Saving Energy Can Help You Gain Capital

If you’d like to go green, SBA’s 504 Loan Program offers special incentives for incorporating energy efficiency or renewable energy into building projects. The 504 Loan Program is designed to assist small businesses with financing real estate and equipment purchases. The loans are generally used for large projects that will make a positive impact on their community through job creation and local economic development.

More Energy, More Money

The SBA 504 lending limits are determined by how the funds will be used and whether the project creates jobs and/or fulfills public policy or community development goals. One of these goals is a public policy goal for energy efficiency and renewable energy. Complying projects must either reduce energy consumption by at least 10% or generate more than 15% of the energy used by the Applicant at the project facility (ex: wind, solar or geothermal energy sources). If the public policy goal is met, borrowers can increase their SBA 504 lending limit from $5 million to $5.5 million per project. So, by spending less on your utilities, you can actually get more capital for your business improvement project!

Resources are Available

DOE has designed two resources for helping small businesses spark some energy saving ideas and better understand the process required to incorporate energy solutions into their building projects. They are:

- A Borrower’s Guide to Increase Their Bottom Line Using Energy Efficiency

- A Guide to Help SBA Lenders Understand and Communicate the Value of Energy Efficiency Investments

The Benefits of Going Green

Increased loan limits and utility bills savings aren’t the only benefits of going green. Investing in energy efficiency can also:

- Reduce operating costs – by saving on operation and maintenance costs with longer-lasting, more efficient lighting

- Improve the building’s air quality – by reducing air leakages and drafts and increasing the amount of daylight

- Enhance your brand image – by increasing the value of your asset to potential renters and marketing to environmentally concerned customers

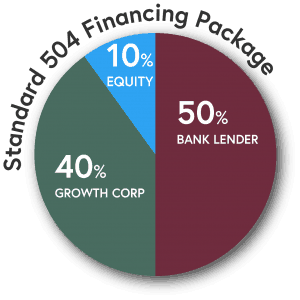

SBA 504 Loan Structure

- 40% of the total project cost is provided by a non-profit CDC

- 50% of the total project cost is provided by a participating lender (typically a bank)

- 10% of the total project cost is provided by the applicant small business borrower

How the 504 Loan Program Offers Additional Help with Going Green

Besides the typical benefits of 504 Loans, which include low, fixed rates, long loan terms (up to 25 years) and low down payments, the 504’s Green Initiative adds the following benefits:

- Up to $5.5 million per project

- Removes the dollar limit on the SBA portion

- Slashes the banks’ risk to 50% of the project costs

- Allows borrowers to take multiple loans

About the SBA 504 Loan Program

The SBA 504 Loan Program is an economic development tool that provides small businesses with long-term, fixed rate loans to help them acquire major fixed assets for expansion or modernization of their businesses. These loans are most frequently used to acquire land, buildings, machinery or equipment. A 504 loan can be a 10-, 20- or 25-year term, which is beneficial for small business owners. Pairing the fixed rate aspect with these term lengths gives small business owners stability, allowing them to budget and manage cash flow without concerns about rising rates or balloon payments.

About Growth Corp

Small Business Growth Corporation (Growth Corp) is a nonprofit, mission-based lender dedicated exclusively to connecting small businesses with quality expansion capital through administration of the SBA 504 Loan Program. With a commitment to economic development, job creation and the small business sector, Growth Corp is ranked a Top 10 National CDC for SBA 504 loan volume and is Illinois’ largest 504 loan provider. In fact, Growth Corp’s substantial portfolio ($750+ million) is particularly impressive because every dollar was utilized by Midwest entrepreneurs to open and expand their small businesses. Contact any member of our lending team today!