The 504 Loan Program’s volume is surging nationwide, with more than 9,000 loans made, for a total dollar amount of more than $7.9 billion. This begs the question…why is this small business loan program continuing to show double-digit, year-over-year growth?

The 504 Loan Program’s volume is surging nationwide, with more than 9,000 loans made, for a total dollar amount of more than $7.9 billion. This begs the question…why is this small business loan program continuing to show double-digit, year-over-year growth?

Created over 30 years ago, the SBA 504 Loan Program is a small business loan program authorized by the U.S. Small Business Administration to help promote economic development and retain quality jobs in communities throughout the United States. This unique financing option provides small businesses with long-term, fixed rate financing, which are most frequently used to acquire land, buildings and/or equipment; to construct, expand and/or renovate buildings; or to refinance commercial mortgages. But why…during a pandemic…would this loan program be seeing double-digit growth?

Volume is surging…because SBA 504 Loans were specifically designed to help businesses grow, strengthen, and recover…

SBA 504 Loans offer small businesses:

- Low, fixed interest rate on the 504 portion – see the current fixed rates

- Long loan terms (10-, 20-, or 25-year terms)

- Low down payments (10% in most cases)

- The ability to include furniture, fixtures and fees

- An option for refinancing commercial debt

- Payment stability

- Preservation of working capital

- Protection from balloon payments

- The ability to include leasehold improvements

- Up to $5 million for SBA portion of the loan, and no limit on the overall project size

- The option of using the 504 Loan Program multiple times to continue expansion

- The ability to keep your current bank/lender

Record-Low Fixed Interest Rates Make The 504 Ideal for Growing Your Business

An SBA 504 loan is perfect for purchasing fixed assets and for making investments in your business’s future. The 10% down payment is quite low compared to conventional loans. Plus, the biggest benefits of an SBA 504 loan are the low interest rates and long terms. Since the loan is government-backed, the rates and fees on an SBA 504 loan are lower than what you’re likely to find with a bank.

SBA 504 loans have long repayment terms, which is part of what makes them so beneficial for small business owners. In fact, one of the reasons SBA 504 Loan Volume is up in FY 2021 is the addition of the 25-year fixed rate loan term. A long repayment term translates to lower monthly payments for your business, which helps you conserve cash flow. SBA 504 loan terms depend on what you’re using the loan for. The term is 10 years if you’re purchasing machinery or equipment, and 20 or 25 years if you’re purchasing or converting land or buildings.

Long-Term Refinancing Helps Businesses Strengthen and Recover

The SBA 504 Refinance Loan is government-backed financing that comes with three huge advantages. One, it offers business owners a below-market, fixed rate and a repayment period of up to 25-years. Two, the down payment requirements are as low as ten percent and are often fulfilled by existing equity in the project. And three, borrowers can elect to get cash out for business expenses. Cash can be taken out for salaries, rent, repairs, maintenance, inventory, utilities, credit cards, lines of credit, etc.

With the 504, the borrower’s equity injection is typically much lower than traditional business loans and can help you keep more of your cash in the business rather than tied up in real estate. Plus, existing equity in the collateral often fulfills the down payment requirement.

Real World Applications. Think 504 When…

- You are looking to buy, build or renovate a commercial facility

- You need to finance the purchase of heavy machinery or equipment

- You are looking to add multiple retail locations

- Your business is buying real estate as part of a business acquisition

- An owner wants to sell his/her share of real estate to the other owners

- A balloon payment is coming due on your commercial mortgage and you want to refinance the debt into a long-term, fixed-rate loan

The SBA 504 Loan Program is designed to help business owners be successful. Funds can be used for purchasing land, purchasing existing buildings, construction and improvements, including grading, utilities, parking lots, landscaping, equipment or furniture/fixtures.

Using the 504 to Finance Real Estate…

The 504 Loan is perfect for:

- Purchasing land

- Purchasing existing facilities

- Construction of new facilities

- Modernizing, renovating or converting existing facilities

Using the 504 to Finance New Equipment…

The 504 Loan is perfect for the purchase and installation of new or used, fixed, long-life machinery and equipment, such as:

- X-Ray or Digital Imaging Machines

- Manufacturing Equipment

- Dry-Cleaning Equipment

- Commercial Printers

- Food Processing Machinery

- Highly Calibrated Machines

- Equipment that generates renewable energy

Whether you’re just replacing a piece of existing equipment or buying a larger facility and stocking it with all new equipment, the SBA 504 has flexible financing options. Machinery and equipment can be financed independent of real estate. Or, machinery and equipment can be financed in conjunction with a commercial real estate purchase. Loan terms of 10-, 20- or 25-years are available (term length is limited to the useful life declaration provided by the manufacturer).

Using the 504 to Refinance Debt…

The 504 Loan is perfect for refinancing existing commercial mortgages too:

- Multiple loans can be consolidated and/or refinanced

- Up to 90% loan-to-value (first and second combined)

- Cash out available up to 85%

- FIXED for 20 or 25 years on 504 loan

Using the 504 to Finance Total Project Costs

Let’s face it, the true bottom line of an expansion project, no matter the size, is often far more than the just the cost for brick and mortar or equipment. Soft costs and closing costs can add up. Most conventional bank loans do not include soft costs in the financing, leaving borrowers to pay for them out of their own pocket. However, the SBA 504 Loan Program finances total project costs. Total project costs include not just the cost for land and building, hard construction or equipment, but also the soft costs like moving your equipment, furniture, fixtures, closing costs and professional fees.

SBA 504 Financing Can Include:

Furniture and Fixtures

Lighting

Office Furniture

Partitions

Shelving Units

Menu Boards

Leasehold Improvements

HVAC, Flooring, Electrical, Plumbing

Landscaping

Parking Lots

Other Costs

Appraisals

Attorney Fees

Building Permits

Environmental Reviews

Design/Architectural Fees

Inspections

Interim Interest

Almost All For-Profit Businesses Are Candidates

The 504 Loan Program is a financing tool for economic growth and development that provides small to medium sized businesses with long-term, fixed rate loans to help them acquire major fixed assets for expansion or modernization. These loans are most frequently used to acquire land, buildings, machinery or equipment.

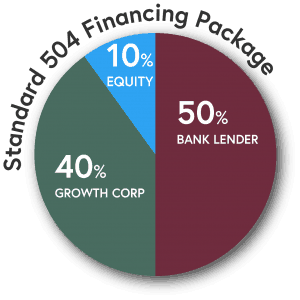

- 50% of the project’s total cost will come from a conventional lender (your bank). You and your lender will determine the conditions of that loan, including the amount. This loan is the first mortgage.

- 40% of the project’s total cost will come from a CDC (Growth Corp) with a 10-year or 20-year fixed rate loan guaranteed by SBA. This loan is the second mortgage.

- The remaining 10% of the project’s total cost will come from you, the borrower. Certain types of facilities are classified as “single-purpose” facilities and may require additional equity, but most projects fall into the 50-40-10 split.

Keep in mind…SBA 504 Loans are offered in conjunction with local banks, not in competition with them!

The Bottom Line

An SBA 504 loan is one of the first types of financing you should consider if you plan to purchase commercial real estate or long-term equipment. And now it’s no secret why its volume is surging…the low interest rates, long repayment terms and low-down payment requirements takes the pressure off business cash flow and instead preserves it for working capital.

Why Growth Corp?

Founded in 1992, Growth Corp is the largest provider of SBA 504 commercial real estate financing in Illinois.

Growth Corp is a non-profit development company certified by the U.S. Small Business Administration (SBA) to originate SBA 504 loans in Illinois and its surrounding areas. Driven by a passion for helping small businesses grow, Growth Corp is the largest SBA 504 Lender in Illinois and one of the top ten Certified Development Companies in the country. With a current portfolio in excess of $740 million, Growth Corp has helped thousands of small and medium-sized businesses get the financing they need.

We know your success depends on having access to expansion capital. We offer affordable and accessible expansion capital to grow your business. Our experienced staff takes pride in making a difference in the lives of small business owners and their employees. Start-ups to seasoned businesses and everything in between can benefit from working with Growth Corp. Here’s why:

- We’re the #1 SBA 504 Lender in Chicago and Illinois. Growth Corp also consistently ranks as one of the top ten SBA 504 Lenders nationwide.

- SBA recognized Growth Corp as an Accredited Lender after a thorough review of its policies, procedures and prior performance. The prestigious ALP status grants Growth Corp increased authority to process and close 504 loans, which provides expedited processing of loan approvals and closings.

- We simplify the loan approval process. Our team coordinates the entire process from application through closing, funding and servicing, making it seamless for you and your bank lender.

- We are SBA 504 Experts. Our responsive and educated staff focuses almost exclusively on SBA 504 loans. We’ve got the process down to a science!

- We’ve worked with thousands of businesses, spanning various industries. That means, there’s not much we haven’t seen. Your goals, project structure and business type will likely be familiar to us and we’ll understand your unique situation.

- Our mission is to advocate for small business. We love our communities and believe small business is the foundation of their economic prosperity. We will do all we can to support you and your business goals.

If you run a small to medium sized business in and need financing to buy or construct a building or to purchase machinery/equipment, Growth Corp’s team of professionals will work with you directly to provide the best financing strategy for reaching your goal. Contact any member of our Lending Team today!