Why this small business loan program continues to show double-digit, year-over-year growth, especially in these extraordinary times.

Created over 30 years ago, the SBA 504 Loan Program is a small business loan program authorized by the U.S. Small Business Administration to help promote economic development and retain quality jobs in communities throughout the United States. This unique financing option provides small businesses with long-term, fixed rate financing, which are most frequently used to acquire land, buildings and/or equipment; to construct, expand and/or renovate buildings; or to refinance commercial mortgages. But why…during a pandemic…would this loan program be seeing double-digit growth?

…Because SBA 504 Loans were specifically designed to help businesses grow, strengthen and recover…

SBA 504 Loans offer small businesses:

- Low, fixed interest rate on the 504 portion – see the current fixed rates

- Long loan terms (10-, 20-, or 25-year terms)

- Low down payments (10% in most cases)

- The ability to include furniture, fixtures and fees

- An option for refinancing commercial debt

- Payment stability

- Preservation of working capital

- Protection from balloon payments

- The ability to include leasehold improvements

- Up to $5 million for SBA portion of the loan, and no limit on the overall project size

- The option of using the 504 Loan Program multiple times to continue expansion

- The ability to keep your current bank/lender

The 504 loan program had another year of increased performance, with more than 7,000 loans made for a total dollar amount of more than $5.8 billion.

Record-Low Fixed Interest Rates Make The 504 Ideal for Growing Your Business

An SBA 504 loan is perfect for purchasing fixed assets and for making investments in your business’s future. The 10% down payment is quite low compared to conventional loans. Plus, the biggest benefits of an SBA 504 loan are the low interest rates and long terms. Since the loan is government-backed, the rates and fees on an SBA 504 loan are lower than what you’re likely to find with a bank.

SBA 504 loans have long repayment terms, which is part of what makes them so beneficial for small business owners. In fact, one of the reasons SBA 504 Loan Volume is up in FY 2020 is the addition of the 25-year fixed rate loan term. A long repayment term translates to lower monthly payments for your business, which helps you conserve cash flow. SBA 504 loan terms depend on what you’re using the loan for. The term is 10 years if you’re purchasing machinery or equipment, and 20 or 25 years if you’re purchasing or converting land or buildings.

Long-Term Refinancing Helps Businesses Strengthen and Recover

The SBA 504 Refinance Loan is government-backed financing that comes with three huge advantages. One, it offers business owners a below-market, fixed rate and a repayment period of up to 25-years. Two, the down payment requirements are as low as ten percent and are often fulfilled by existing equity in the project. And three, borrowers can elect to get cash out for business expenses. Cash can be taken out for salaries, rent, repairs, maintenance, inventory, utilities, credit cards, lines of credit, etc.

With the 504, the borrower’s equity injection is typically much lower than traditional business loans and can help you keep more of your cash in the business rather than tied up in real estate. Plus, existing equity in the collateral often fulfills the down payment requirement.

Almost All For-Profit Businesses Are Candidates

The 504 Loan Program is a financing tool for economic growth and development that provides small to medium sized businesses with long-term, fixed rate loans to help them acquire major fixed assets for expansion or modernization. These loans are most frequently used to acquire land, buildings, machinery or equipment.

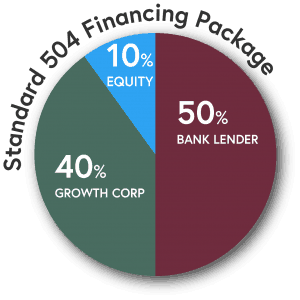

The loan itself is a partnership between you, your CDC (such as Growth Corp), and a local bank. The breakdown typically looks like this:

50% of the project’s total cost will come from a conventional lender (your bank). You and your lender will determine the conditions of that loan, including the amount. This loan is the first mortgage.

- 40% of the project’s total cost will come from a CDC (Growth Corp) with a 10-year or 20-year fixed rate loan guaranteed by SBA. This loan is the second mortgage.

- The remaining 10% of the project’s total cost will come from you, the borrower. Certain types of facilities are classified as “single-purpose” facilities and may require additional equity, but most projects fall into the 50-40-10 split.

Since 1996, the 504 Loan Program has facilitated over $151 billion in total expansion financing.

How to Apply for an SBA 504 Loan

Once you decide to get an SBA 504 loan, it’s time to find a lender who can help. Since the bank and CDC are both involved in this process, you’ll need to find a bank that’s willing to work on the bank portion of the loan and a CDC that’s willing to work on the CDC portion of the loan.

Many national, regional, and community banks participate in the SBA 504 lending program and you can most likely stay with the lender you already use for your business banking. Alternatively, you can start by finding the CDC. The SBA’s website has a CDC finder tool, and the CDC should be able to direct you to a local bank. Larger CDCs have more experience with 504 loans and tend to offer faster processing. We always recommend working with an ALP (Accredited Lender Program) CDC as they usually have preferred processing with the SBA. Growth Corp is the largest CDC in the Midwest and one of the top ten in the Nation. We are a non-profit organization and have earned ALP status with SBA, allowing us faster processing of SBA 504 loans.

Want to Learn More?

Contact our team of qualified lenders, who are experts at helping small business owners get approved for SBA 504 loans that can help them compete, grow and succeed.

50% of the project’s total cost will come from a conventional lender (your bank). You and your lender will determine the conditions of that loan, including the amount. This loan is the first mortgage.

50% of the project’s total cost will come from a conventional lender (your bank). You and your lender will determine the conditions of that loan, including the amount. This loan is the first mortgage.