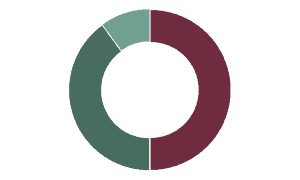

The typical Breakdown of 504 Financing is a 50-40-10 split between the Lender (50%), the SBA 504 (40%) and the Borrower (10%)

The decision on when to expand and/or relocate your business is a difficult one. Two of the most recognized hurdles your business may face are preservation of capital (“Do I have enough cash to expand my business?”) and finding appropriate financing (“What’s the best deal available and will I qualify?”). Many businesses have an inability to cash-flow an expansion because they need to retain their operating capital. In turn, owners will then inquire about financing options with the lending institution with whom their business has an established relationship. However, let’s face it, a bank usually wants 20 percent borrower equity in a project.

Wouldn’t it be nice if you could reduce your equity injection at the outset and lock in a low, fixed interest rate for 20 years? You can. And this financing opportunity is one many small business owners are missing out on.

SBA 504 Loan Program

The U.S. Small Business Administration (SBA) established a program over 30 years ago called the 504 Loan Program. This program works in conjunction with your bank to allow business owners to receive up to 90% financing for the acquisition, construction, improvement or expansion of commercial property or for acquiring heavy machinery or equipment. The program essentially consists of three key elements: 50% of the project’s total cost is provided by a lending institution, usually a bank; 40% is provided through the SBA’s 504 Loan Program; and 10% equity is provided by the borrower. (Start-up businesses and single-purpose facilities require a slightly higher equity contribution.) By requiring a smaller down payment, the 504 can help the business conserve their operating capital, while the structure of the program makes it attractive to financial institutions.

What’s Eligible?

Most types of businesses are eligible to receive 504 financing. Businesses with a successful track record and growth potential can generally qualify for the 504 Loan Program if they are for-profit and average less than $5 million in annual profits and $15 million in net worth. Qualifying projects should involve the purchase, construction or improvement of fixed assets such as land and building and/or the purchase of heavy machinery and equipment. Projects that qualify must, according to SBA guidelines, promote economic development, which generally means the creation or retention of jobs. There is no limit on the size of the deal, but SBA participation is limited to $5 million. This amount is increased to $5.5 million for those businesses meeting Public Policy goals (such as minority, woman or veteran-owned businesses.

Advantages of the 504 Loan Program

Many advantages exist when a business chooses to utilize the 504 Loan Program. First, the 504 has a long payback term. Projects involving equipment have a 10-year term and real estate projects have a 20-year term. Second, the down payment is lower than utilizing a straight conventional source; in most cases a business only puts 10% down. Finally, the interest rate on the 504 portion is fixed for the life of the loan. This means there are no future balloon payments to worry about.

Lending institutions also benefit from utilizing the 504 Loan Program. Since the lender finances only 50% of the project and has first lien position on the assets financed, their risk is cut significantly. The lender is free to set their rate on their portion of the loan and, because the lender is participating with SBA, it also meets economic development and community reinvestment goals.

What are Certified Development Companies?

Certified Development Companies (CDC’s), such as Growth Corp, administer the 504 Loan Program throughout the United States. The various roles of a CDC include assisting businesses and lenders with qualifying projects for 504 financing. In addition, they prepare and process a complete application, obtain approval from SBA and close the 504 loan. Each state has at least one CDC and they can be found by visiting SBA’s website (www.sba.gov).

Common Misconceptions

There are misconceptions associated with SBA loan programs. The most common myth is the length of time and paperwork required to get an SBA loan done. In actuality, a 504 loan can be closed in a reasonable amount of time if the paperwork is ready to go…and the paperwork is not much different than what is required for conventional financing. Finally, borrowers fear the fees associated with the program may be too expensive. SBA actually just reduced fees, so 504 loans are more affordable than ever.

When considering your next expansion or acquisition, don’t miss out on the opportunity to take advantage of the 504 Loan Program. It truly is the smartest financing tool available for small business owners.