With the new year almost upon us, it’s time to think about seizing new opportunities for growth in the months to come. That’s why the U.S. Small Business Administration (SBA) developed the 504 Loan Program…to offer business owners a more affordable and accessible way to grow and expand their business.

The SBA 504 Loan Program is designed to help business owners be successful. Funds can be used for purchasing land, purchasing existing buildings, construction and improvements, including grading, utilities, parking lots, landscaping, equipment or furniture/fixtures.

New Opportunities: Think 504 When…

- You are looking to buy, build or renovate a commercial facility

- You need to finance the purchase of heavy machinery or equipment

- You are looking to add multiple retail locations

- Your business is buying real estate as part of a business acquisition

- An owner wants to sell his/her share of real estate to the other owners

- A balloon payment is coming due on your commercial mortgage and you want to refinance the debt into a long-term, fixed-rate loan

- A 25-year loan could help manage your operating capital

Using the 504 to Finance Real Estate…

The 504 Loan is perfect for:

- Purchasing land

- Purchasing existing facilities

- Construction of new facilities

- Modernizing, renovating or converting existing facilities

Using the 504 to Finance New Equipment…

The 504 Loan is perfect for the purchase and installation of new or used, fixed, long-life machinery and equipment, such as:

- X-Ray or Digital Imaging Machines

- Manufacturing Equipment

- Dry-Cleaning Equipment

- Commercial Printers

- Food Processing Machinery

- Highly Calibrated Machines

- Equipment that generates renewable energy

Options

Whether you’re just replacing a piece of existing equipment or buying a larger facility and stocking it with all new equipment, the SBA 504 has flexible financing options.

- Machinery and equipment can be financed independent of real estate

- Or, machinery and equipment can be financed in conjunction with a commercial real estate purchase

- Loan terms of 10-, 20- or 25-years are available (term length is limited to the useful life declaration provided by the manufacturer)

Using the 504 to Refinance Debt…

The 504 Loan is perfect for refinancing existing commercial mortgages when:

- The loan is at least two years old

- The property being refinanced is at least 51% owner occupied or long-term equipment

- The debt to be refinanced was originally used for the purchase or improvement of fixed assets

- The business has been current on the debt to be refinanced for the past 12 months?

Options

- Multiple loans can be consolidated and/or refinanced

- Up to 90% loan-to-value (first and second combined)

- Cash out available up to 85%

- FIXED for 20 or 25 years on 504 loan

Using the 504 to Finance Total Project Costs

Let’s face it, the true bottom line of an expansion project, no matter the size, is often far more than the just the cost for brick and mortar or equipment. Soft costs and closing costs can add up. Most conventional bank loans do not include soft costs in the financing, leaving borrowers to pay for them out of their own pocket. However, the SBA 504 Loan Program finances total project costs. Total project costs include not just the cost for land and building, hard construction or equipment, but also the soft costs like moving your equipment, furniture, fixtures, closing costs and professional fees.

SBA 504 Financing Can Include:

Furniture and Fixtures

Lighting

Office Furniture

Partitions

Shelving Units

Menu Boards

Leasehold Improvements

HVAC, Flooring, Electrical, Plumbing

Landscaping

Parking Lots

Other Costs

Appraisals

Attorney Fees

Building Permits

Environmental Reviews

Design/Architectural Fees

Inspections

Interim Interest

12 benefits that prove SBA 504 Loans were specifically designed to help businesses expand and prosper…

SBA 504 Loans from Growth Corp feature:

- Low down payments (10% in most cases)

- Low, fixed interest rate on the 504 portion

- Long loan terms (10-, 20-, or 25-year terms)

- The ability to include furniture, fixtures and fees

- An option for refinancing commercial debt

- Payment stability

- Preservation of working capital

- Protection from balloon payments

- The ability to include leasehold improvements

- Up to $5 million for SBA portion of the loan, and no limit on the overall project size

- The option of using the 504 Loan Program multiple times to continue expansion

- The ability to keep your current bank/lender

How Does It Work?

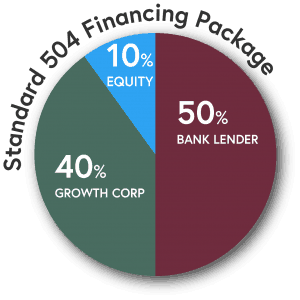

The 504 program offers financing that covers 90% of a project’s total cost, as opposed to the 70%-80% offered with most conventional loan programs. The typical breakdown of the funds in a 504 loan is:

• 50 percent from a bank or other private lender,

• 40 percent from the SBA, and

• 10 percent from the borrower

Business owners can reduce their initial capital outlays by as much as $1 million in some circumstances by leveraging the 504 Program’s 90 percent loan-to-cost financing.

Keep in mind…SBA 504 Loans are offered in conjunction with local banks, not in competition with them!

Most Businesses Qualify

To qualify for the SBA 504 Loan Program, the business must:

- have fewer than 500 employees

- be located in the United States

- be a for-profit business

- have a tangible net worth of not more than $15 million and average net income after taxes (two years prior to application) of not more than $5 million

- be owner-occupied

- if a manufacturing company, meet the definition of a small to mid-sized manufacturer as classified in the North American Industry Classification System, sectors 31-33.

504 Case Study Example

A widget manufacturer was just awarded a multi-million dollar contract, but needs to purchase a new piece of equipment to keep up with their growing demand.

| Purchase Equipment | $800,000 |

| Real Estate | $0 |

| Purchase Furniture & Fixtures | $0 |

| Soft Costs* | $0 |

| Total | $800,000 |

Unlike real estate, terms for equipment loans vary greatly. Depending on the nature of the borrower’s lending relationship with the bank and how much equity they have in any existing equipment, the terms could run anywhere from three to ten years, a three to seven year range for the balloon and up to 20% down payment. However, utilizing the 504 Loan Program, up to 90% of the project costs can be financed. The bank lends up to 50%, thereby reducing its risk and corresponding interest rate. Growth Corp lends up to 40% at a fixed rate for 20 years, with a down payment of only 10% from the borrower.

| Conventional | With 504 | |

| Bank | $640,000 | $400,000 |

| Growth Corp | $0 | $320,000 |

| Borrower | $160,000 | $80,000 |

| Total | $800,000 | $800,000 |

As shown, the borrower’s equity injection can be reduced by $80,000, thereby conserving cash and providing the necessary working capital to support continued growth. Additionally, cash flow is improved as a result of the longer maturity and potentially lower interest rates.

Founded in 1992, Growth Corp is the largest provider of SBA 504 commercial real estate financing in Illinois.

Growth Corp is a non-profit development company certified by the U.S. Small Business Administration (SBA) to originate SBA 504 loans in Illinois and its surrounding areas. Driven by a passion for helping small businesses grow, Growth Corp is the largest SBA 504 Lender in Illinois and one of the top ten Certified Development Companies in the country. With a current portfolio in excess of $675 million, Growth Corp has helped thousands of small and medium-sized businesses get the financing they need.

Why Growth Corp?

We know your success depends on having access to expansion capital. We offer affordable and accessible expansion capital to grow your business. Our experienced staff takes pride in making a difference in the lives of small business owners and their employees. Start-ups to seasoned businesses and everything in between can benefit from working with Growth Corp. Here’s why:

- We’re the #1 SBA 504 Lender in Chicago and Illinois. Growth Corp also consistently ranks as one of the top ten SBA 504 Lenders nationwide.

- SBA recognized Growth Corp as an Accredited Lender after a thorough review of its policies, procedures and prior performance. The prestigious ALP status grants Growth Corp increased authority to process and close 504 loans, which provides expedited processing of loan approvals and closings.

- We simplify the loan approval process. Our team coordinates the entire process from application through closing, funding and servicing, making it seamless for you and your bank lender.

- We are SBA 504 Experts. Our responsive and educated staff focuses almost exclusively on SBA 504 loans. We’ve got the process down to a science!

- We’ve worked with thousands of businesses, spanning various industries. That means, there’s not much we haven’t seen. Your goals, project structure and business type will likely be familiar to us and we’ll understand your unique situation.

- Our mission is to advocate for small business. We love our communities and believe small business is the foundation of their economic prosperity. We will do all we can to support you and your business goals.

If you run a small to medium sized business in and need financing to purchase machinery/equipment or construct/purchase a new building, Growth Corp’s team of professionals will work with you directly to provide the best financing strategy for reaching your goal. Contact any member of our Lending Team today!