A question we get asked often is, “Can the SBA 504 Loan Program help me access working capital?” Yes…SBA 504 Refinance Loans provide access to equity a borrower has built up in real estate while re-amortizing with a low, long-term, fixed interest rate product.

The SBA 504 Refinance Loan is government-backed financing that comes with three huge advantages. One, it offers business owners a below-market, fixed rate and a repayment period of up to 25-years. Two, the down payment requirements are as low as ten percent and are often fulfilled by existing equity in the project. And three, borrowers can elect to get cash out for business expenses. Cash can be taken out for salaries, rent, repairs, maintenance, inventory, utilities, credit cards, lines of credit, etc.

Access Working Capital by Refinancing Commercial Mortgage Debt with an SBA 504

The SBA 504 Loan Program offers business owners the opportunity to secure below-market, fixed interest rates, amortized over 25 years, for up to 90 percent of the appraised value of commercial real estate property.

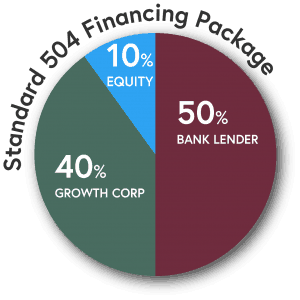

Loans are administered by a Certified Development Company (CDC) such as Growth Corp and granted in conjunction with a conventional lender (usually a bank). Here’s how it works:

- 50% of the project’s total cost is provided by a lending institution

- 40% of the project’s total cost is provided by Growth Corp

- 10% equity is provided by the applicant small business/borrower (Higher equity requirements exist for start-up or leveraged companies and/or projects involving acquisition or construction of limited or single-purpose real estate.)

With the 504, the borrower’s equity injection is typically much lower than traditional business loans and can help you keep more of your cash in the business rather than tied up in real estate. Plus, existing equity in the collateral often fulfills the down payment requirement.

The Benefits Extend Beyond Just Access to Working Capital

- Refinance up to 90% of the appraised property value (if no cash-out)

- If taking cash out for eligible business expenses: refinance up to 85% of the appraised property value (business expenses are limited to 20% of appraised value)

- Below-market interest rates,

- The ability to consolidate multiple loans

- Existing equity often fulfills the down payment requirement

- Long amortizations – up to 25 years

Nationwide, SBA 504 lending activity is up compared to the previous five years. The record low interest rates and long loan terms make the SBA 504 Loan Program hard to beat in the current market.

SBA 504 Refinance – Eligibility Guidelines

- Property to be refinanced is owner-occupied

- Existing loan must be at least 6 months old

- Business is at least two years old

- At least 85% of the existing conventional loan must have been for SBA 504-eligible purposes

- Appraisal will be required for funding, and is preferred at time of application

The SBA website has additional resources regarding this subject matter as well. The requirements might seem rigorous, but Growth Corp will guide you through the entire process. The improved cash flow you’ll see as a result of a longer amortization and fixed, predictable monthly payments will far outweigh any trepidation you may have about the application process. Plus, the SBA 504 interest rates are at record lows right now…and remember, the interest rates are fixed for the life of the loan. There will be no future balloon payments to worry about.

SBA 504 – A Powerful Tool for Commercial Lending

Refinancing your commercial mortgage with an SBA 504 loan can help you free up trapped capital and enjoy lower monthly payments due to the low, long term, fixed interest rate. An SBA 504 loan can also be used to:

- purchase land or buildings

- construct, upgrade or renovate buildings

- purchase equipment with a service life of ten years or more

SBA 504 loans are a very powerful tool, yet they remain under-utilized because many small business owners just aren’t aware this financing option exists. Last year, 504 loans helped fuel just shy of $5 billion in new capital investments for 6,100 businesses throughout the U.S.

Why Growth Corp?

We know your success depends on having access to expansion capital that is both affordable and accessible. Our experienced staff takes pride in making a difference in the lives of small business owners and their employees. Start-ups to seasoned businesses and everything in between can benefit from working with Growth Corp. Here’s why:

- We’re the #1 SBA 504 Lender in Chicago and Illinois. Growth Corp also consistently ranks as one of the top ten SBA 504 Lenders nationwide.

- SBA recognized Growth Corp as an Accredited Lender after a thorough review of its policies, procedures and prior performance. The prestigious ALP status grants Growth Corp increased authority to process and close 504 loans, which provides expedited processing of loan approvals and closings.

- We simplify the loan approval process. Our team coordinates the entire process from application through closing, funding and servicing, making it seamless for you and your bank lender.

- We are SBA 504 Experts. Our responsive and educated staff focuses almost exclusively on SBA 504 loans. We’ve got the process down to a science!

- We’ve worked with thousands of businesses, spanning various industries. That means, there’s not much we haven’t seen. Your goals, project structure and business type will likely be familiar to us and we’ll understand your unique situation.

- Our mission is to advocate for small business. We love our communities and believe small business is the foundation of their economic prosperity. We will do all we can to support you and your business goals.

If you run a small to medium sized business in and would like to discuss your refinancing options, Growth Corp’s team of professionals will work with you directly to provide the best financing strategy for reaching your goal. Contact any member of our Lending Team today!