Wondering how to finance heavy equipment? The SBA 504 Loan Program is one of the best options for manufacturing operations looking to purchase heavy machinery and equipment, or for those looking to purchase new facilities, warehouses or other commercial real estate assets.

SBA 504 Loan Program Basics

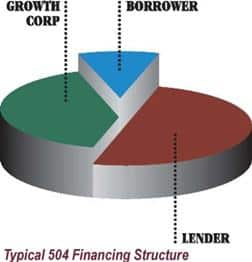

The SBA 504 Loan Program annually facilitates billions of dollars in commercial real estate transactions as well as improvements and equipment purchases. In a typical 504 loan there are three players:

- A bank providing a first mortgage for 50% of the total project costs

- A Certified Development Company (such as Growth Corp), providing a second mortgage for 40% of the total project costs

- The borrower providing 10% equity

Since conventional loans usually require a 20-30% equity contribution from the borrower, the upfront savings resulting from the 504’s 90% financing is reason enough for choosing the 504. However, there’s more.

Benefits for Manufacturers

Check out these other benefits:

- Long loan terms of 20 years for real estate and 10 years for equipment.

- Low, fixed interest rates for the life of the 504 loan

- Manufacturers may be eligible for up to $5.5 million per project on the SBA second mortgage portion of the loan. There is no limit overall on project size.

- There is no limit on the number of SBA 504 loan projects allowed to manufacturers. So a growing, small manufacturer could use the program to purchase a new facility, finance various pieces of new equipment and open an additional facility. Funds for small manufacturing projects are not limited by SBA’s lending limits of $5 million per borrower.

- SBA financing is total project cost financing. This means it includes land, construction/renovations, equipment, furniture/fixtures, soft costs and closing costs. Financing total project costs is a clear advantage as it allows borrowers to preserve capital and use it to grow their business in other ways.

Download Growth Corp’s Commercial Buyer Guide

How Funds May Be Used

- Acquisition of an existing building –

- New Construction

- Land

- Equipment

- Refinancing of qualified commercial real estate debt –

Read more: SBA 504 Reference Guide | 504 Refinance Loan Guide

What Manufacturing Operations Qualify?

The manufacturing business must:

- have fewer than 500 employees and meet the definition of a small to mid-sized manufacturer as classified in the North American Industry Classification System, sectors 31-33.

- be located in the United States

- be a for-profit business

- have a tangible net worth of not more than $15 million and average net income after taxes (two years prior to application) of not more than $5 million

- be owner-occupied

The Bottom Line

An SBA 504 loan is one of the first types of financing you should consider if you plan to purchase commercial real estate or long-term equipment. The low interest rates, long repayment terms and low down payment requirements takes the pressure off business cash flow and instead preserves it for working capital.