With the July 2020 debenture pricing, we are seeing historic low rates for SBA 504 loans. Small business owners looking to refinance, purchase equipment or build/buy/renovate commercial real estate will find the SBA 504 Loan’s 25-year and 20-year fixed interest rates at the lowest in the program’s 33-year history.

The 20-year effective rate for the July 504 debenture sale was 2.34%. This is the fourth month in a row of 20-year fixed rates dipping below 3% for borrowers. The 25-year loan, which launched in April of 2018, is also at a record low of 2.41%. This is the first time in the program’s history the 20-year and 25-year effective rate calculations have been this low*. The 25-year SBA 504 loan has gained tremendous traction since its inception as well, approving over $2.4 billion in financing.

Rebuilding with SBA 504

The SBA and its loan programs have always played a crucial role in the strength and advancement of our small business sector and in fostering economic growth. During the COVID-19 pandemic, SBA also demonstrated a quick and massive implementation of initiatives aimed at giving small businesses and their employees a fighting chance. But one of SBA’s key players, the 504 Loan Program, will play an important role as America begins to reopen and rebuild.

Created over 30 years ago, the SBA 504 Loan Program is an economic development tool that provides small businesses with long-term, fixed rate financing. These loans are most frequently used to acquire land, buildings and/or equipment; to construct, expand and/or renovate buildings; or to refinance commercial mortgages. A 504 loan can be a 10-, 20- or 25-year term, which is beneficial for small business owners. Pairing the fixed rate aspect with these term lengths gives small business owners stability, allowing them to budget and manage cash flow without concerns about rising rates or balloon payments.

SBA 504 Loan Program

Many people are asking if these great financing terms will stick around. The best indicator we have is to look back. We have compiled a fifteen year rate history (504 Interest Rate History – July 2020) for 20-year loans that helps visualize the ups and downs. To see the history of the 25-yr and 10-year as well, please refer to the tabs on our Rates page.

Historic – July 2020 Debenture Pricing for 504 Loans

25-YR: 2.41% | 20-YR: 2.34% | 10-YR: 2.39% | REFI: +0.0015%

We have compiled a rate comparative (504 Rate History – Comparative – July 2020) showing how the historic 20-Year and 25-Year interest rates are stacking up to Prime.

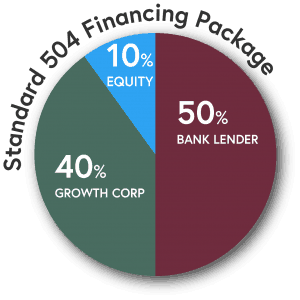

SBA Has Expanded Loan Availability

There is plenty of money available for lending. In fact, the SBA has recently displayed significant effort in making the 504 Loan Program available to even more businesses. With higher loan limits, expanded eligibility standards, and a new debt refinance option, more businesses are now able to utilize the 504 than ever before. Plus, the 504 offers 90% loan-to-cost financing for most commercial real estate projects (inclusive of land, existing building, ground-up construction, furniture, fixtures, equipment, soft costs and closing costs), SBA 504 loans are a very powerful tool, yet they remain under-utilized because many small business owners just aren’t aware this financing option exists. Last year, 504 loans helped fuel just north of $5 billion in new capital investments for approximately 6,000 businesses throughout the U.S.

For more information: 504 Loan Program – July 2020

How to Get Started

Contact our team of qualified lenders, who are experts at helping small business owners get approved for SBA 504 loans that can help them compete, grow and succeed. Don’t miss your opportunity to take advantage of these historic rates.