The SBA and its loan programs have always played a crucial role in the strength and advancement of our small business sector and in fostering economic growth. During the COVID-19 pandemic, SBA also demonstrated a quick and massive implementation of initiatives aimed at giving small businesses and their employees a fighting chance. But one of SBA’s key players, the 504 Loan Program, is playing an active role in the recovery and growth of America’s small businesses.

SBA 504 loans, guaranteed by the U.S. Small Business Administration, provide long-term financing for the purchase of real estate, equipment, and other fixed assets. There are three parties to an SBA 504 loan—the borrower, the bank, and the SBA-approved certified development company (CDC) (Growth Corp). Check out some of the many reasons why a 504 Loan may be exactly what you need right now.

Below-Market, Fixed Interest Rates

The SBA second mortgage is a fixed rate tied to the 10-year Treasury, unaffected by market instability or inflation expectations. The rate is consistently low and stable, being under 6 percent for the past 10 years. Today, that rate is:

October 2021 Debenture Pricing

25-YR: 2.91% | 20-YR: 2.77% | 10-YR: 2.37% | REFI: +0.0115%

Many people are asking if these great financing terms will stick around. The best indicator we have is to look back…please refer to the tabs or downloads on our Interest Rates History page.

Favorable Loan Terms

The 504 rate has loan options of 10-years, 20-years, and 25-years. It is fully amortized through the life of the loan, meaning there is no balloon payment at the end of the term. This long term, below market rate provides small business owners with affordable monthly payments and enables them to control their overhead costs for the long term.

504 loans can be repaid early and under very favorable conditions, sometimes with no penalty. Being a unique program, the 504 has unique prepayment conditions as well. After the first half of the loan term has passed, the loan can be repaid early at no additional cost. That is, a 20-year loan can be repaid without penalty in the 11th year or later, and a ten-year loan can similarly be repaid without penalty after five years.

For the first half of the loan, the penalty is the debenture rate (typically under 3 percent) on the balance of the loan. That penalty is reduced by 10 percent each year, reaching zero at the term’s halfway point.

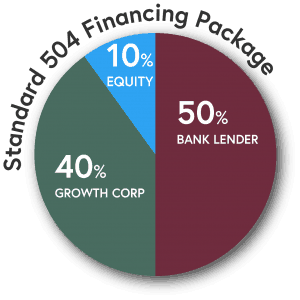

Low Down Payments

The low 10 percent down payment is one of the biggest attractions of the 504 Loan Program. Conventional loans often require a 20-40 percent down payment, an unattainable figure for many business owners. A lower down payment requirement opens the doors for many small business owners that otherwise couldn’t afford to purchase real estate or equipment. Certain circumstances require a down payment of 15 percent, such as when the loan is being used to purchase a special use property or if the business has been in operation for less than two years. However, this is still significantly less than conventional financing.

With the 504 loan’s low equity injection, businesses retain precious working capital. Renovations and soft costs can also be financed, allowing further cash savings.

Provides Total Project Financing

The 504 loan is widely known as a commercial real estate loan, however it can be used for much more. Funds from a 504 loan can be used for:

- Acquisition of real estate (land and buildings)

- Acquisition of equipment

- Construction and renovation costs

- Soft costs – the ability to include furniture, fixtures, and fees

- Refinance conventional loans

There is no limit to the total project cost with a 504 Loan. The SBA portion (40 percent of the total project cost) is capped at $5,000,000 or $5,500,000 for manufacturing projects or projects that implement green efficiencies.

Improves Cash Flow

Improved cash flow is of vital interest to all businesses. Business owners faced with high-interest mortgages or upcoming balloon payments can greatly benefit from the SBA 504 Refinance Program. SBA 504 Loans provide access to equity a borrower has built up in real estate while re-amortizing with a low, long-term, fixed interest rate product.

The SBA 504 Refinance Loan is government-backed financing that comes with three huge advantages. One, it offers business owners a below-market, fixed rate and a repayment period of up to 25-years. Two, the down payment requirements are as low as ten percent and are often fulfilled by existing equity in the project. And three, borrowers can elect to get cash out for business expenses. Cash can be taken out for salaries, rent, repairs, maintenance, inventory, utilities, credit cards, lines of credit, etc.

Controls Overhead Costs

Entrepreneurs typically start their business in a leased facility. In fact, many small business owners think financing a commercial real estate purchase isn’t even an option because they fear the down payment requirements will be too high. However, buying or constructing a new facility with 504 provides a great opportunity for fixing occupancy costs and locking in low interest rates. Other benefits include:

- Builds equity: each payment is an investment in the future

- Occupancy costs are stabilized: rent increases no longer apply and the SBA 504 payment is fixed

- Preserves cash: in most cases, with the 504, the monthly payment to own is less than a rent payment

By locking in a low rate, which is fully amortized for up to 25 years, borrowers see predictable monthly payments. Plus, 504 Loans have no future balloon payments.

SBA 504 loans also allow borrowers to roll closing costs, soft costs and other fees into the loan, thus preserving cash. Not to mention, the cost of equipment, furniture and fixtures, parking lots, architectural fees, etc. can also be rolled into the loan.

Helps Streamline or Increase Production

Whether the business is product or service based, having the necessary equipment is vital to maintaining smooth operations. However, replacing, upgrading or purchasing new equipment can put a serious pinch on cash flow. A 504 Loan offers business owners a more affordable way to get needed equipment without making a substantial dent in the bottom line.

504 Loans are perfect for the purchase and installation of new or used, fixed, long-life machinery and equipment, such as:

- X-Ray or Digital Imaging Machines

- Manufacturing Equipment

- Dry-Cleaning Equipment

- Commercial Printers

- Food Processing Machinery

- Highly Calibrated Machines

- Equipment that generates renewable energy

Machinery and equipment can be financed independent of real estate or in conjunction with a commercial real estate purchase. Loan terms of 10-, 20- or 25-years are available, which is determined by the useful life declaration provided by the manufacturer.

Most Businesses Qualify

The SBA’s definition of “small” is substantially larger than what most people assume (a tangible net worth of less than $15 million and profit after taxes of less than $5 million (including affiliates). The truth is, most for-profit businesses are eligible for 504 financing. The business must occupy at least 51% of the building on real estate purchases. This requirement ensures the integrity of the program aimed to help small businesses, not large investment companies.

Keep Your Lender & Improve Your Odds

In particular, businesses such as startups or those within specialized industries, have difficulty securing a conventional loan. With a 504 loan, the partnership with a CDC lowers the bank risk and increases a business owner’s chances of securing a loan with them. Growth Corp has longstanding relationships with all types of lenders and can help find the best bank to accommodate the first mortgage.

Support from a Local Certified Development Company

According to SBA, “A Certified Development Company (CDC) is a nonprofit organization that promotes economic development within its community through 504 loans. CDCs are certified and regulated by the SBA, and work with SBA and participating lenders (typically banks) to provide financing to small businesses, which in turn accomplishes the goal of community economic development.”

Perhaps the most important aspect of CDCs is how tightly woven they are with the wider community, specifically the state in which they operate, and even the region surrounding the state in which they are headquartered. CDCs are designed to help strengthen local businesses by connecting them with quality financing for fixed asset investments (real estate or equipment), which, in turn, supports local economies, revitalizes neighborhoods, and breathes new life into local communities.

Certified Development Companies work in conjunction (not in competition) with local banks to offer financing through the SBA 504 Loan Program. CDCs package and process loan applications through the SBA, and then close and service those loans once they’ve been approved. Small business borrowers gain expert advice from the CDC on SBA 504 Loan terms, rates, uses, and structures. These recommendations are all incredibly beneficial to small businesses that are looking to finance their company’s growth and expansion.

How can a small business become eligible for SBA 504 financing?

To be eligible for the SBA 504 loan program, a small business must:

- have fewer than 500 employees

- be located in the United States

- be a for-profit business

- have a tangible net worth of not more than $15 million and average net income after taxes (two years prior to application) of not more than $5 million

- be owner-occupied

- if a manufacturing company, meet the definition of a small to mid-sized manufacturer as classified in the North American Industry Classification System, sectors 31-33.

About Growth Corp

Small Business Growth Corporation (Growth Corp) is a nonprofit, mission-based lender dedicated exclusively to connecting small businesses with quality expansion capital through administration of the SBA 504 Loan Program. With a commitment to economic development, job creation and the small business sector, Growth Corp is ranked a Top 10 National CDC for SBA 504 loan volume and is Illinois’ largest 504 loan provider. In fact, Growth Corp’s substantial portfolio ($740+ million) is particularly impressive because every dollar was utilized by Midwest entrepreneurs to open and expand their small businesses. Contact any member of our lending team today!