25-YR FIXED RATE

6.37%

20-YR FIXED RATE

6.39%

10-YR FIXED RATE

6.17%

REFINANCE RATE

+0.025%

empowering economic growth

504 Refinance program

Why should I refinance my existing loan?

Right now, interest rates are at near historic lows. Chances are good you’re paying too much for your current mortgage. Refinancing with the 504 Loan Program can offer you a variety of advantages.

- Reducing your total monthly expenses

- Locking in a low, fixed rate with a repayment period of up to 25 years

- Turning equity into cash out for eligible business expenses, such as salaries, rent, repairs, maintenance, inventory, utilities, credit cards, lines of credit, etc.

504 Refi Stats

$1.1B Refinanced so far in 2021

Thousands of businesses have utilized 504 Refinancing

Growth Corp is the Top 504 Refi Lender in the U.S.

frequently asked questions

What is a 504 Refinance loan?

The SBA 504 Refinance Loan is government-backed financing that comes with three huge advantages. One, it offers business owners a below-market, fixed rate and a repayment period of up to 25-years. Two, the down payment requirements are as low as ten percent and are often fulfilled by existing equity in the project. And three, borrowers can elect to get cash out for business expenses. Cash can be taken out for salaries, rent, repairs, maintenance, inventory, utilities, credit cards, lines of credit, etc.

What kind of rate can I expect?

The interest rate is fixed for 10-, 20-, and 25-years much like the standard 504 Loan Program. However, the effective rate will be slightly higher (0.0348%) than standard 504 loans due to higher servicing fees. Check out the current interest rates.

Can I refinance an existing 504 or 7(a) loan?

Yes. Under a few conditions.

- must provide a substantial benefit to the borrower, meaning a minimum 10% savings on the new installment attributable to the debt being refinanced

- If a 7(a) loan – requires the CDC to verify in writing that the present lender is either unwilling or unable to modify the current payment schedule

- If a 504 loan – the Third Party Lender Loan and the 504 must be refinanced, or the Third Party Loan must be paid in full.

Are there pre-payment penalties if I refinance my 504?

Yes. If you are in the first half of your 504 loan, prepayment penalties will apply. However, these can be rolled into the loan so long as the equity requirements are met.

What are the criteria for qualifying?

If you answer “yes” to the following questions, the 504 Refinance Program may be a good fit:

- Is the loan at least 6 months old?

- Is the property being refinanced at least 51% owner-occupied or long-term equipment?

- Was at least 85% of the debt to be refinanced originally used for the purchase/improvement of fixed assetssuch as land and building, and/or purchase of heavy machinery or equipment?

- Does the businesses have a successful track record and growth potential

- Is the business a for-profit business?

- Does the business average less than $5 million in annual profits and $15 million in net worth?

What are the benefits of a 504 refinance?

- The borrower’s equity in the collateral often fulfills the down payment requirement

- Low, fixed interest rate on the 504 portion

- Long loan term

- Ability to access cash in the building

- Consolidates multiple loans

- Payment stability

- Improved cash flow

- Protection from balloon payments

Is a cash-out refinance available?

Yes. Talk to a Growth Corp loan officer for project specific details.

Generally, cash out for eligible business expenses is limited to 20% of the appraised value. Cash can be used for:

- Salaries

- Rent

- Repairs, Maintenance

- Inventory, Utilities

- Reduce a line of credit

- Other obligations of the business that were incurred, but not paid, prior to the date of application or that will become due for payment within 18 months after the date of application, or to pay off/down business lines of credit or business credit cards

What is in-eligible for cash-out with 504 refinancing?

- Owner’s personal expenses

- Acquiring a new business

- A change of ownership with partner buyout

- Capital expenditures

What are the eligible uses of cash?

- Repairs or maintenance

- Salaries

- Rent

- Inventory

- Utilities

- Payables

- Line-of-credit

- Business credit cards

NOTE: must show accounting statements

Is there any fine print I should be aware of?

- The project must meet all other SBA eligibility guidelines

- The advance rate if no cash is taken is 90% loan-to-value

- The advance for cash-out is 85% loan-to-value

- Up to 20% of the appraised value as cash out for qualifying business expenses (salaries, rent, utilities, inventory, etc.)

- Appraisal: is required for funding…we prefer to receive it at the time of application

- Loans with federal agency guarantees (504, 7a) are eligible – talk to a Loan Officer for details.

- Other assets can be used as collateral for LTV (if no cash out)

How do I get started?

With today’s interest rates at all-time lows, we anticipate the demand for 504 refinancing will be high. Therefore, we’ve put together the following checklists and quick reference guides to help you prepare your loan application.

Debt Refinancing Key Points

Debt Refinancing with SBA 504 – Quick Reference Guide

504 Debt Refinance – No Cash Out

A widget manufacturer is refinancing an existing $1.8 million commercial real estate loan. The property appraises at $2 million.

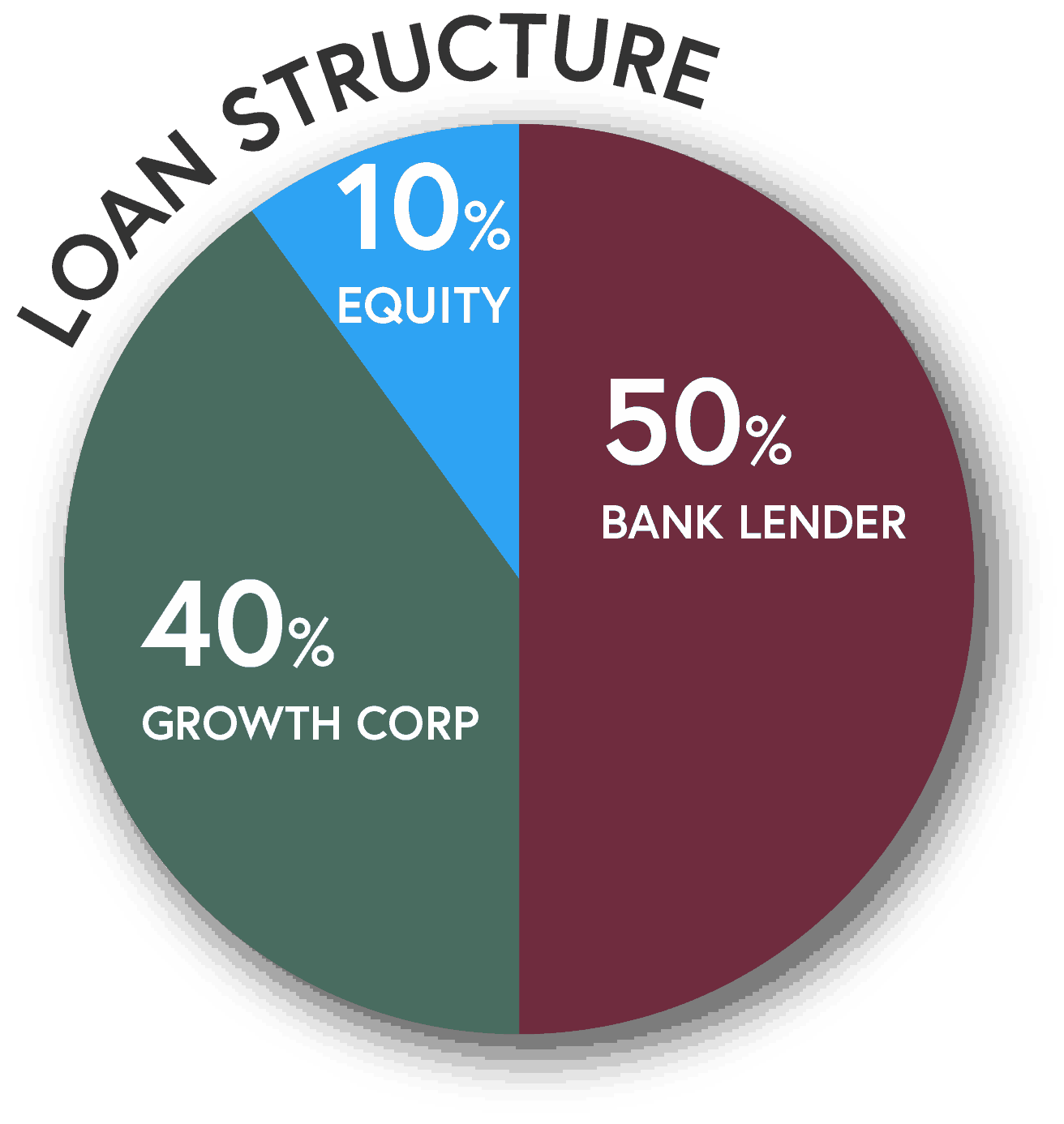

Loan Structure:

[su_table]

| Portion | Amount | |

| Bank | 50% | $1,000,000 |

| Growth Corp | 40% | $800,000 |

| Borrower | 10% | $200,000 |

| Total | 100% | $2,000,000 |

[/su_table]

NOTE: The third-party (bank) loan must be equal to, or greater than, the SBA 504 debenture amount. The SBA piece cannot exceed 40% of the appraised value.

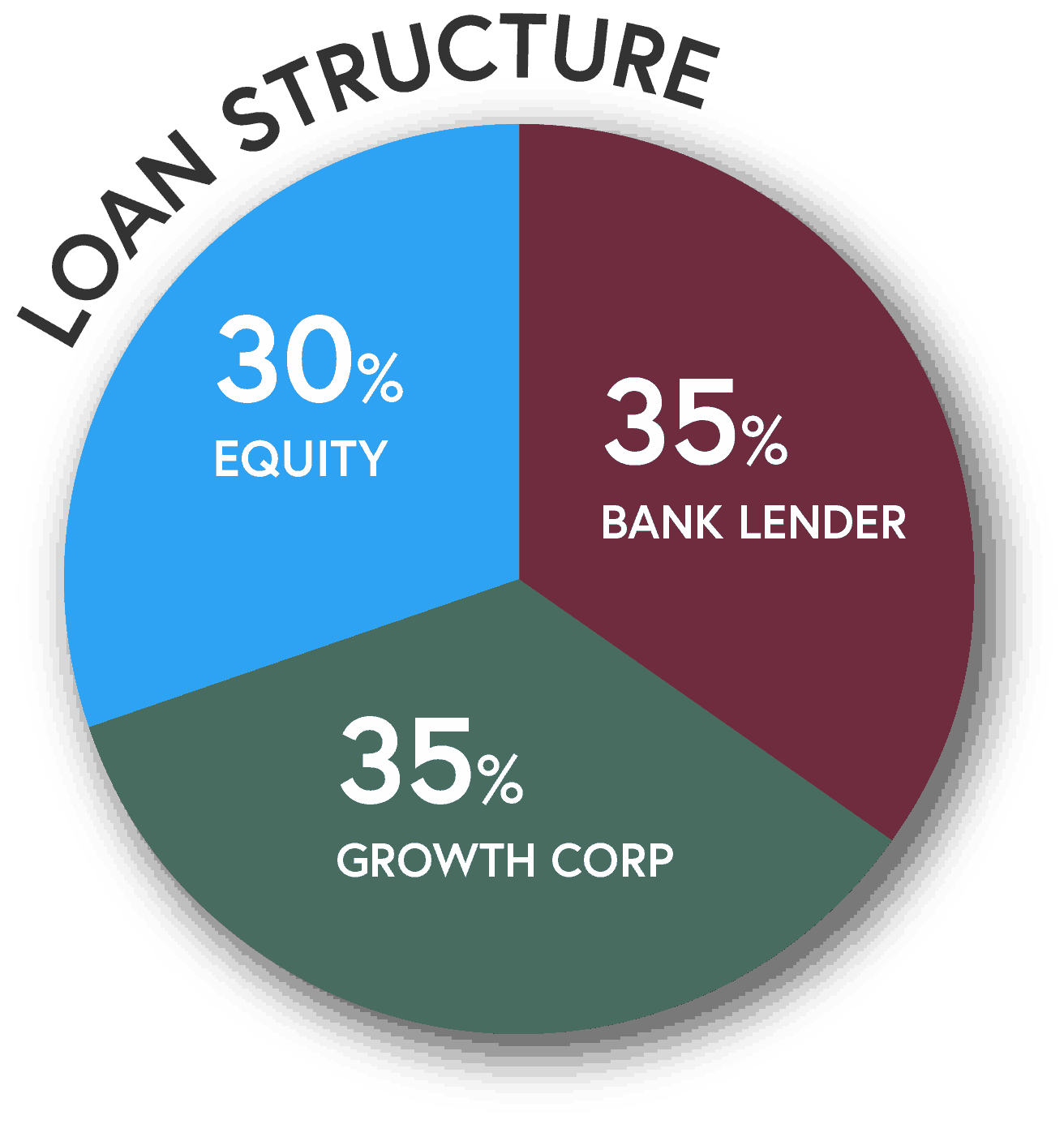

504 Debt Refinance – Cash Out

A widget manufacturer is refinancing an existing $1 million commercial real estate loan and would like to get cash out of the building for eligible business expenses. The property appraises at $2 million.

- Appraised Value: $2,000,000

- Qualified CRE Debt: $1,000,000

- Eligible Business Expenses (Cash Out): $400,000

Loan Structure:

[su_table]

| Portion | Amount | |

| Bank | 35% | $700,000 |

| Growth Corp | 35% | $700,000 |

| Borrower | 30% | $600,000 |

| Total | 100% | $2,000,000 |

[/su_table]

NOTE: The loan-to-value does not exceed 85% and the cash out portion does not exceed 20% of the appraised value.

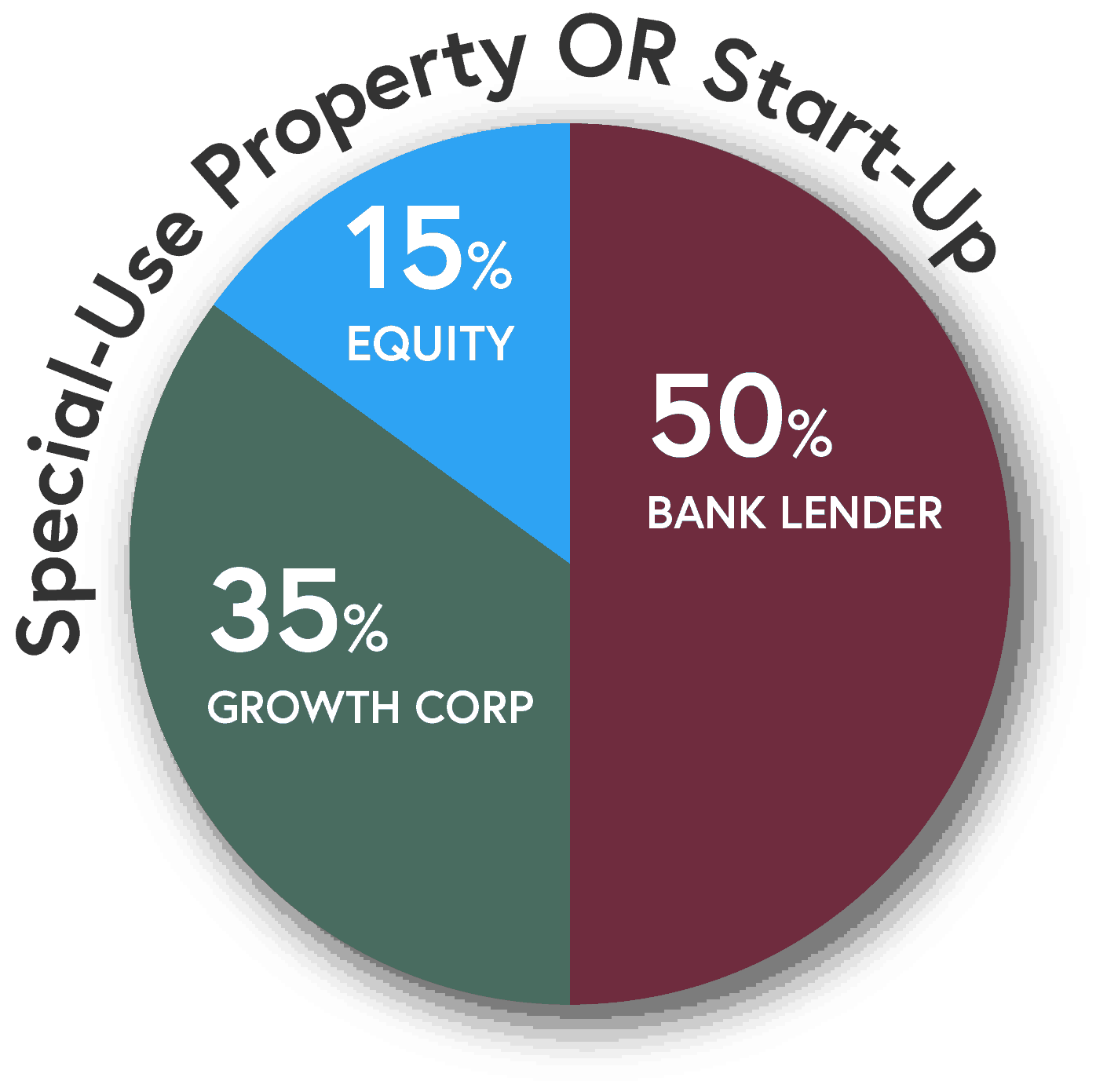

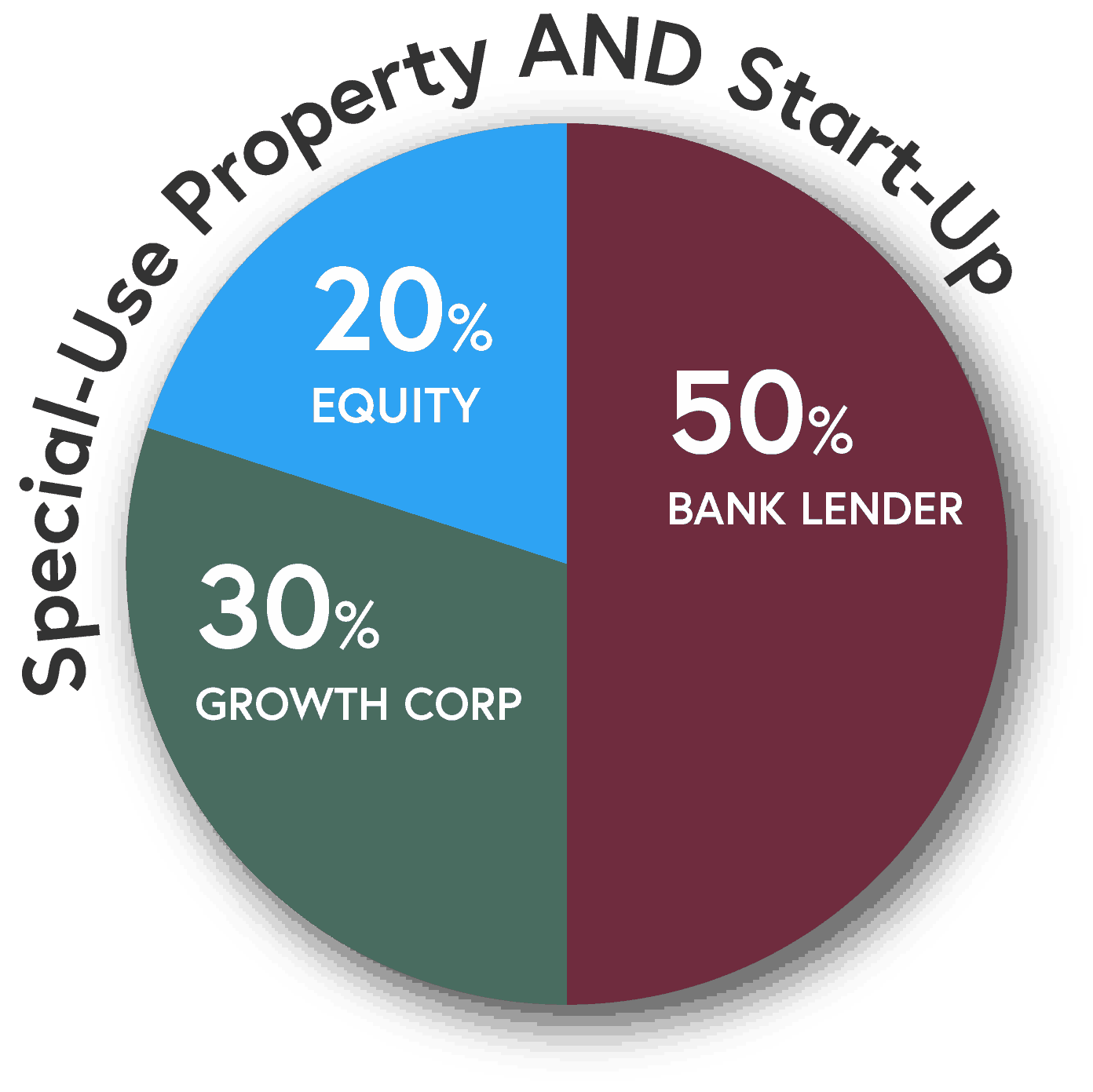

How SBA 504 Loans Work

50%

LOCAL BANK

A bank provides a first mortgage for

50% of the total project costs

40%

SBA 504 LOAN

Growth Corp provides an SBA 504 Loan

for 40% of the total project costs

10%

BORROWER EQUITY

The borrower provides a down payment of

typically just 10% of the total project costs

Higher equity requirements exist for start-ups or special purpose properties…the equity required will increase by 5% if one condition exists or by 10% if both.

SBA 504 Loans are made in conjunction with your local bank...so you can keep your lending relationship.

SBA 504 LOANS

How Will You Grow Your Business?

877-BEST 504

www.GrowthCorp.com