation of their economic prosperity. We will do all we can to support you and your business goals.

If you run a small to medium sized business in and need financing to purchase machinery/equipment or construct/purchase a new building, Growth Corp’s team of professionals will work with you directly to provide the best financing strategy for reaching your goal. Contact any member of our Lending Team today!