Attention Accountants/CPAs…if you, or your client, is considering buying, building or refinancing fixed assets, there’s simply no better program on the market than the SBA 504 Loan Program. In fact, the financing terms offered through this program are so good, 504 lending is up 24% in Fiscal Year 2021. The 504’s below-market fixed rates, repayment terms of up to 25 years and lower monthly payments have already helped thousands of businesses this year…let’s talk about how it can help yours.

504 Loans: Important Tool for Accountants/CPAs

We have something in common. We both have the privilege of helping small business clients grow and strengthen their business. That’s why we want to make sure you’re aware of the biggest opportunity we’ve seen in the 504 Loan Program’s 33+ year history.

Key provisions in the Economic Aid Act allow for three months of SBA 504 Loan payment subsidies, fee eliminations and expanded opportunities for refinancing, all of which are intended to help alleviate economic hardship. New 504 Refinance Loan applications approved through September 30, 2021, have the potential to see massive savings.

In a nutshell, the 504 Loan Program provides small businesses with long-term, fixed rate financing, which is most frequently used to buy, build, or refinance fixed assets, usually buildings or equipment. Nationwide, in fiscal year 2020, 504 lending saw double-digit increases, fueling $5.8 billion in new capital investments for 7,000 businesses throughout the U.S. So whether your client is looking to access cash, control overhead expenses, or expand to meet increased demand, the 504 can help pave the way forward.

Benefits of 504 Loans

SBA 504 loans are attractive to borrowers because they offer a great opportunity for fixing occupancy costs with a long-term, fixed-rate loan and a minimal down payment. More and more borrowers are seeing the upside to buying their properties, or refinancing into long-term, fixed-rate loans, while interest rates are low.

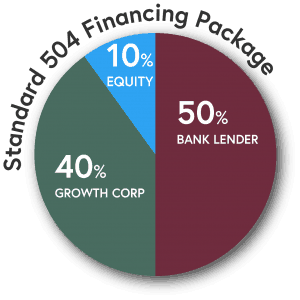

• Low down payment (10% in most cases)

• Low, fixed interest rate

• Long loan terms (10-, 20- or 25-years)

• Includes soft costs (furniture, fixtures and fees)

• Preserves working capital

• Protection from balloon payments

• Can include leasehold improvements

• Payment stability

Why Accountants/CPAs Recommend Growth Corp

Why Growth Corp? We know small business. It’s our passion. We are proud to have helped thousands of businesses facilitate expansion. As the largest 504 Lender in Illinois, we have dedicated ourselves to making the 504 Loan Program as efficient and seamless as possible. In addition, we are an authorized Continuing Professional Education sponsor and can provide you with C.P.E. credits for our SBA 504 Loan Program update course.

Let’s join forces! Make Growth Corp your partner in helping businesses discover the very best solution to their expansion or refinancing concerns…the 504 Loan Program. If you want to learn more, we would be happy to meet with you. Just give us a call at (217) 787-7557 or contact any member of our Lending Team.