Attention small business owners: If you’re tired of paying rent for your business, you need to know about a government-backed financing option that can help you buy or build a new facility for your business: the SBA 504 Loan Program.

Should I Rent or Buy?

That’s something many small business owners often find themselves asking. Below are a few questions that will help assess where you’re at.

Questions to Ask Yourself…

- Future Plans. How many years do I expect to occupy my commercial building? Do I need flexibility?

- Building Location. Do I need the building to be in a specific geographic area?

- Building Customizations. Does my business need a specific look/appearance or layout to operate at its best?

- Uncertainty. Is there a chance my landlord won’t renew my lease? Could my landlord increase my rent? How much of a disruption would this cause?

- Pay-To. Have you asked yourself why you’re paying someone else’s rent instead of investing in your own asset? Are you helping to build your landlord’s wealth instead of your own? Or, are you willing to pay more for flexibility?

- Affordability. Do you have enough liquidity for the down payment (it’s usually just 10% with an SBA 504 real estate loan – see below) and closing costs without stressing your day-to-day operations?

- Investment. How do you feel about adding commercial real estate to your personal financial portfolio?

Buy or Build with an SBA 504 Loan

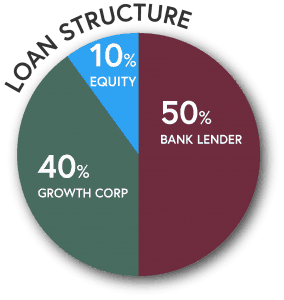

If you’ve determined that owning the commercial real estate that houses your business is a smart, strategic investment but fear the cost of the financing involved, read on. There is an option for business owners who can’t afford to contribute 20, 30 or even 35 percent of the project in the form of a down payment. Let’s take a look at how the Small Business Administration’s (SBA) 504 loan can help you buy or build your own facility.

Down Payment Requirements

For businesses looking to protect their cash flow, or facing tighter cash flow because of higher interest rates, the SBA 504 offers an advantage. Down payments as low as ten percent. This amounts to huge cash savings as most conventional loans require 20%, or even up to 35%, down.

Interest Rates and Loan Terms

Conventional loan rates are typically only fixed for a certain period of time, usually 3-10 years. After that, the rate is reset and could become variable. In a rising rate environment, that means you could find yourself with a much higher rate in the future. Conversely, a long-term fixed-rate mortgage, such as the SBA 504, locks in today’s low interest rates and eliminates concern over future interest rate hikes. The interest rate for SBA 504 loans is well below prime and has been a record lows this year. By locking in this low rate, which is fully amortized over 10-, 20-, or 25-years, you’ll see predictable and lower monthly payments.

Balloon Payments and Call Provisions

A balloon loan mortgage, common in commercial real estate, is usually a short mortgage that requires a large one-time payment at the end of the term. This can mean your payments are lower in the years before the balloon payment comes due, but you will either owe a lump sum at the end or be required to refinance the balance. This can lead to another round of building appraisals and credit approvals to endure. However, unlike conventional commercial real estate loans, a 504 Loan has no balloon payments.

Call provisions are similar to balloon payments in that, with a conventional loan, you may be required to maintain a specific debt-service coverage ratio as a way for lenders to lower their risk. If you fail to meet that provision, the bank can “call in” your loan. This means you would either have to pay off the balance, or refinance it. The SBA 504 Loan Program has no covenants or call provisions either. What you get is a long-term, fixed rate loan offering secure, predictable monthly payments for the life of the loan.

The SBA 504 Finances Total Project Costs

Let’s face it, the true bottom line of an expansion project, no matter the size, is often far more than the just the cost for brick and mortar or equipment. Soft costs and closing costs can add up. Most conventional bank loans do not include soft costs in the financing, leaving borrowers to pay for them out of their own pocket. However, the SBA 504 Loan Program finances total project costs. Total project costs include not just the cost for land and building, hard construction or equipment, but also the soft costs like moving your equipment, furniture, fixtures, closing costs and professional fees.

SBA 504 Financing Can Include:

Furniture and Fixtures

Lighting

Office Furniture

Partitions

Shelving Units

Menu Boards

Leasehold Improvements

HVAC

Flooring

Electrical

Plumbing

Landscaping

Parking Lots

Other Costs

Appraisals

Attorney Fees

Building Permits

Environmental Reviews

Design/Architectural Fees

Inspections

Interim Interest

Most Businesses Qualify

To qualify for the SBA 504 Loan Program, the business must:

- have fewer than 500 employees

- be located in the United States

- be a for-profit business

- have a tangible net worth of not more than $15 million and average net income after taxes (two years prior to application) of not more than $5 million

- be owner-occupied

- if a manufacturing company, meet the definition of a small to mid-sized manufacturer as classified in the North American Industry Classification System, sectors 31-33.

504 Loans Are Attractive To Conventional Lenders

SBA 504 loans offer banks a good deal, as well. Your 504 loan is a low risk for the conventional bank because they hold the first mortgage. They have a lien on the whole property, even though they are only financing a portion of it. It is an easy way for the bank to attract new business and to enlarge their impact in the community. This means that you are more likely to get financing from a conventional bank when you are backed by the SBA with a 504 loan. The bank may even give you better conditions than they would offer otherwise.

Ready to Buy or Build? Benefits to Owning

The SBA 504 Program was designed to make building ownership possible for small business owners by pairing it with the best terms on the market. It is the most affordable way to purchase a building – and now, with record low interest rates and loan forgiveness, you will not find a more optimal time to take advantage of the program.

When the SBA 504 Program is utilized for a building purchase, mortgage payments are often comparable to rent payments, plus you are gaining so much more. Such as:

- Equity: with every monthly payment, you are building equity rather than putting money in your landlord’s pocket

- Tax Benefits: There are tax benefits to owning in every state. Please do consult your tax professional for more specific tax benefits.

- Stability: Gain peace of mind knowing what your occupancy costs will be for 25 years.

- Preserves Cash: in many cases, the monthly payment to own your business’s building is less than renting. Small business owners can use the additional working capital that resulted from buying a building for their business for other things that can help grow their company like to buy inventory, hire new employees, equipment financing, or invest in other strategies to grow or improve the business.

Why Growth Corp?

Founded in 1992, Growth Corp is the largest provider of SBA 504 commercial real estate financing in Illinois.

Growth Corp is a non-profit development company certified by the U.S. Small Business Administration (SBA) to originate SBA 504 loans in Illinois and its surrounding areas. Driven by a passion for helping small businesses grow, Growth Corp is the largest SBA 504 Lender in Illinois and one of the top ten Certified Development Companies in the country. With a current portfolio in excess of $740 million, Growth Corp has helped thousands of small and medium-sized businesses get the financing they need.

We know your success depends on having access to expansion capital. We offer affordable and accessible expansion capital to grow your business. Our experienced staff takes pride in making a difference in the lives of small business owners and their employees. Start-ups to seasoned businesses and everything in between can benefit from working with Growth Corp. Here’s why:

- We’re the #1 SBA 504 Lender in Chicago and Illinois. Growth Corp also consistently ranks as one of the top ten SBA 504 Lenders nationwide.

- SBA recognized Growth Corp as an Accredited Lender after a thorough review of its policies, procedures and prior performance. The prestigious ALP status grants Growth Corp increased authority to process and close 504 loans, which provides expedited processing of loan approvals and closings.

- We simplify the loan approval process. Our team coordinates the entire process from application through closing, funding and servicing, making it seamless for you and your bank lender.

- We are SBA 504 Experts. Our responsive and educated staff focuses almost exclusively on SBA 504 loans. We’ve got the process down to a science!

- We’ve worked with thousands of businesses, spanning various industries. That means, there’s not much we haven’t seen. Your goals, project structure and business type will likely be familiar to us and we’ll understand your unique situation.

- Our mission is to advocate for small business. We love our communities and believe small business is the foundation of their economic prosperity. We will do all we can to support you and your business goals.

If you run a small to medium sized business in and need financing to purchase machinery/equipment or construct/purchase a new building, Growth Corp’s team of professionals will work with you directly to provide the best financing strategy for reaching your goal. Contact any member of our Lending Team today!