25-YR FIXED RATE

6.69%

20-YR FIXED RATE

6.76%

10-YR FIXED RATE

6.59%

REFINANCE RATE

+0.025%

empowering economic growth

504 loan program

SBA 504 Debt Refinance

What is a 504 Refinance Loan?

The 504 Refinance Program helps strengthen banks by reducing their lending exposure, while also providing a lifeline to businesses with balloon payments coming due.

With the re-launch of the 504 Refinance Program, small business owners can use the long-term, fixed rate 504 Loan Program to refinance existing commercial mortgages. This is huge considering the current trends are pointing toward tighter credit standards and higher interest rates.

At a time when it’s becoming increasingly difficult to refinance commercial loans, the 504 Refinance Program is here to fill the gap by providing an affordable refinancing product that both lenders and the small business community can eagerly embrace!

What Kind of Rate Can I Expect?

The interest rate is fixed for 20 years much like the standard 504 Loan Program. However, the effective rate will be slightly higher than standard 504 loans due to higher servicing fees.

Will My Project Qualify?

If you answer “yes” to the following questions, the project will likely qualify for the 504 Refinance Program.

- Is the loan at least 6 months old?

- Is the property being refinanced at least 51% owner-occupied or long-term equipment?

- Was the debt to be refinanced originally used for the purchase/improvement of fixed assets?

Is Refinancing a Permanent Option with 504?

Sort of. While this is not a “temporary program” as it was in 2012, there is a mandate in place stating the Debt Refinancing Program will only be in effect in years the 504 Loan Program is operating at a zero-subsidy. Every year since FY16 has been a zero-subsidy year.

Borrower Benefits

- The borrower’s equity in the collateral often fulfills the down payment requirement

- Low, fixed interest rate on the 504 portion

- Long loan term

- Ability to access cash in the building

- Consolidates multiple loans

- Payment stability

- Improved cash flow

- Protection from balloon payments

What Businesses Qualify?

Businesses with a successful track record and growth potential can generally qualify for the 504 Loan Program if the business is for profit and averages less than $5 million in annual profits and $15 million in net worth. Qualifying projects must have originally involved the purchase, construction or improvement of fixed assets such as land and building, and/or purchase of heavy machinery or equipment.

Eligibility

- The project must meet all other SBA eligibility guidelines

- The advance rate if no cash is taken is 90% loan-to-value

- The advance for cash-out is 85% loan-to-value

- Up to 20% of the appraised value as cash out for qualifying business expenses (salaries, rent, utilities, inventory, etc.)

- Appraisal: is required for funding…we prefer to receive it at the time of application

- Loans with federal agency guarantees are not eligible

- Other assets can be used as collateral for LTV (if no cash out)

Is a Cash-Out Refinance Available?

Yes. Talk to a Growth Corp loan officer for project specific details.

Eligible Uses of Cash?

- Repairs or maintenance

- Salaries

- Rent

- Inventory

- Utilities

- Payables

- Line-of-credit

- Business credit cards

NOTE: must show accounting statements

504 Debt Refinance – No Cash Out

A widget manufacturer is refinancing an existing $1.8 million commercial real estate loan. The property appraises at $2 million.

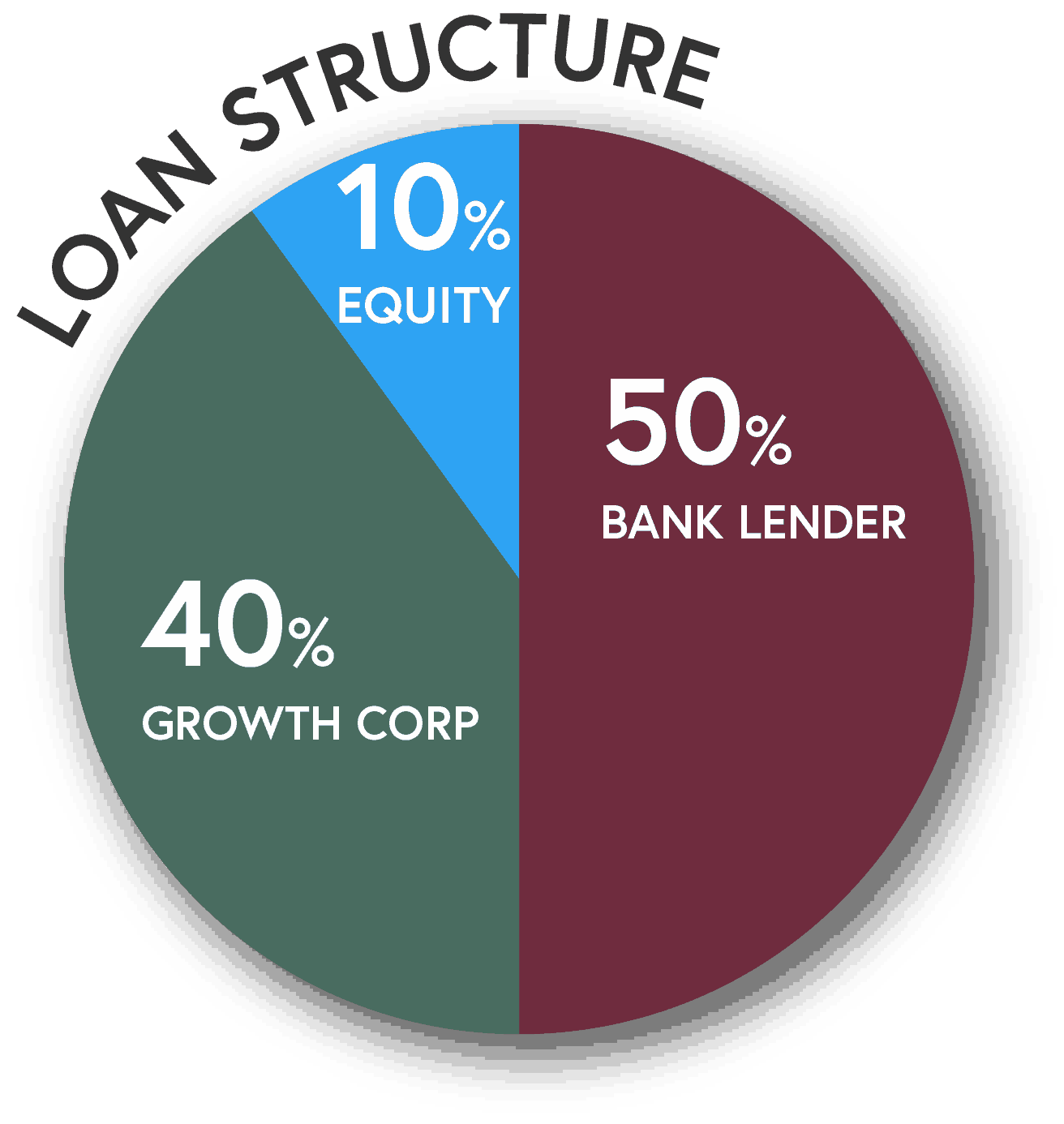

Loan Structure:

| Portion | Amount | |

| Bank | 50% | $1,000,000 |

| Growth Corp | 40% | $800,000 |

| Borrower | 10% | $200,000 |

| Total | 100% | $2,000,000 |

NOTE: The third-party (bank) loan must be equal to, or greater than, the SBA 504 debenture amount. The SBA piece cannot exceed 40% of the appraised value.

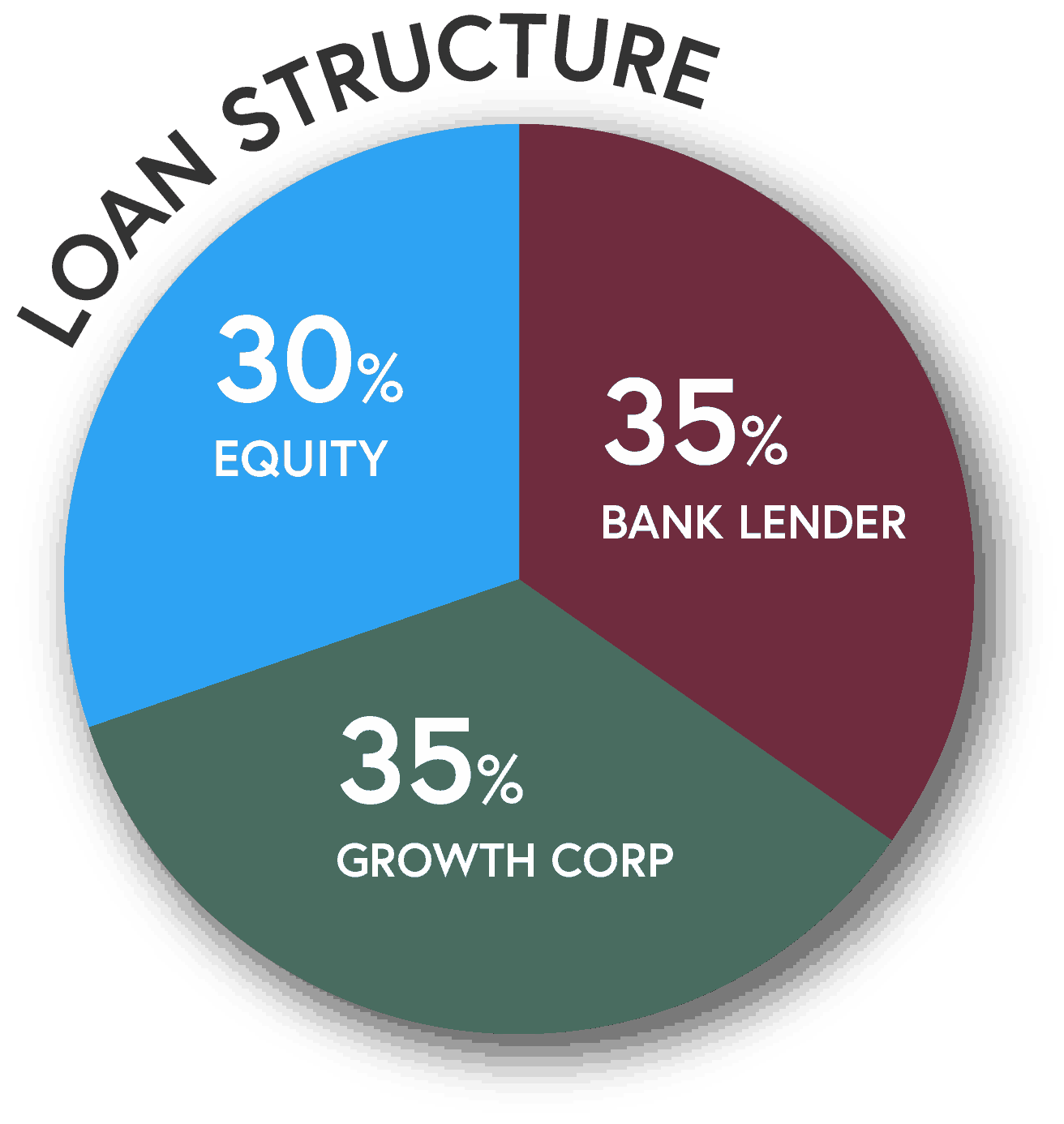

504 Debt Refinance – Cash Out

A widget manufacturer is refinancing an existing $1 million commercial real estate loan and would like to get cash out of the building for eligible business expenses. The property appraises at $2 million.

- Appraised Value: $2,000,000

- Qualified CRE Debt: $1,000,000

- Eligible Business Expenses (Cash Out): $400,000

Loan Structure:

| Portion | Amount | |

| Bank | 35% | $700,000 |

| Growth Corp | 35% | $700,000 |

| Borrower | 30% | $600,000 |

| Total | 100% | $2,000,000 |

NOTE: The loan-to-value does not exceed 85% and the cash out portion does not exceed 20% of the appraised value.

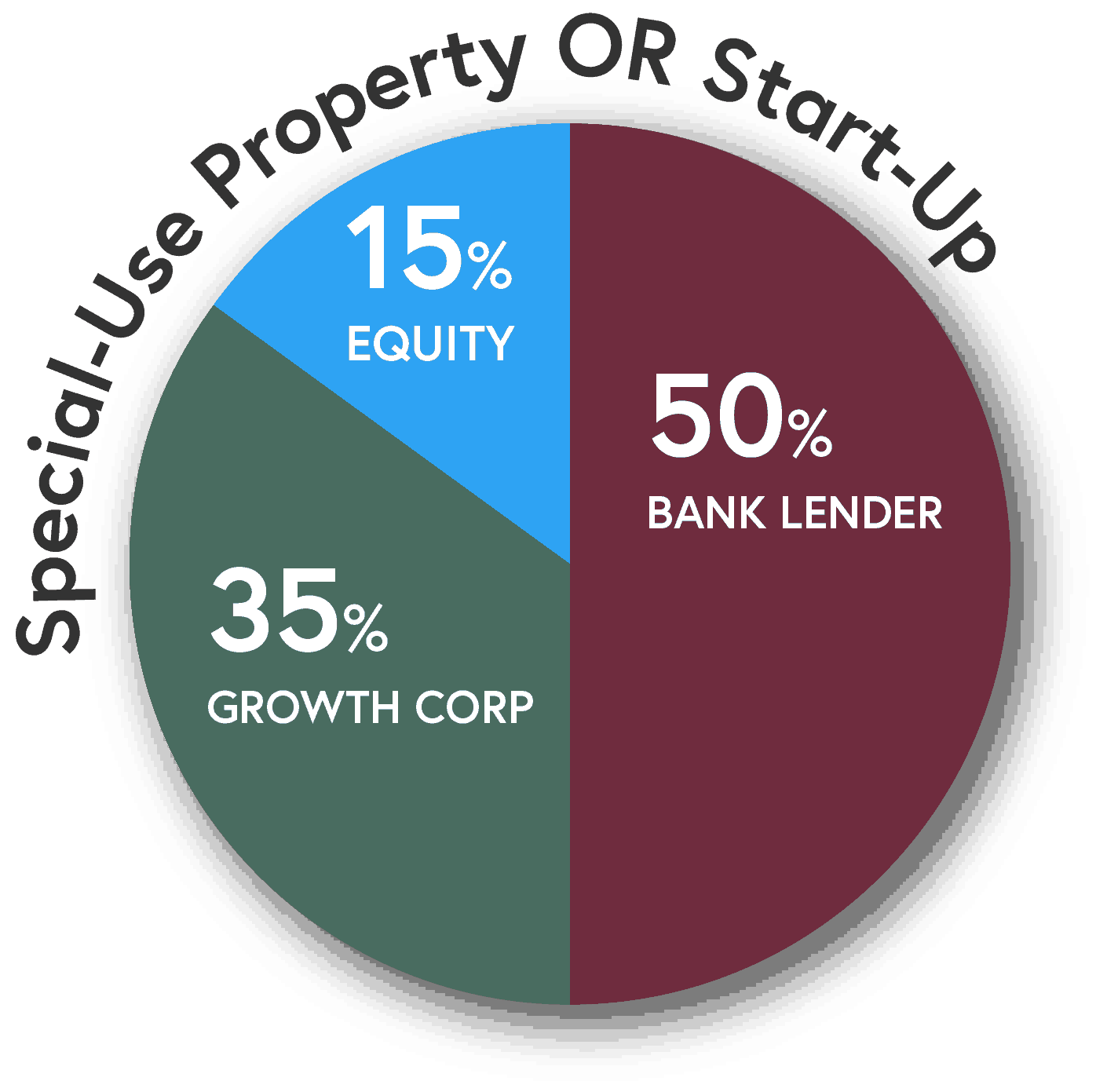

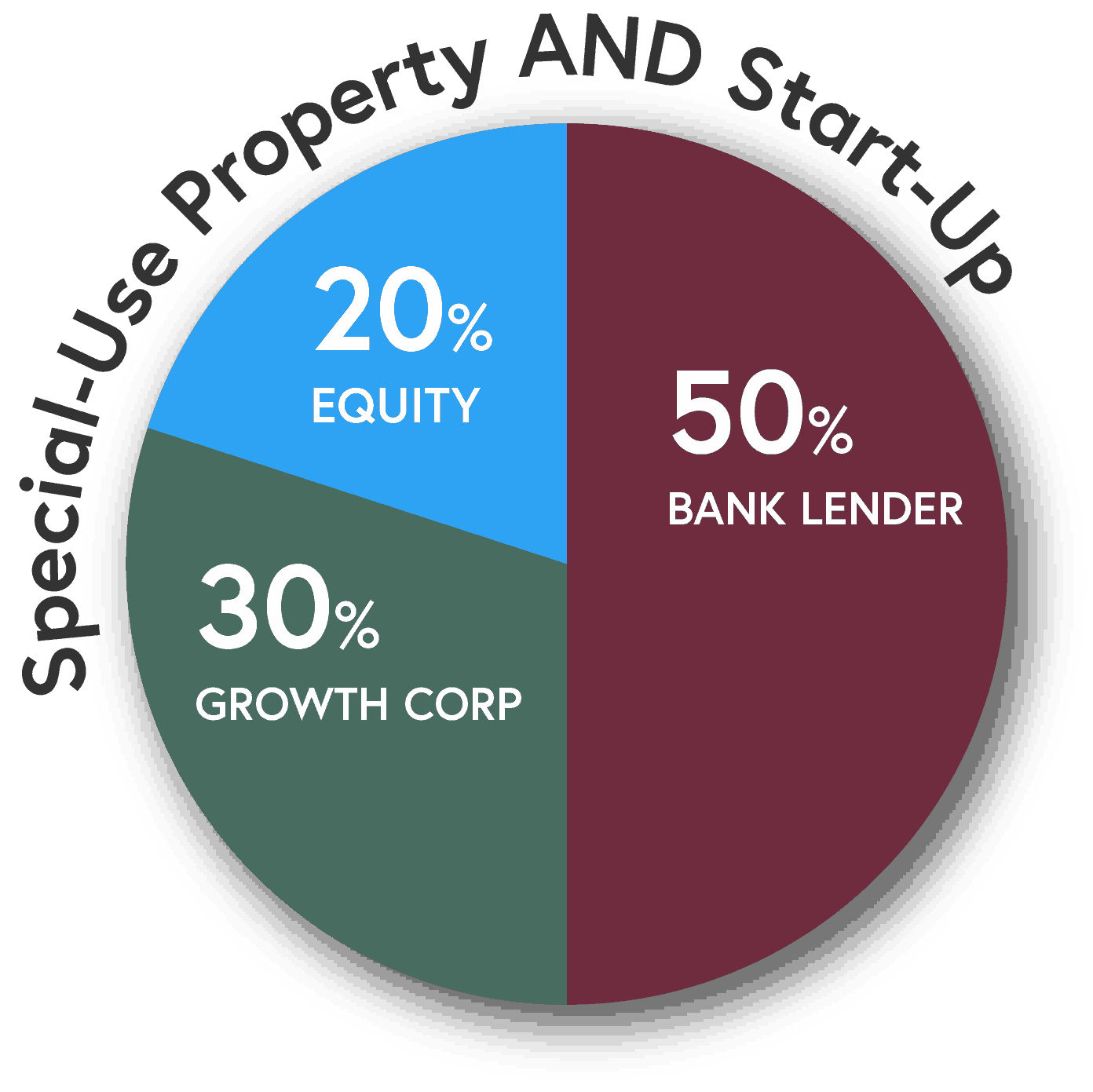

How SBA 504 Loans Work

50%

LOCAL BANK

A bank provides a first mortgage for

50% of the total project costs

40%

SBA 504 LOAN

Growth Corp provides an SBA 504 Loan

for 40% of the total project costs

10%

BORROWER EQUITY

The borrower provides a down payment of

typically just 10% of the total project costs

Higher equity requirements exist for start-ups or special purpose properties…the equity required will increase by 5% if one condition exists or by 10% if both.

SBA 504 Loans are made in conjunction with your local bank...so you can keep your lending relationship.

SBA 504 LOANS

How Will You Grow Your Business?

877-BEST 504

www.GrowthCorp.com

A Non-Profit Organization Focused Exclusively on Small Businesses

By using this website, you understand that Growth Corp is good, but not perfect (although we do try!). Therefore, it is possible that you may find information on this site that is no longer accurate. Links, images, downloads, pages and blog posts may inadvertently contain information that has been superseded over the years. You also understand that we aren’t giving any legal, tax, or financial advice. So, while we hope our site makes you love 504 Loans as much as we do, the content herein is for informational purposes only.