25-YR FIXED RATE

5.80%

20-YR FIXED RATE

5.86%

10-YR FIXED RATE

5.67%

MANUFACTURER'S RATE

5.56%

empowering economic growth

504 loan program

SBA 504 Loans Success Stories

expansion solutions

Purchase a Building

Construct a New Facility

Renovate Your Current Property

Purchase Heavy Machinery or Equipment

Refinance Commercial Mortgage Debt

Recent Blog Posts…

SBA 504 – Built for Veterans

Unlock business growth with SBA 504 - built for Veterans like you! Why was the SBA 504 built for Veterans and their...

Build Your Business From the Ground Up

Ready to build your business from the ground up? Join thousands of smart business owners financing their growth with the...

How SBA 504 Loans Work

50%

LOCAL BANK

A bank provides a first mortgage for

50% of the total project costs

40%

SBA 504 LOAN

Growth Corp provides an SBA 504 Loan

for 40% of the total project costs

10%

BORROWER EQUITY

The borrower provides a down payment of

typically just 10% of the total project costs

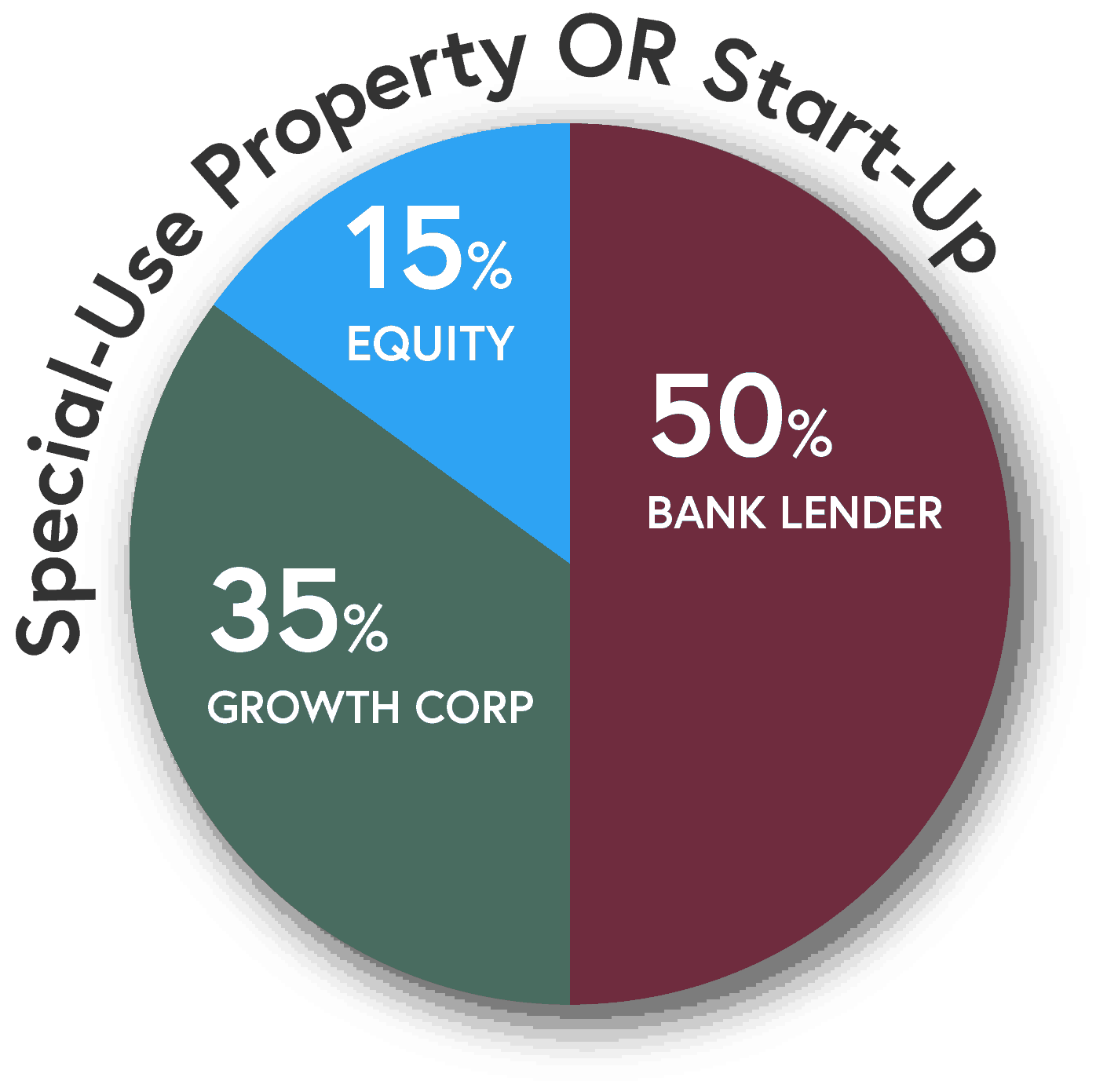

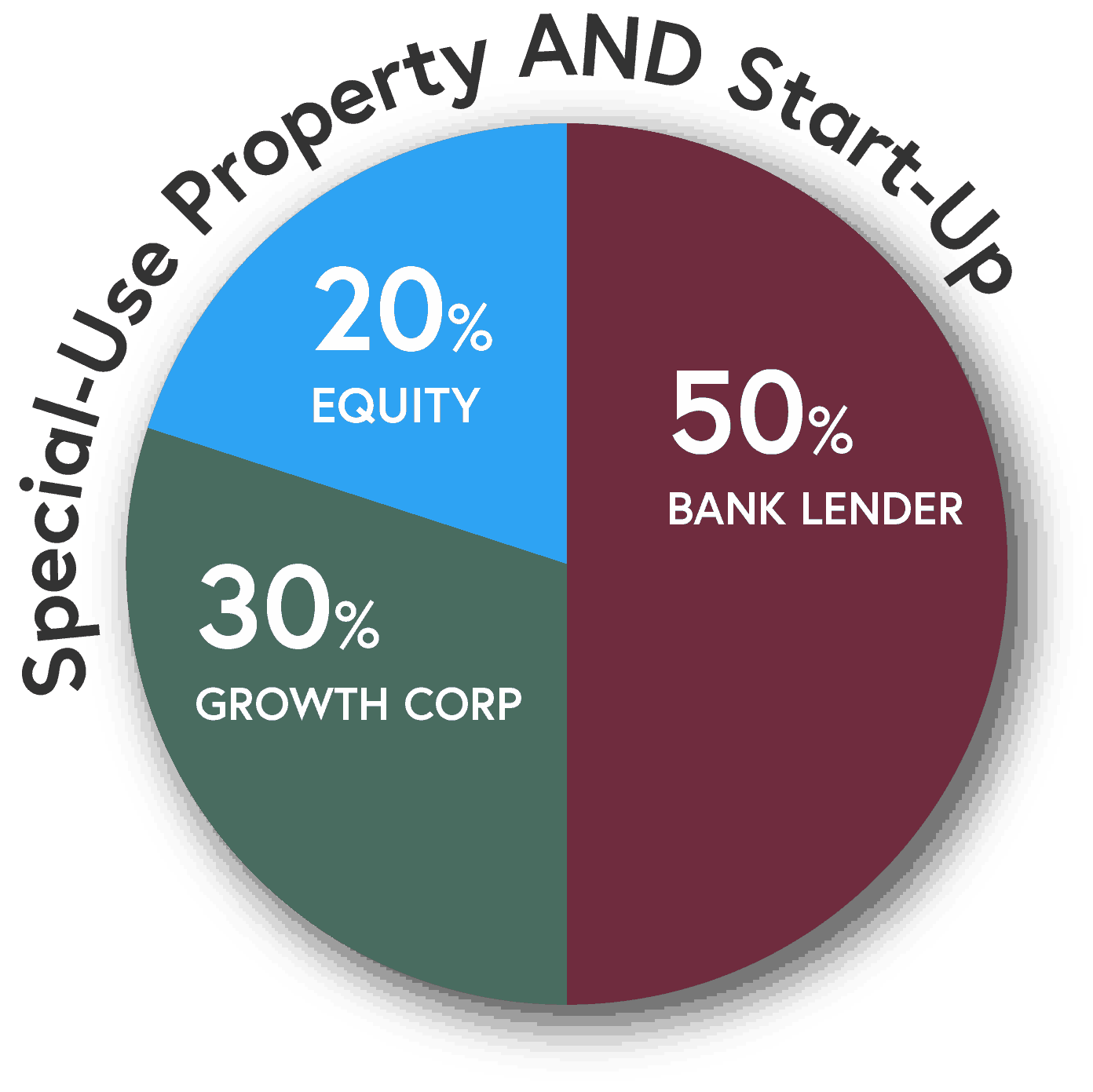

Higher equity requirements exist for start-ups or special purpose properties…the equity required will increase by 5% if one condition exists or by 10% if both.

SBA 504 Loans are made in conjunction with your local bank...so you can keep your lending relationship.

504 Case Study – New Construction

A widget manufacturer that has been leasing space wants to construct a building to facilitate business expansion.

| Purchase Land | $500,000 |

| Construct Building | $1,500,000 |

| Purchase Furniture & Fixtures | $250,000 |

| Soft Costs* | $150,000 |

| Total | $2,400,000 |

*Soft costs can include interim interest and fees, professional fees, a construction contingency, appraisal and environmental costs, etc.

If a bank was willing to finance the project conventionally, it would typically lend up to 80% of the project costs at a floating interest rate with a 15 year amortization and a balloon after three to five years. However, utilizing the 504 Loan Program, up to 90% of the project costs can be financed. The bank lends up to 50%, thereby reducing its risk and corresponding interest rate. Growth Corp lends up to 40% at a fixed rate for 20 years, with a down payment of only 10% from the borrower.

| Conventional | With 504 | |

| Bank | $1,920,000 | $1,200,000 |

| Growth Corp | $0 | $960,000 |

| Borrower | $480,000 | $240,000 |

| Total | $2,400,000 | $2,400,000 |

As shown, the borrower’s equity injection can be reduced by $240,000, thereby conserving cash and providing the necessary working capital to support continued growth. Additionally, cash flow is improved as a result of the longer maturity and potentially lower interest rates.

Let’s keep in touch…join our email list…

SBA 504 LOANS

How Will You Grow Your Business?

877-BEST 504

www.GrowthCorp.com