We are a couple of months into this COVID journey and, for some, the closures will continue for at least a bit longer. It seems like we’ve lived a lifetime during this relatively short period of time though. Major disaster assistance initiatives have been debated, approved and implemented at lightning speed. And our industry has dedicated long hours toward helping small businesses survive. But now we’re facing an even bigger challenge: helping small businesses recover.

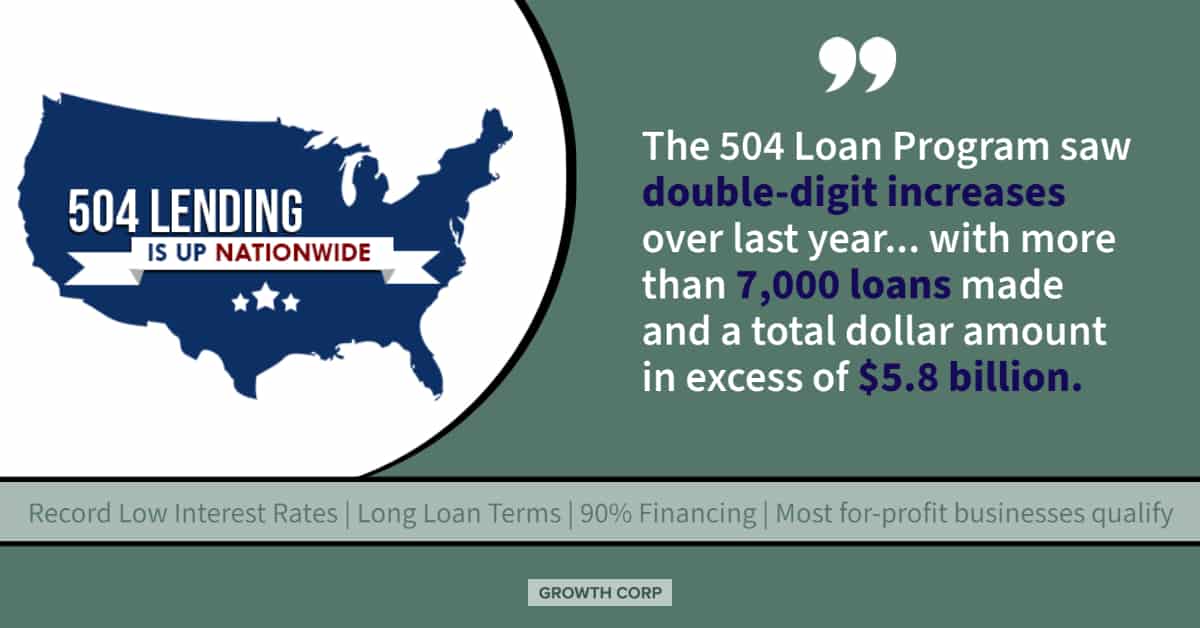

The SBA and its loan programs have always played a crucial role in the strength and advancement of our small business sector and in fostering economic growth. During this pandemic, SBA also demonstrated a quick and massive implementation of initiatives aimed at giving small businesses and their employees a fighting chance. But one of SBA’s key players, the 504 Loan Program, will play an important role as America begins to reopen and rebuild.

An Overview of the SBA 504 Loan Program

Created over 30 years ago, the SBA 504 Loan Program is an economic development tool that provides small businesses with long-term, fixed rate financing. These loans are most frequently used to acquire land, buildings and/or equipment; to construct, expand and/or renovate buildings; or to refinance commercial mortgages. A 504 loan can be a 10-, 20- or 25-year term, which is beneficial for small business owners. Pairing the fixed rate aspect with these term lengths gives small business

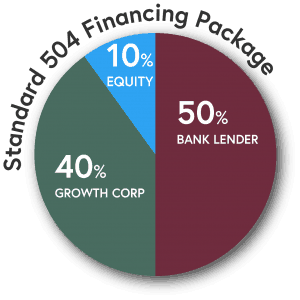

These loans essentially consist of three key elements:

- 50% of the project’s total cost is provided by a lending institution;

- 40% is provided through the SBA’s 504 Loan Program;

- 10% equity is provided by the borrower. (Start-up businesses and single-purpose facilities require a slightly higher equity contribution.)

Most types of businesses are eligible to receive 504 financing; however, the property must be majority owner-occupied. Businesses with a successful track record and growth potential can generally qualify for the 504 Loan Program if they are for-profit and average less than $5 million in annual after-tax profits and $15 million in net worth. Projects that qualify must, according to SBA guidelines, promote economic development, which generally means the creation or retention of jobs. There is no limit on the size of the deal, but the SBA participation is limited to $5 million.

How the SBA 504 Strengthens Small Businesses

Improves Cash Flow

Improved cash flow is of vital interest to all businesses. Business owners faced with high-interest mortgages or upcoming balloon payments can greatly benefit from the SBA 504 Refinance Program. SBA 504 Loans provide access to equity a borrower has built up in real estate while re-amortizing with a low, long-term, fixed interest rate product.

The SBA 504 Refinance Loan is government-backed financing that comes with three huge advantages. One, it offers business owners a below-market, fixed rate and a repayment period of up to 25-years. Two, the down payment requirements are as low as ten percent and are often fulfilled by existing equity in the project. And three, borrowers can elect to get cash out for business expenses. Cash can be taken out for salaries, rent, repairs, maintenance, inventory, utilities, credit cards, lines of credit, etc.

To qualify for refinancing, the mortgage(s) to be refinanced must be at least two years old and originally used for the purchase or improvement of fixed assets. Payment history is important too…no late payments of 30+ days in the past year. Keep in mind…loans that currently have a government guarantee (7a, USDA, 504, etc.) do not qualify for a 504 refinance.

Controls Overhead Costs

Entrepreneurs typically start their business in a leased facility. In fact, many small business owners think financing a commercial real estate purchase isn’t even an option because they fear the down payment requirements will be too high. However, buying or constructing a new facility with 504 provides a great opportunity for fixing occupancy costs and locking in low interest rates. Other benefits include:

- Builds equity: each payment is an investment in the future

- Occupancy costs are stabilized: rent increases no longer apply and the SBA 504 payment is fixed

- Preserves cash: in most cases, with the 504, the monthly payment to own is less than a rent payment

By locking in a low rate, which is fully amortized for up to 25 years, borrowers see predictable monthly payments. Plus, 504 Loans have no future balloon payments.

SBA 504 loans also allow borrowers to roll closing costs, soft costs and other fees into the loan, thus preserving cash. Not to mention, the cost of equipment, furniture and fixtures, parking lots, architectural fees, etc. can also be rolled into the loan.

Helps Streamline or Increase Production

Whether the business is product or service based, having the necessary equipment is vital to maintaining smooth operations. However, replacing, upgrading or purchasing new equipment can put a serious pinch on cash flow. A 504 Loan offers business owners a more affordable way to get needed equipment without making a substantial dent in the bottom line.

504 Loans are perfect for the purchase and installation of new or used, fixed, long-life machinery and equipment, such as:

- X-Ray or Digital Imaging Machines

- Manufacturing Equipment

- Dry-Cleaning Equipment

- Commercial Printers

- Food Processing Machinery

- Highly Calibrated Machines

- Equipment that generates renewable energy

Machinery and equipment can be financed independent of real estate or in conjunction with a commercial real estate purchase. Loan terms of 10-, 20- or 25-years are available, which is determined by the useful life declaration provided by the manufacturer.

Practical Examples

Working capital was hard to come by…

A local retail provider was seeking working capital to purchase inventory and pay business expenses. Since the business owned its commercial real estate, the lender suggested a 504 Refinance Loan. The 504 allowed the borrower access to the equity they’d built in the real estate while re-amortizing with a low, long-term, fixed interest rate product. With a lower interest rate and better terms, the retailer lowered their monthly payment and accessed much needed working capital without taking on additional debt.

A balloon payment was looming…

A manufacturing company was four years into their mortgage payments and business was booming. However, with a five-year term loan, the balloon payment was quickly approaching. The lender stepped in and offered a recommendation for refinancing with the SBA 504 Program’s Refinance Loan…a long-term financing option with low fixed interest rates. This allowed the client to stabilize their expenses and spread their predictable payments out over 25 years.

A stalled expansion got back on track…

A wholesale bakery, nearing the end of a lease term, received news their business property was being sold and needed vacated. Facing an inevitable move, the business owner decided to make the most of the situation and began to seek a property that would not only house the business but would also allow for expanded production.

Nearby land was purchased, and construction of a larger building began. However, due to cost overruns, conventional financing could no longer allow for the completion of the construction…the borrower suddenly required a higher advance rate than the bank could offer. Exploring alternative options in hopes of getting the expansion back on track, the lender suggested the 504 Loan Program and they found it to be the perfect solution.

The participation of the 504 Loan Program allowed the bank to offer a 90% advance, which gave the business the financing they needed to pay contractors and finish the project. The new location offers ample space to produce, distribute and sell an expanded line of bakery items.

The SBA 504 is Impact Capital

When small businesses have access to quality financing through which to strengthen or grow their business, they, in turn, support the growth and success of the communities in which they are based. That’s why the 504 is a win-win for all those involved…

- Banks reduce their lending risk and can extend capital to more businesses

- Business borrowers strengthen and/or grow their business

- Communities benefit through job creation and local reinvestment – when businesses buy real estate, they are laying a long-term foundation in that community

- The program is a zero-subsidy program and costs taxpayers nothing

- Business districts are revitalized

- Capital is more readily accessible in economically disadvantaged or rural areas

Not only that…there’s another component of the 504 Loan Program. SBA requires CDC’s, such as Growth Corp, to reinvest into the economic development of local communities. This means providing direct financial support and educational resources to entrepreneurs and the small business sector in its area of operations. The SBA 504 Loan Program is truly impact capital.

Pending Legislation

As of late May 2020, a bill titled “Health and Economic Recovery Omnibus Emergency Solutions Act”, or “HEROES Act” was in the hands of the Senate for consideration after passing the House on May 15, 2020. The legislation includes proposed changes that would allow for a more flexible and responsive SBA 504 Loan Program along with an expanded authority to refinance debt. Utilizing existing, proven programs, such as the SBA 504 Loan Program, as a means of helping businesses rebuild, re-strengthen and reopen is crucial to America’s economic recovery.

As lenders, whether we are fulfilling our critical role as a provider of quality capital to America’s growing businesses, working shoulder-to-shoulder with clients to help them overcome challenges and capitalize on opportunities, or contributing to the communities in which we live and work, our impact has never been greater.