High Interest Rate Environment

- Prime Rate and long-term treasury yields remain elevated due to ongoing inflation control measures

- SBA 504 loans offer long-term, fixed interest rates.

- Why it matters: Businesses are seeking stability in their debt-service obligations and 504 loans provide exactly that

Demand for Owner-Occupied Commercial Real Estate

- Businesses are increasingly looking to build equity and control occupancy costs instead of leasing, especially as commercial rent inflation continues in some urban markets

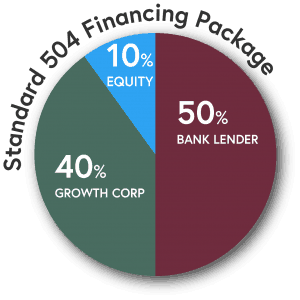

- SBA 504 loans allow borrowers to finance up to 90% of project costs, preserving cash for operations

- Why it matters: SBA 504 is a perfect match for businesses prioritizing asset-building during economic uncertainty

Cautious Optimism

- The U.S. economy in mid-2025 is experiencing modest growth, with the Federal Reserve pausing rate hikes so far

- Many businesses are cautiously expanding and prefer low-down-payment, low-interest options to finance commercial real estate or new equipment

- Why it matters: SBA 504 is a conservative capital option aligned with a business owner’s cautious optimism

Increased Capital Investment in Key Sectors

- There is renewed interest in manufacturing, logistics, and healthcare

- These sectors often need equipment and facility financing – both eligible under SBA 504

- Why it matters: SBA 504 is tailor-made for high-capex industries with strong long-term outlooks

Tightened Lending Standards

- Many conventional lenders have tightened underwriting standards due to regulations, reserve concerns, and portfolio exposure

- SBA 504 loans involve lower risk to banks (typically just 50% LTV and with first lien position), thanks to the CDC and SBA guarantee structure

- Why it matters: SBA 504 enables banks to support borrowers while managing their own capital risk

Rising Construction Costs

- Inflation in construction materials and labor makes affordable financing more important than ever.

- SBA 504 offers a 25-year term and low, fixed rates which help keep monthly payments manageable, even on high-cost new builds or renovations

- Why it matters: No surprises. Lock in a low interest rate for 20-25 years. Compare that to commercial loans that reset every five years – and usually go up.

Summary: Why SBA 504 is a Smart Tool in 2025

| Economic Factor | SBA 504 Advantage |

| High Interest Rates | Low, fixed long-term rates |

| Real Estate Demand | 90% financing, asset ownership |

| Cautious Optimism | Conservative expansion capital |

| Sector investment | Facility + equipment financing |

| Tighter Lending Standards | Lower bank risk, strong collateral |

| Construction Inflation | Extended terms reduce payment shock |

A Closer Look at The 504

- The SBA 504 allows business owners to put less money down than they would have to with conventional financing. This means you retain more of your capital for use in other parts of your business during the construction process.

- The SBA 504 allows for business owners to finance construction costs, closing costs and soft costs, including architectural fees, engineering fees, surveys, title insurance and more within the loan. Furniture, fixtures, landscaping, signage, parking lots and equipment can also be included. This also allows you to retain more of your capital on hand for other expenses during the construction process.

- The SBA 504 offers low, long-term interest rates without balloon payments or call provisions. These payments are fully amortized over 20- or 25-years. Smaller monthly payments have less impact on your cash flow and you won’t have another round of appraisals and refinancing to worry about in the near future.

- The SBA 504 allows business owners to build a larger facility than they currently need to occupy, as long as it satisfies the owner-occupied provisions of SBA financing. So you can rent out extra space and generate additional rental income to assist in meeting the monthly loan payments. However, if you need that space later for additional business expansion, you’ve got it available.

Why Growth Corp?

We know your success depends on having access to expansion capital. We offer affordable and accessible expansion capital to grow your business. Our experienced staff takes pride in making a difference in the lives of small business owners and their employees. Start-ups to seasoned businesses and everything in between can benefit from working with Growth Corp. Here’s why:

- We’re the #1 SBA 504 Lender in Chicago and Illinois. Growth Corp also consistently ranks as one of the top ten SBA 504 Lenders nationwide.

- SBA recognized Growth Corp as an Accredited Lender after a thorough review of its policies, procedures and prior performance. The prestigious ALP status grants Growth Corp increased authority to process and close 504 loans, which provides expedited processing of loan approvals and closings.

- We simplify the loan approval process. Our team coordinates the entire process from application through closing, funding and servicing, making it seamless for you and your bank lender.

- We are SBA 504 Experts. Our responsive and educated staff focuses almost exclusively on SBA 504 loans. We’ve got the process down to a science!

- We’ve worked with thousands of businesses, spanning various industries. That means, there’s not much we haven’t seen. Your goals, project structure and business type will likely be familiar to us and we’ll understand your unique situation.

- Our mission is to advocate for small business. We love our communities and believe small business is the foundation of their economic prosperity. We will do all we can to support you and your business goals.

If you run a small to medium sized business in and need financing to purchase machinery/equipment or construct/purchase a new building, Growth Corp’s team of professionals will work with you directly to provide the best financing strategy for reaching your goal. Contact any member of our Lending Team today!