The decision on when to expand and/or relocate your business is a difficult one. Two of the most recognized hurdles your business may face are:

- preservation of capital (“Do I have enough cash to expand my business?”); and

- finding appropriate financing (“What’s the best deal available?”).

Many businesses have an inability to cash-flow an expansion because they need to retain their operating capital. In turn, owners will then inquire about financing options with the lending institution with whom their business has an established relationship. However, let’s face it, a bank usually wants 20 percent borrower equity in a project.

Wouldn’t it be nice if you could reduce your equity injection to 10 percent or less at the outset and get a 20-year fixed rate that’s historically below five percent? How? By utilizing a program established over 25 years ago by the U.S. Small Business Administration.

SBA 504 Loan Program – What is it?

The short answer is…owner-occupied real estate and equipment financing. The 504 Loan Program was created over 30 years ago by the U.S. Small Business Administration and is available to most businesses for the purchase, construction, or expansion/renovation of buildings and/or for the purchase of heavy machinery and equipment.

What Can the 504 Do For My Business?

The 504 can:

- Finance your expansion with a very low down payment thus saving your working capital

- Help you avoid future balloon payments

- Ease budget concerns

- Provide payment stability

- Allow you to invest in your business property

- Prevent rising lease costs

- Allow for the inclusion of eligible business expenses in the loan

- Refinance qualifying commercial mortgage debt

How Does It Work?

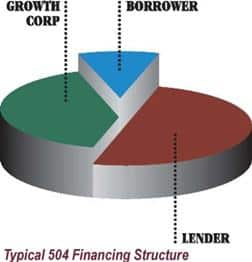

The 504 provides 90% financing at a long-term fixed rate and essentially consists of three components:

- 50% of the project’s total cost is provided by a lending institution, such as First State Bank

- 40% of the project’s total cost is provided by a CDC authorized to administer 504 financing, such as Growth Corp

- 10% equity is provided by the applicant small business/borrower*

Project Example

Here’s an example…a manufacturer had been leasing space on Industrial Drive since incorporating in 2012. The company was paying monthly rents of $21,875 plus real estate taxes. An opportunity to purchase the property for $2,000,000 came about. The owner of the company contacted his lender who recommended the sale be financed through the 504 Loan Program since the borrower wanted to hold on to as much working capital as possible. The lender was able to finance 50% as the first mortgage, 40% was guaranteed by the SBA 504 Loan Program, and the borrower only put down 10%. The combined monthly payment on the acquisition of this property was approximately $16,000/month – a savings of nearly $6,000.

Misconceptions

There are some misconceptions associated with SBA loan programs. The most common is the amount of paperwork or length of time required to get an SBA loan done. In actuality, a 504 loan is not much different than a conventional loan as far as timing and documentation, and can be closed in a reasonable amount of time. In addition, many fear the fees associated with the program may be too expensive. In reality, 504 loans offer a low interest rate (4.37% – January 2017), which is fixed for 20 years. Any fees are offset in a short amount of time with no concern over future balloon payments or property valuations.

When considering your next expansion or acquisition, look into the SBA 504 Loan Program. It is one of the smartest financing tools available for manufacturers. The numerous benefits and low interest rates make this the best kept secret in small business financing.