One of SBA’s top priorities is to get capital flowing to small businesses. SBA’s array of loan programs were created to meet the needs of varying markets and entrepreneurs by ensuring access to quality capital on reasonable terms for small businesses.

[su_table]

SBA’s Array of Loan Programs

| 7(a) |

|

| 504 |

|

| Microloan |

|

| Export |

|

|

|

[/su_table]

Spotlight on the 504 Loan Program

What is the 504 Loan Program?

SBA established the 504 Loan Program to help businesses grow through the purchase of commercial real estate and equipment. This program puts financing within reach for small businesses through low down payments and low, long-term, fixed interest rates. SBA 504 loans are attractive to borrowers because they offer a great opportunity for fixing occupancy costs with a long-term, fixed-rate loan and a minimal down payment. It also reduces the risk to lenders through a shared financing structure.

Does SBA Lend Money?

No. SBA offers a government guarantee; it does not loan money. Instead, it authorizes Certified Development Companies (CDC’s) to administer the 504 Loan Program. CDC’s, such as Growth Corp, are nonprofit organizations that are certified by, but independent of, the SBA. There are at least 230 CDC’s across the country, each with a specific regional focus. These organizations are often tightly integrated into their local economies, fostering neighborhood revitalization and long-term community growth.

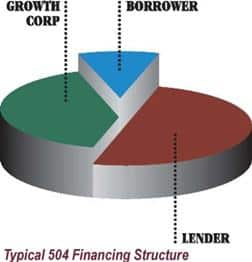

CDC’s Partner with Local Banks

CDC’s work in conjunction with banks to provide 504 funding. This creates a solid lending partnership with community banks

A 504 loan package is made up of three parts…typically a “50-40-10” split. First, a bank provides approximately 50% of the loan package. The 504 loan is the next portion. This can be up to 40% of the package total, up to $5.5 million. The final part of the loan package, usually just 10%, is funded by the small business borrower.

A Zero Subsidy Program

Through the balance of this structure, the program’s fees and rigorous oversight by SBA, the 504 Loan Program is self-supporting and costs taxpayers nothing!

The Distinguishing Factor is Jobs

By law, each $65,000 in financing through the 504 Loan Program must create or sustain one job, or meet one of several public policy goals. The 504 is a jobs program at its core.

The Statistics Speak for Themselves

According to recent SBA data, since 1991, 504 loans have created or sustained 2.1 million jobs through 128,000 loans, which have delivered more than $70 billion in financing to Main Street. In fact, 504 loans have added over 87,000 jobs to Illinois alone. It is nearly impossible to drive through the state and not see businesses that have funded their growth, and, thus, positively impacted communities, by use of the 504.

504 Loans Grow Communities

SBA 504 loans boost economic development for communities because they not only require borrowers to create jobs, they also allow businesses to build a long-term foundation in their community.

- Job creation and retention

- Local economic growth & reinvestment

- Encourages free competitive enterprise

- Helps maintain local consumer spending

- Increases consumer confidence

- Supports the development of minority, women and veteran-owned businesses

Revitalizes business districts - Expands capital access in economically disadvantaged rural areas

Encourages innovation

Case Study

The Challenge

A manufacturing firm had outgrown their leased facility and needed to move to a larger building. While purchasing the real estate

made sense, allocating the cash for a down payment was a problem.

The Solution

Utilizing the 504 Loan Program, 90% of the project costs were financed, thereby conserving the company’s cash and preserving the necessary working capital to support continued growth.

The Result

The combined monthly payment on the acquisition of their new building is actually less than their lease payment was and the company was able to stay local. In addition, with more space, they expanded production and added 5 new, full-time jobs.

If you run a small to medium sized business, or if you are part of an economic development team, and need quality business expansion financing, Growth Corp’s team of professionals will work with you directly to provide the best financing strategy for reaching your goal. Contact any member of our Lending Team today!